Ethereum Pectra Upgrade Sparks 31% Rally—But $2,500 Hangs Like a Sword of Damocles

Ethereum’s latest upgrade—Pectra—just sent prices rocketing 31% in a week. Now traders are eyeing the $2,500 resistance level like Wall Street brokers eyeing a bonus pool.

Can ETH break through? The upgrade’s scalability fixes have bulls frothing, but remember: crypto markets eat ’game-changing tech’ for breakfast and still demand lunch.

Key factors to watch: network adoption post-upgrade, whether gas fees actually drop, and if institutional money finally stops pretending it’s ’just exploring blockchain.’

One thing’s certain—if ETH stalls here, the ’buy the rumor, sell the news’ crowd will exit faster than a VC during a SEC subpoena.

Ethereum Pectra Upgrade Goes Live

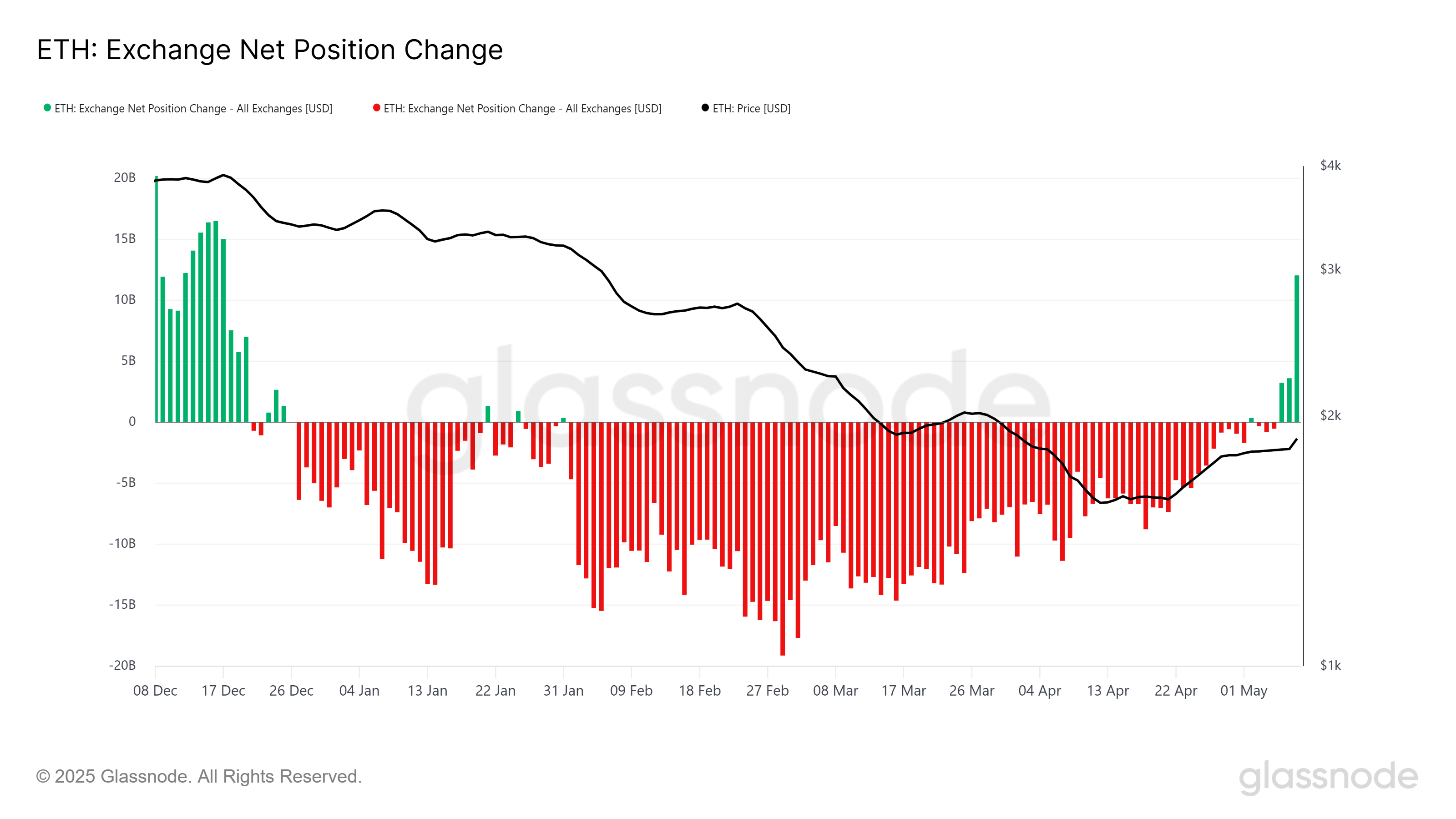

The Pectra upgrade has significantly impacted the market sentiment surrounding Ethereum, with exchanges recording net inflows of $15.6 billion since its launch. On May 8 alone, $12 billion worth of ETH was sold, marking the highest single-day sale in over five months.

