Bitcoin (BTC) Flirts With Death Cross as Shorts Eye $90K Plunge

Bitcoin’s 50-day moving average threatens to cross below the 200-day line—a technical omen that’s historically preceded brutal selloffs. Bears are now loading up on put options targeting a drop to $90,000, despite BTC’s 120% YTD gain.

Meanwhile, institutional accumulation continues at a record pace. BlackRock’s IBIT alone added 8,200 BTC last week—proving Wall Street still bets on the digital gold narrative even as retail traders panic.

Will this be another ’death cross’ fakeout like 2023’s 40% rally that followed the signal? Or is the market finally pricing in the Fed’s ’higher for longer’ rates? Grab your popcorn—this divergence between derivatives and spot flows is getting spicy.

BTC Bearish Signals Pile Up

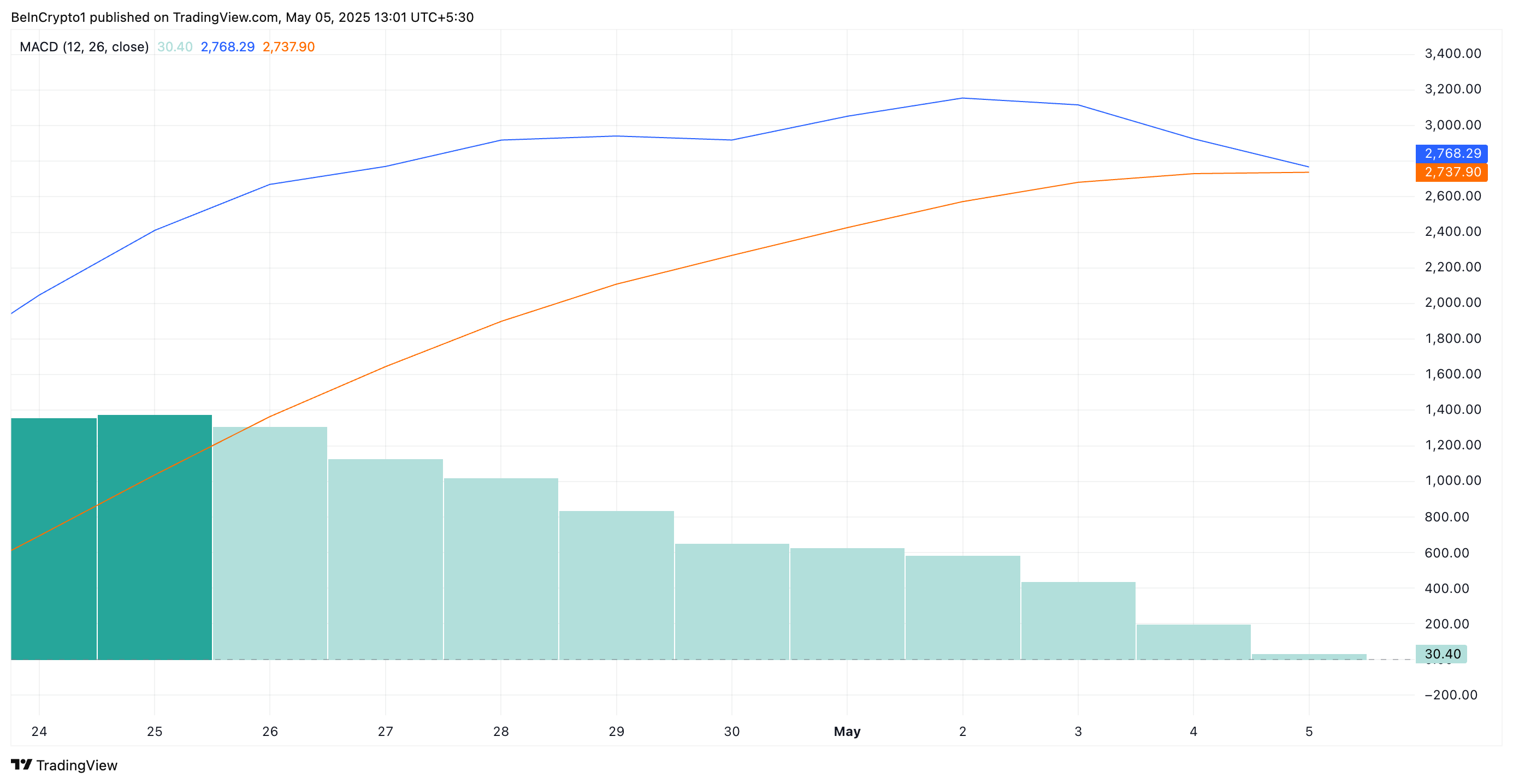

