Crypto Whales Pile Into These 5 Altcoins Post US-China Trade Deal—Here’s Why

Crypto’s big players are placing bullish bets—and it’s not just Bitcoin soaking up the institutional demand. After the US-China trade détente eased macro fears, altcoin accumulation spiked. Here’s where the smart money’s flowing:

• Ethereum (ETH): The merge narrative still has legs—gas fee cuts and staking yields lure whales despite DeFi’s ’summer of reckoning.’

• Solana (SOL): Institutional darling status holds even after last year’s outages—VCs keep stacking at 80% below ATH.

• Chainlink (LINK): Oracle networks become critical infrastructure as TradFi firms quietly test blockchain integrations (with regulators none the wiser).

• Polygon (MATIC): The ’AWS of Web3’ keeps onboarding enterprises—recent Disney deal proves even mouse ears can’t resist cheap L2 transactions.

• BNB: CZ’s empire strikes back—exchange coin thrives as retail traders return, blissfully ignoring that 43% of its volume is still... creative accounting.

Watch these plays closely. When whales move, markets follow—until the next ’black swan’ sends them all scrambling for the stablecoin exits.

Sendcoin (SEND)

Sendcoin, a solana token positioning itself as a “collective of sovereign startups” powered by a unified marketing engine, has surged nearly 40% in the past 24 hours.

The sharp rally comes amid strong interest from crypto whales, who have been steadily accumulating the token over recent days.

Whale holdings in SEND jumped more than 35% since yesterday, rising from 33.79 million to 45.7 million tokens.

This accumulation has pushed SEND’s fully diluted valuation (FDV) close to $18 million, signaling growing confidence in coin.

Goatseus Maximus (GOAT)

GOAT, once one of the most popular tokens in the Solana ecosystem, had been in a deep correction throughout 2025, dropping 58% year-to-date.

However, sentiment is starting to shift as GOAT has surged nearly 197% over the past seven days, making it the second-best performing Solana token with a market cap above $200 million.

