Crypto Whales Gobble Up These 5 Altcoins as Market Roars Back—Here’s What They’re Betting On

Crypto whales just flashed their buying power—and these altcoins are their latest prey. While retail investors panic-sold last week’s dip, the big players quietly loaded up. Here’s where the smart money’s flowing.

Solana (SOL): The ‘Ethereum killer’ keeps attracting whale-sized bids after its 300% rally this year. Network upgrades and meme coin mania are fueling the frenzy.

Chainlink (LINK): Oracle networks are back in vogue as institutional DeFi adoption grows. Whales accumulated $47M worth in 72 hours—because apparently, someone still trusts price feeds.

Toncoin (TON): Telegram’s darling surged 120% since March. Now whales are doubling down, betting on its 900M-user distribution advantage. Because nothing says ‘decentralization’ like a messaging app monopoly.

Starknet (STRK): Ethereum’s layer-2 dark horse saw 400% volume spikes after Coinbase listing. Whales love a good scaling narrative—especially when transaction fees are still high enough to buy a coffee.

Dogwifhat (WIF): Yes, really. The meme coin ‘with the hat’ somehow pulled in $30M in whale buys. Even crypto’s elite aren’t immune to degenerate gambling—just with bigger stacks.

Meanwhile, traditional finance bros are still waiting for their ‘blockchain ETFs’ to mature. Good luck with that.

Ethereum (ETH)

Leading altcoin ETH has emerged as one of the assets that crypto whales have paid attention to this week. The altcoin has reclaimed $2,000 following the Federal Reserve’s dovish stance and the successful implementation of its Pectra Upgrade two days ago.

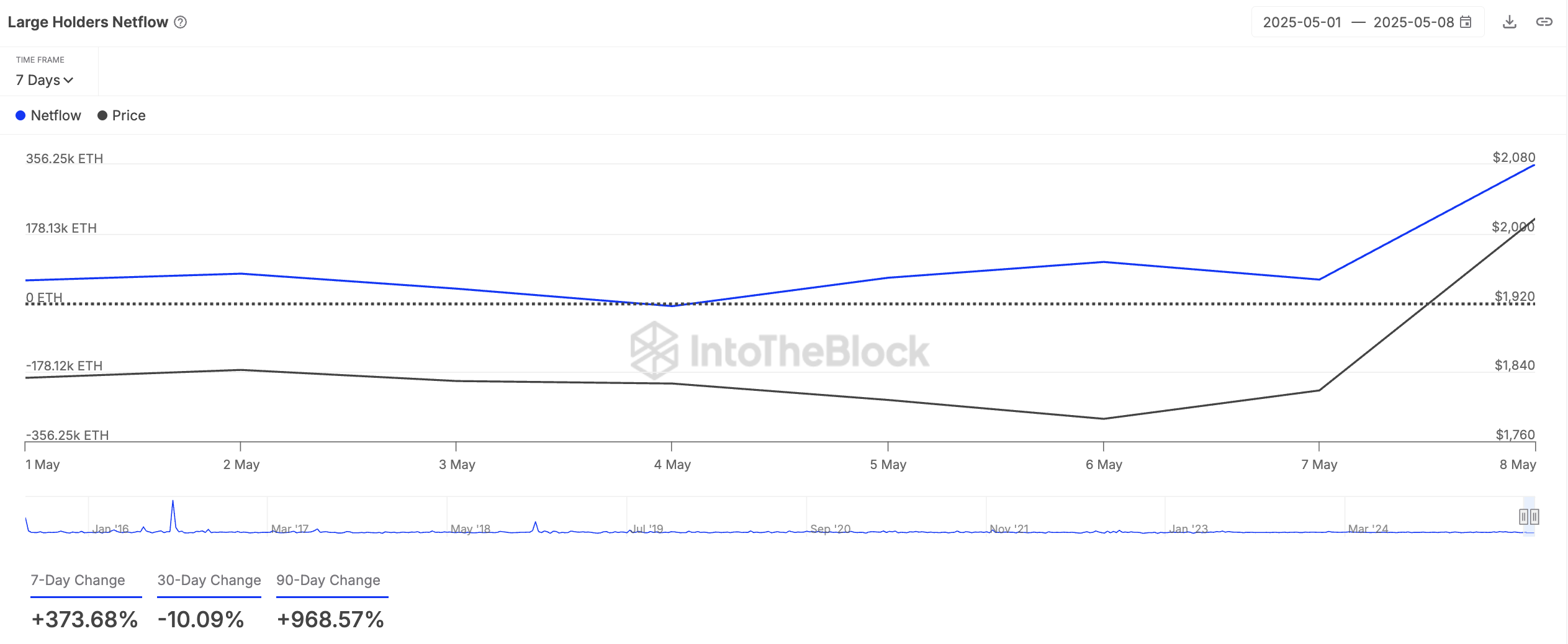

These catalysts have helped restore bullish momentum, and ETH whales are taking advantage. According to IntoTheBlock, the coin’s large holders’ netflow has soared 374% over the past seven days.

A large holder refers to a wallet address that controls more than 0.1% of an asset’s circulating supply. Their netflow measures the balance between coins flowing in and out of these wallets.

A rise in netflow indicates increased whale accumulation, a bullish signal that can prompt retail investors to follow suit.

In ETH’s case, the recent spike in large holder netflow suggests growing confidence among major investors, which could help the price stabilize above $2,000 in the short term.

Apecoin (APE)

APE is another altcoin that the whales have added to their bags this week. At press time, the altcoin trades at $0.61, climbing by 13% in the past seven days.

