Binance Devs Drop Truth Bomb: BSC Validators—Not CZ—Slash Gas Fees by 90%

Behind the scenes of Binance Smart Chain’s gas fee overhaul, core developers reveal it wasn’t CZ’s magic touch—it was the validators pushing the upgrade. The 90% reduction? A decentralized decision, not a top-down decree.

Subheader: Validators Flex Governance Muscle

While retail traders were busy meme-coining, BSC’s validator collective quietly voted through BEP-336. The result? Transaction costs nosedived overnight—proving chain governance can work (when whales aren’t dumping).

Subheader: Cynical Finance Bonus

Wall Street still charges $9.99 per trade. Meanwhile, BSC just made defi swaps cheaper than a bank’s ’account maintenance’ fee—not that they’ll admit it.

CZ May Have Lit the Spark, But Validators Control the Fire

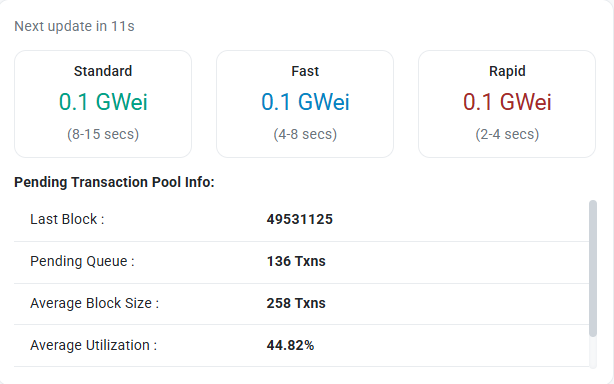

The narrative around Binance Smart Chain’s gas fee plunge this May from 1 Gwei to 0.1 Gwei was quickly pinned to a single catalyst: a tweet from Binance founder Changpeng Zhao.

Let’s reduce BSC gas fees? by 3x, 10x?

— CZ

This is amidst a space often dominated by headlines. However, behind the scenes, something more profound is unfolding.

Validator-driven recalibration of network pricing dynamics is aligned with a strategic push to entrench BNB Chain’s role in a multi-layered, scalable blockchain future.

Speaking exclusively to BeInCrypto, a BNB Chain CORE Development spokesperson dispelled the notion that this was a top-down decree from Changpeng Zhao.

“Because the minimum gas price setting is not part of the consensus mechanism, it is a market dynamic as chosen by validators. The community of validators responds to calls from CZ, but ultimately, it’s their decision,” the spokesperson said.

In other words, while CZ’s call sparked debate, the final lever pull came from validators. The validators comprise a distributed group balancing network demand, block space supply, and protocol economics.

Not About Rival Chains—It’s About Market Efficiency

Ethereum’s Layer-2 rollups and Solana’s fee advantages did not inspire the 90% reduction in BSC gas fees. Instead, changing validator sentiment and user expectations drove this decision.

“It is driven by community, and a market dynamic of block space. It is not universally enforced either. Some dApps and platforms still use higher fee settings,” the spokesperson added.

That caveat, where gas fees are not uniformly down across tools and dApps, explains why some users may not yet feel the impact.

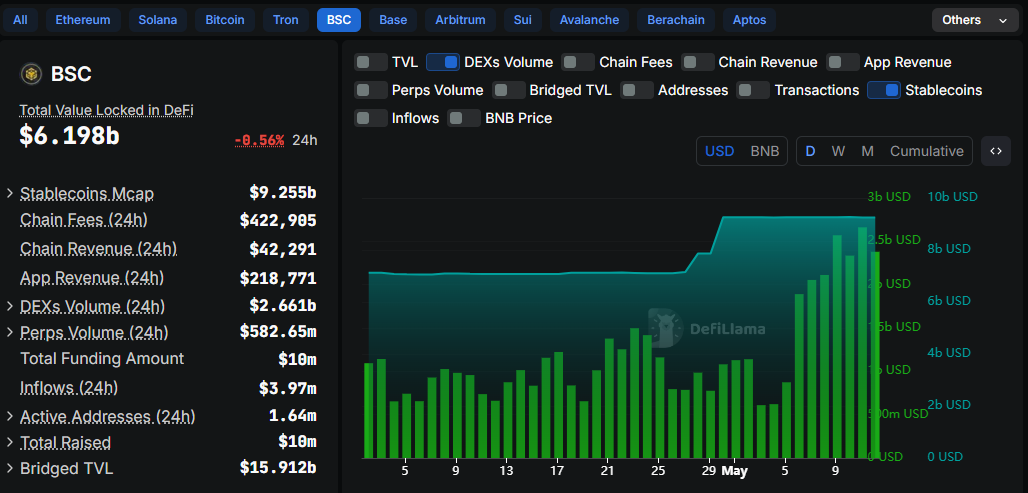

Still, metrics suggest momentum is building. BSC has seen recent spikes in decentralized exchange (DEX) trading and stablecoin transfers, independent of the latest fee change.

BSC + opBNB: Two-Layered, One Vision

While BSC continues to anchor the BNB ecosystem, the real masterstroke lies in its layered architecture. opBNB, the network’s high-speed Layer-2, targets 10,000 transactions per second (TPS) and sub-cent costs. It sets the stage for BNB Chain to straddle the L1 and L2 battlegrounds.

“The BNB Chain ecosystem is positioning itself not just as a single competitive L1, but as a network offering scalable solutions across different layers. opBNB lets us compete fiercely in the L2 domain for high-volume, low-cost applications, while BSC remains a robust base layer,” the team told BeInCrypto.

This duality, a resilient base and scalable layer, is becoming a standard among major chains eyeing mass adoption. According to the BNB Chain core development team, BNB Chain is fully aligned with that thesis.

Sustainable or Temporary? Validators Hold the Dial

Is 0.1 Gwei sustainable? That depends on network load and validator sentiment. With BSC averaging just 20% capacity utilization, congestion risks appear low. Still, according to the team, pricing is not fixed but is an organic mechanism.

“The pricing is an individual market choice from validators. They should adjust it according to ever-changing market conditions,” the spokesperson said.

This market-led model could be BNB Chain’s secret weapon—adjustable, scalable, and community-sensitive.

What began as a viral suggestion from Binance’s founder has matured into a community-coordinated response that reflects BNB Chain’s adaptive architecture and governance.

With DeFi, stablecoins, and high-volume dApps gaining traction and opBNB poised to supercharge throughput, the 90% fee slash is not just about cost—it is about growth.

BNB token was trading for $665.49 as of this writing, up by a modest 1.48% in the last 24 hours.