BTC’s Moving Average Convergence Divergence (MACD) indicator is about to form a death cross, a technical pattern that occurs when the MACD line crosses below the signal line.

The MACD indicator tracks an asset’s price trends and identifies potential buy or sell signals based on trend direction and momentum shifts.

BTC’s current MACD setup is notable because the emerging death cross on the indicator usually signals the start of extended price declines. This adds to the mounting concerns over the coin’s short-term price action.

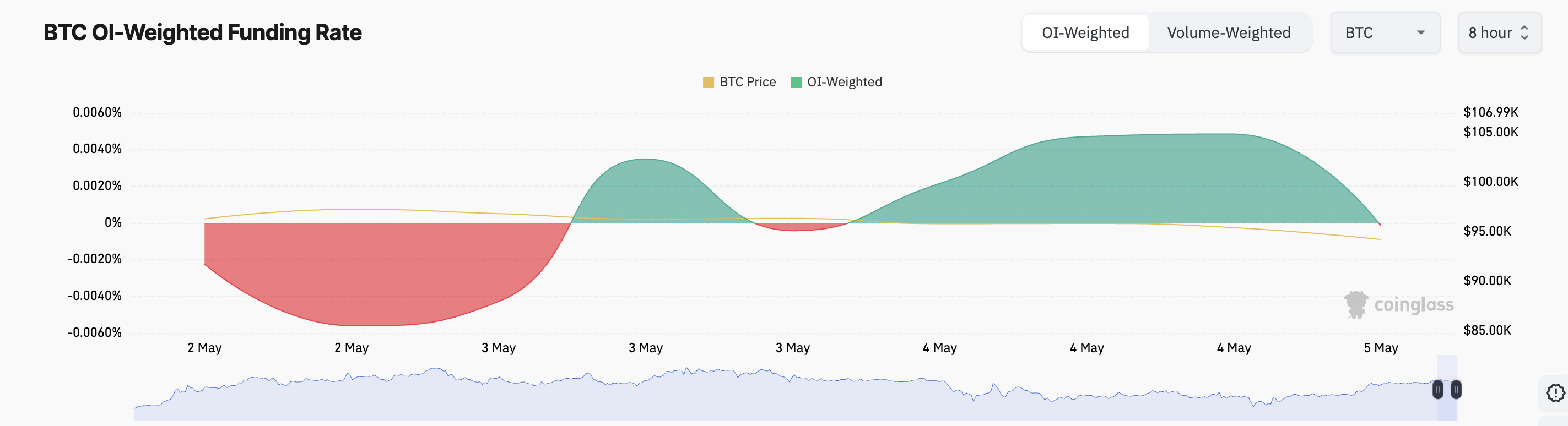

Moreover, BTC’s persistently negative funding rate further adds to this bearish outlook. Data from Coinglass shows that since May 1, the coin’s funding rate has recorded more days in the red than in the green, reflecting a growing preference for short positions among futures traders.

At press time, the funding rate is -0.0002%, indicating that most traders are betting on continued downside rather than a price recovery.