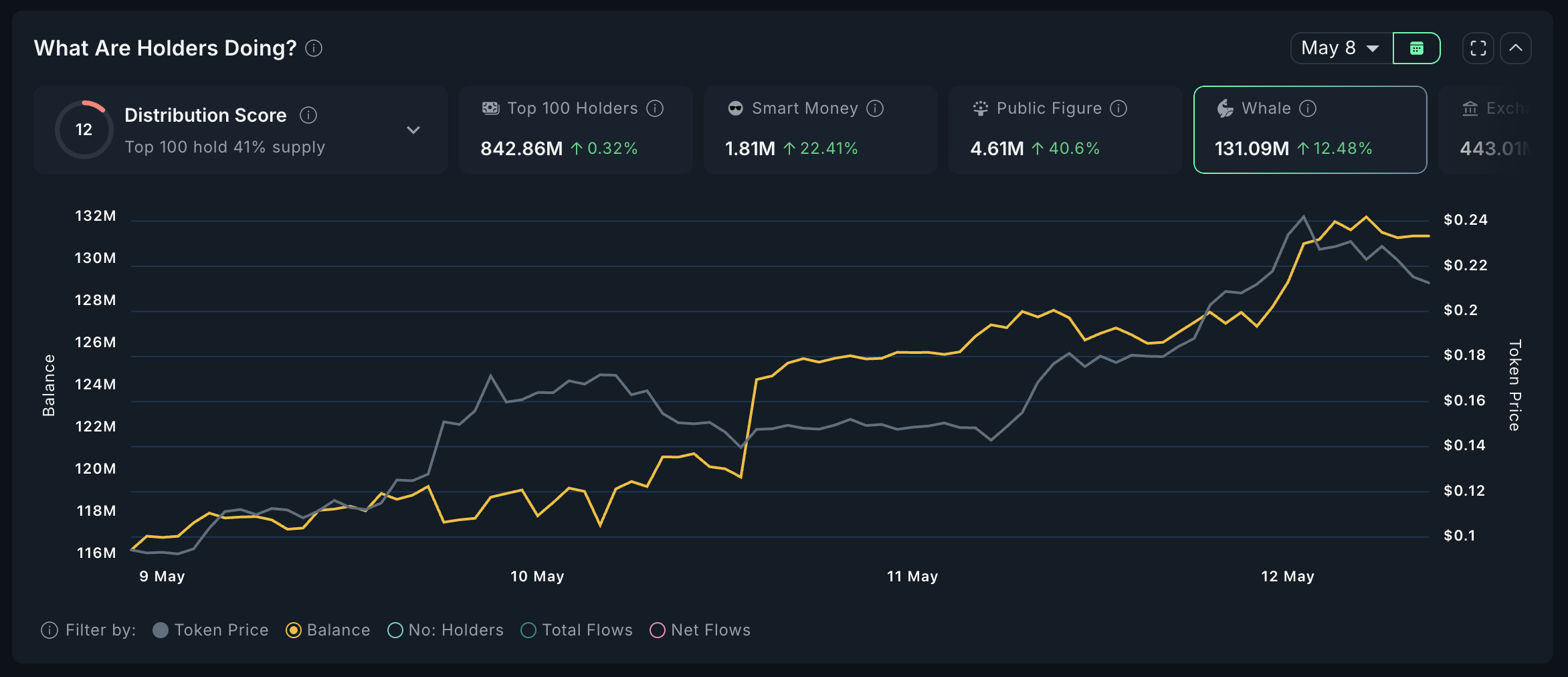

Whale activity is also picking up, with large holders increasing their positions by 12.48% since May 9.

Their total holdings ROSE from 116.18 million to 131.09 million GOAT tokens, suggesting renewed confidence in the project’s potential as momentum returns.

Cat in a dogs world (MEW)

MEW has gained strong momentum over the past week, climbing 52% and pushing its market cap to $368 million.

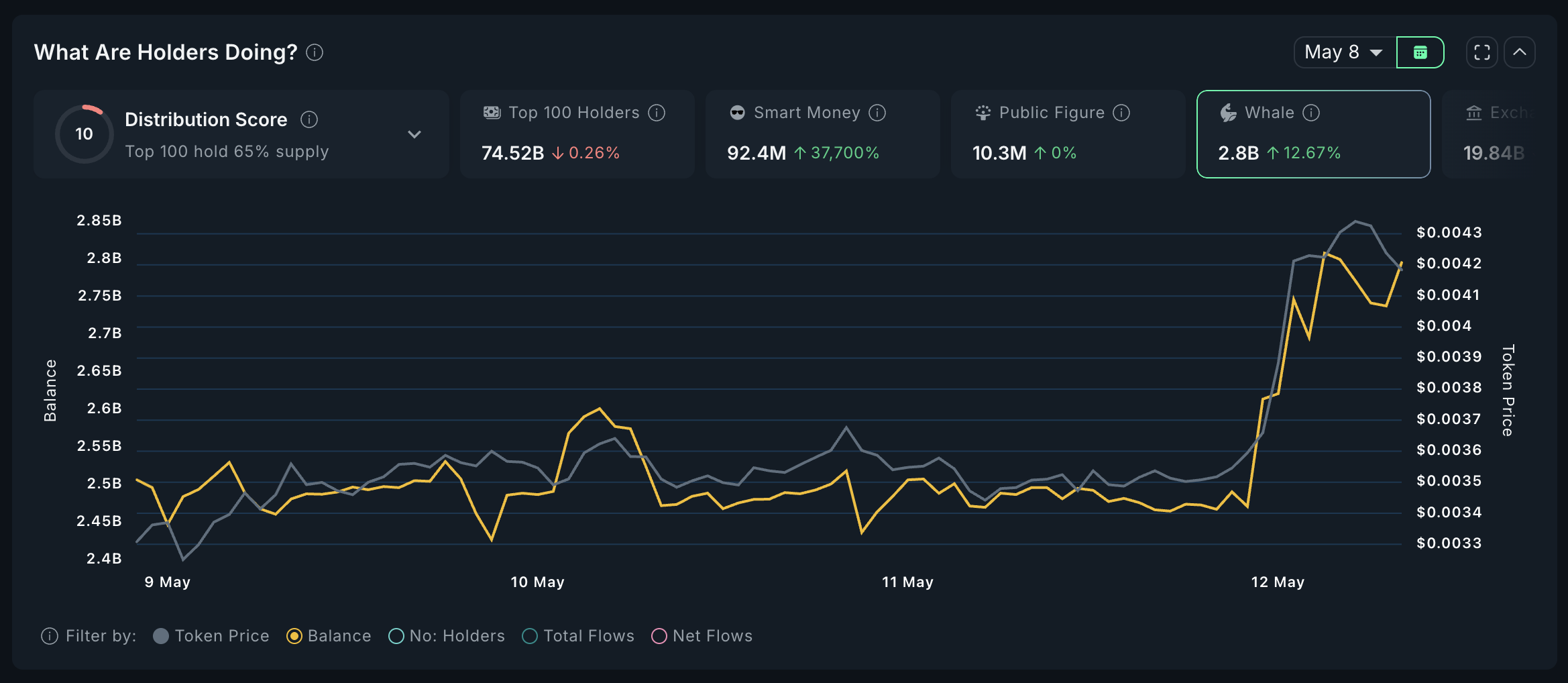

The rally comes amid a notable uptick in whale accumulation, with large holders increasing their mew positions by 12.67% in just a few hours—rising from 2.47 billion to 2.8 billion tokens.

Smart money activity is also heating up for the meme coin.