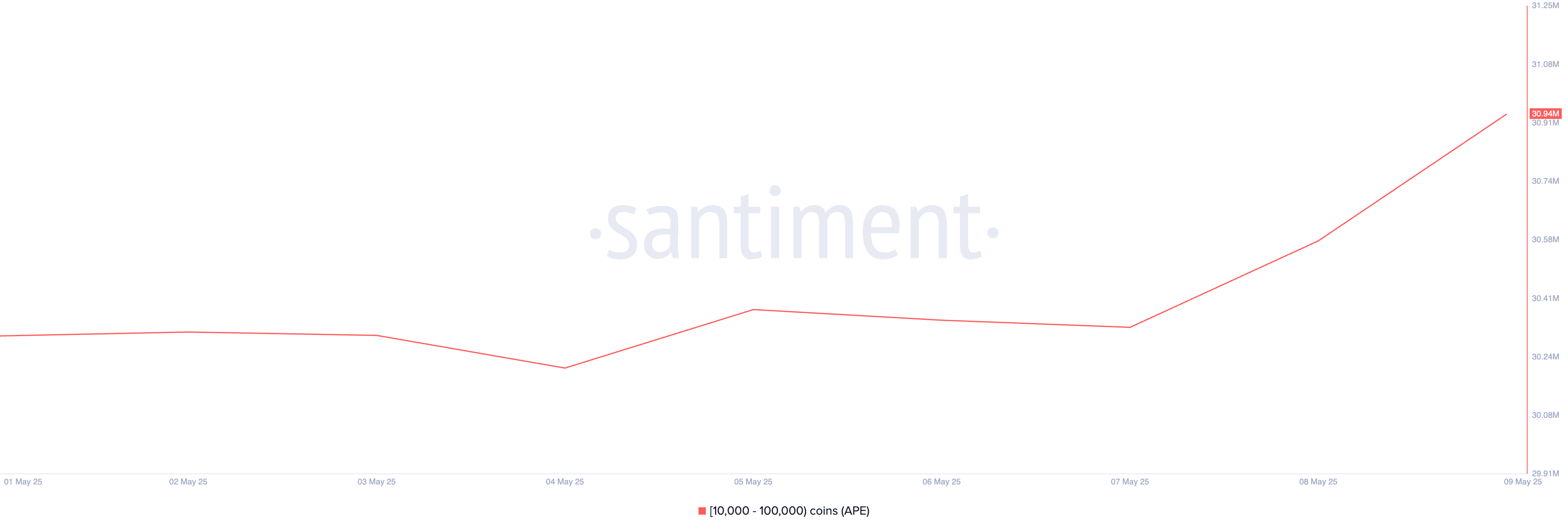

Whale addresses holding between 10,000 and 100,000 tokens have acquired 640,000 APE during that period.

This group of APE investors currently holds 30.94 million tokens, the highest level recorded since November 2022. The surge in holdings highlights renewed confidence and growing interest in APE, signaling that major investors are positioning themselves for potential upside.

Polygon (POL)

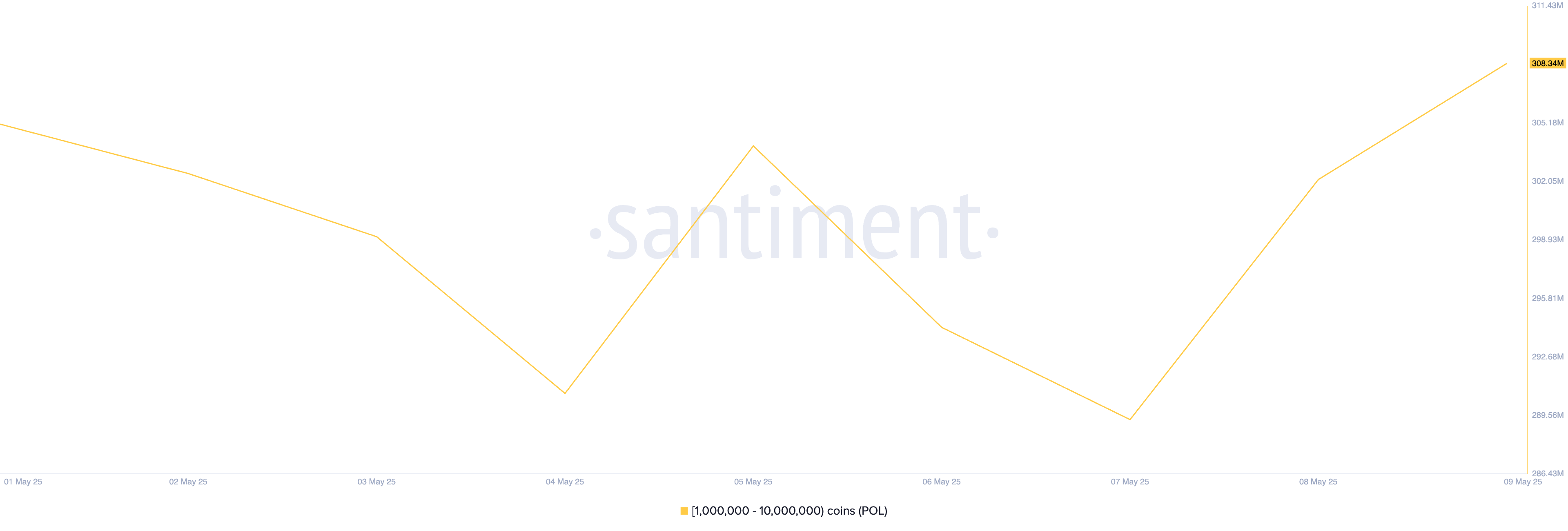

Formerly known as MATIC, POL is another token on whales’ radar this week. Per Santiment, wallet addresses that hold between 1 million and 10 million tokens have bought 3.24 million POL in the past seven days.

This cohort of POL investors currently holds 308.34 million tokens. If whale accumulation persists, POL could extend its ongoing rally in the short term.