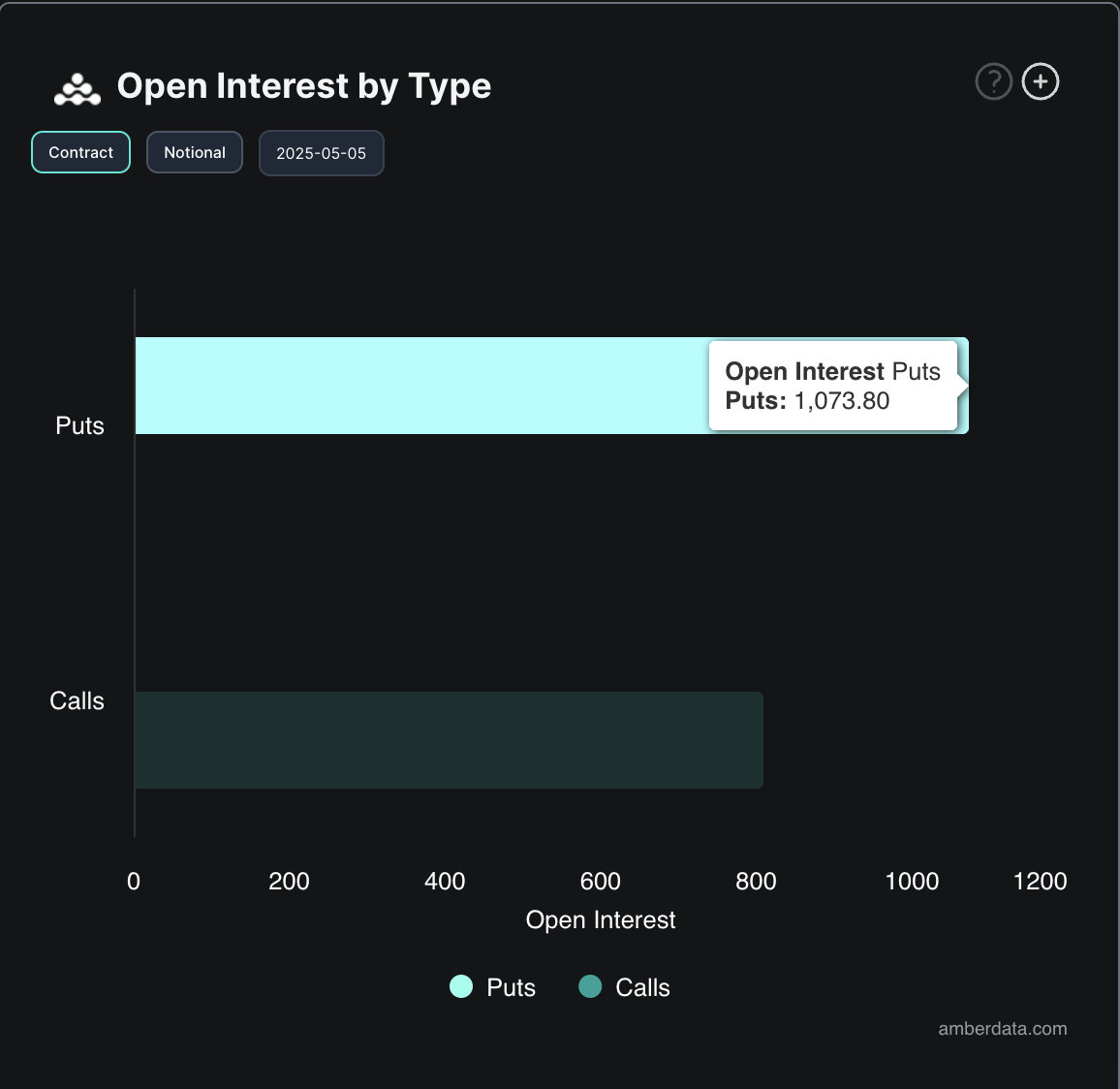

The options market also paints a grim picture for BTC’s short-term price performance. At press time, BTC’s put-to-call ratio is at 1.33.

This means there are significantly more open put contracts—bets that BTC’s price will fall—than call contracts, which are typically bullish. A ratio above one indicates that BTC bears are hedging against further downside or actively positioning for a price drop in the NEAR term.