This suggests that investors are keen to secure profits after the price spike, potentially dampening the prospects of ETH continuing its upward movement. This profit-taking behavior could limit ETH’s upward momentum.

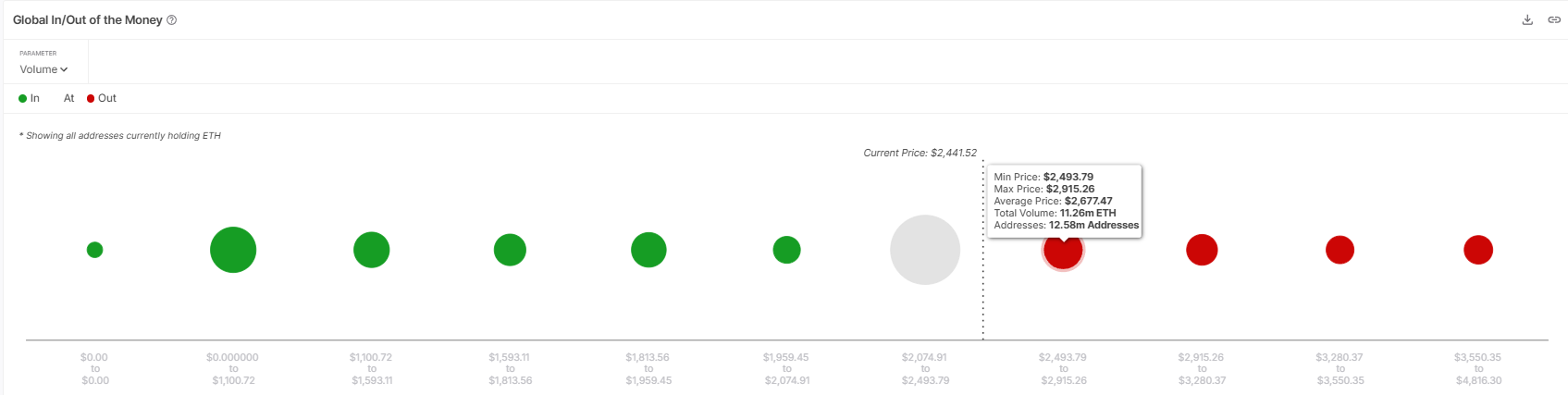

Ethereum’s macro momentum shows both strength and potential headwinds. The IOMAP (In/Out of the Money Around Price) analysis reveals that 11.56 million ETH were bought in the range between $2,493 and $2,915. This range is crucial as ETH must breach $2,500 to continue its upward trend and lock in recent gains.

However, there is significant selling pressure at this range, where $27.8 billion worth of ETH is sitting. This could cap Ethereum’s ability to maintain sustainable growth, as the risk of large-scale sell-offs at higher prices looms large.

ETH Price Hits 2-Month High

Ethereum’s price is currently trading at $2,366, up 31% in the last 24 hours following the Pectra upgrade. This price increase has brought ETH to a 2-month high and closer to the $2,513 resistance level. Breaking this barrier WOULD mark a key milestone for Ethereum, but the challenge remains whether it can sustain this movement in the face of investor selling.

The difficulty in crossing $2,500 lies in ongoing selling pressure from investors who have already capitalized on recent gains and from those who could sell should the price continue rising. Thus, Ethereum could struggle to maintain its upward trajectory, possibly falling back below the support of $2,344. In this scenario, ETH could test the $2,141 level, potentially erasing some of the recent gains.

However, if the broader market remains bullish and ETH follows Bitcoin’s rise beyond $103,000, Ethereum could break through $2,513 and secure it as a support floor. This would create the opportunity for further upward movement toward $2,654, and invalidate the current bearish outlook, signaling that Ethereum could continue its recovery toward new price highs.