Crypto Airdrop Frenzy Pumps Binance Alpha Volume to $2.8B—Traders Chase Free Money While the Music Plays

Crypto degens are at it again—this time flooding Binance’s Alpha platform with record-breaking volume as airdrop mania grips the market. $2.8 billion in trades screams one thing: everyone’s chasing the next free token handout, consequences be damned.

Behind the numbers: Airdrop hunters are leveraging Alpha’s zero-fee structure to farm speculative new tokens, turning the platform into a casino where the house always wins (spoiler: the house is Binance).

The irony? While retail traders play hot potato with vaporware tokens, institutional players quietly accumulate BTC at discount prices. Some things never change in crypto—the dumb money just finds new ways to separate from itself.

Binance Alpha’s Daily Volume Surpasses $330 Million

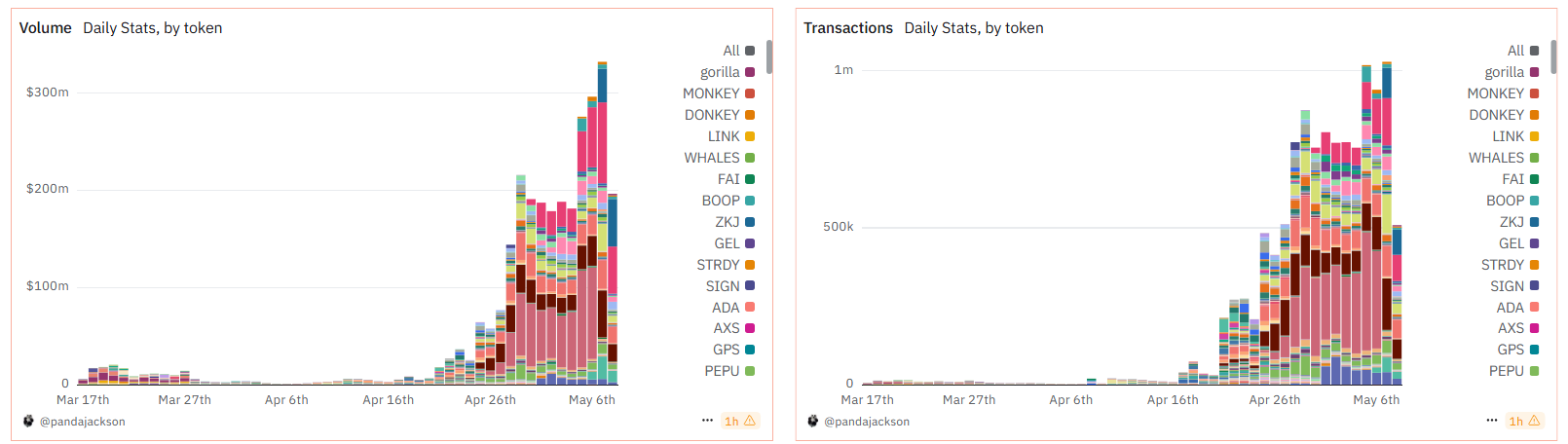

Data from Dune shows that trading volume on Binance Alpha surged after Binance announced the Alpha Points on April 25.

By May 7, trading volume on Binance Alpha had exceeded $330 million. On May 5 and May 7, the platform recorded over 1 million daily transactions. The total accumulated trading volume has now surpassed $2.8 billion, with nearly 117 million transactions.

This achievement reflects the strong appeal of the Alpha Points feature. More users are actively trading to accumulate points and increase their chances of receiving airdrops.

At the same time, Binance has been announcing new project listings on Binance Alpha more frequently.

How Are Investors Responding to the Binance Alpha Points Initiative?

Wonnie, the founder of MBMweb3, is a vocal supporter of the Binance Alpha program. In a post on X, Wonnie described the program as “a golden window” for users to participate before it becomes overcrowded.

He shared his strategy for earning 15 points per day. He holds assets worth over $100,000, which gives him 4 points, and trades more than $2,048 daily, earning him 11 points.

Wonnie emphasized that the daily cost of maintaining this activity is around $1 in gas fees, highlighting the program’s strong profit potential.

“Binance Alpha is still a golden window. Track your score. Minimize costs. And take your share while the rewards are flowing,” Wonnie said.

However, not all investors share Wonnie’s optimism. Many have criticized Binance Alpha, calling it an “extraction scheme”.

One major point of controversy is that Alpha Points only count activity from the past 15 days. Users cannot accumulate points long-term, forcing them to trade continuously to maintain their scores, creating significant financial pressure.

Binance Alpha – A Scheme to Rekt You Without You Even Noticing.

Before we begin: right now, Binance appears completely greedy. Whenever they offer you something, trust me – they’re taking much more from you indirectly.

A lot of people are panicking and FOMOing into Binance… pic.twitter.com/MX3L3PLQPn

In addition, the reward requirements have become increasingly strict. Initially, users only needed 45 points to receive the AIOT airdrop. But now, Binance demands 150 points to qualify for the SXT airdrop.

Based on Binance’s calculation method, users must trade up to $131,072 to earn 17 points.

This has led to users paying transaction fees but still not earning enough points to qualify for an airdrop. Some users even reach the required point threshold but fail the risk assessment, so they don’t receive the airdrop.

“Binance Alpha – a scheme to rekt you without you even noticing… Binance appears completely greedy. Whenever they offer you something, trust me – they’re taking much more from you indirectly,” investor Abhi criticized.

Despite these concerns, the number of projects featured on Binance Alpha continues to grow. According to CoinMarketCap, more than 140 projects have been listed on Binance Alpha.

Nine of those projects have conducted airdrops through the Alpha Points system.