Although overall accumulation slowed slightly in the last few hours, total holdings remain up, and one smart wallet alone bought approximately $378,000 worth of MEW in the past 24 hours—highlighting continued interest from informed investors.

Worldcoin (WLD)

OpenAI CEO Sam Altman’s Worldcoin is back among the top-performing AI tokens, climbing 41% over the past week and reaching a market cap of $1.8 billion.

The surge comes despite recent legal challenges, including a court ruling in Kenya that ordered the deletion of biometric data and a suspension of operations in Indonesia over regulatory violations.

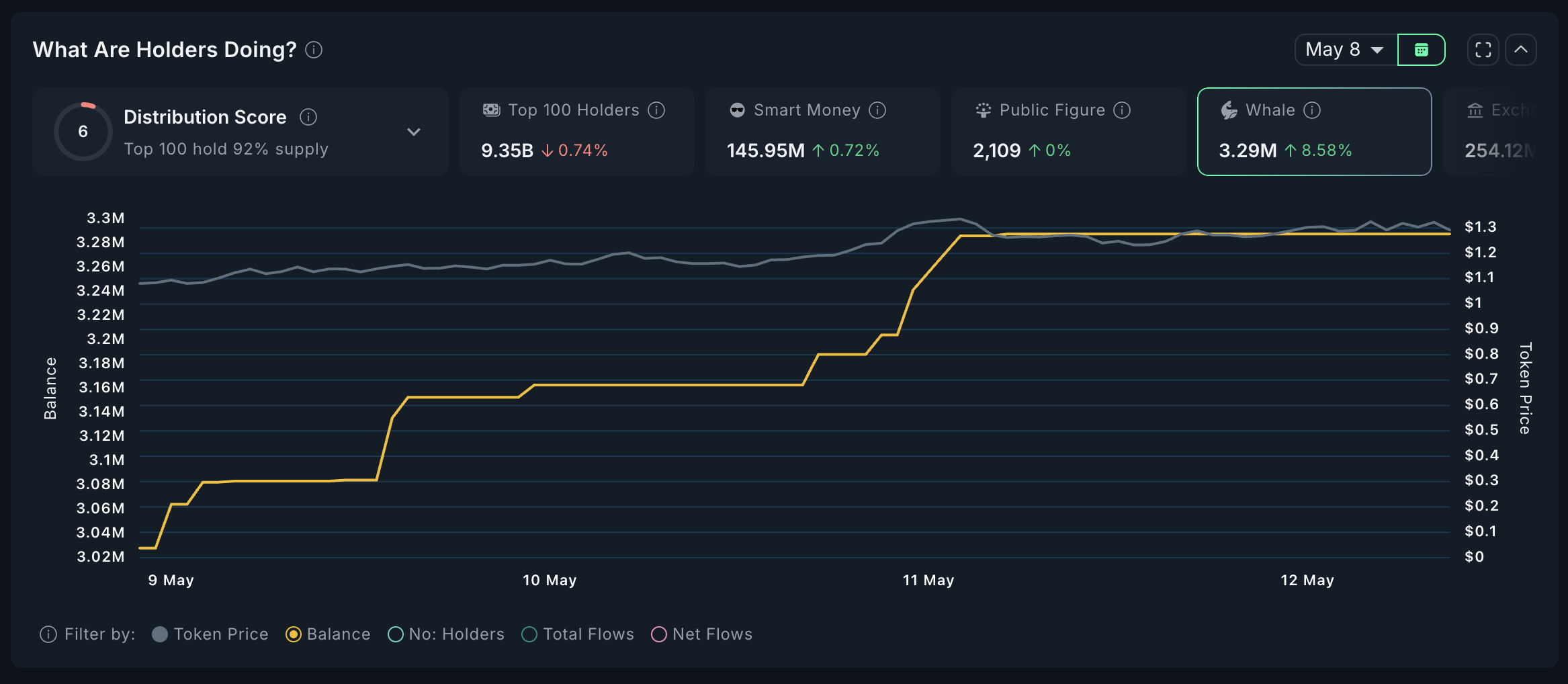

Crypto whales have also been accumulating, increasing their WLD holdings by over 8% between May 8 and May 11.

While accumulation has remained stable in the last 24 hours, the rise in whale activity highlights growing confidence in the token’s market position.

Plume (PLUME)

PLUME has emerged as one of the most talked-about RWA tokens in recent weeks, gaining 26% over the past 30 days.

Its market cap is now nearing $400 million, reflecting growing interest in real-world asset narratives. Analysts predict it will be one of the most interesting crypto narratives for VCs in 2025 Q2.

Whale accumulation has picked up sharply, with holdings jumping 42% in just 24 hours, from 970,000 to 1.38 million PLUME.

One smart wallet alone bought nearly $50,000 worth of the token in the past day.