BTC’s Next Move: $87,000 Crash or $96,000 Rebound?

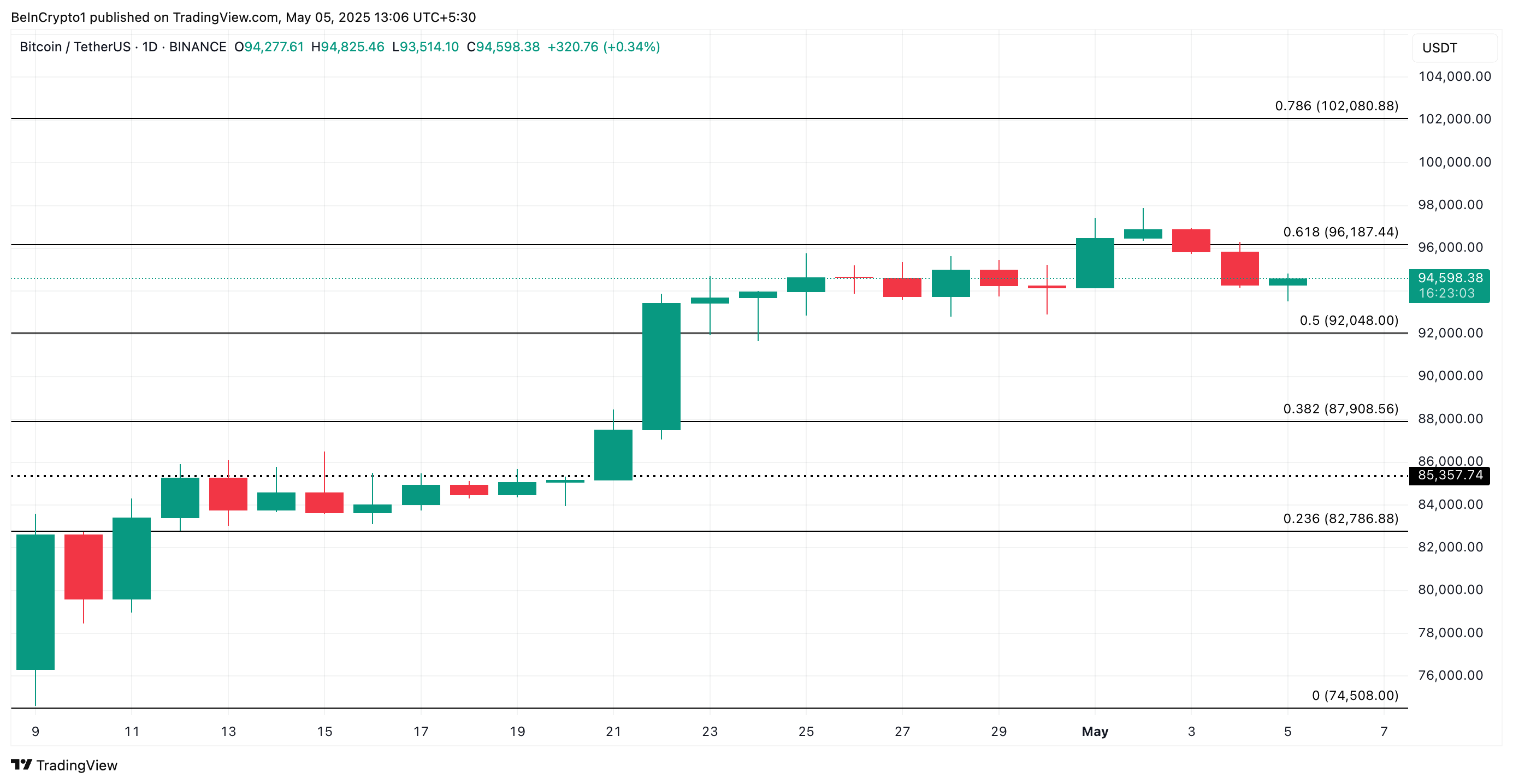

BTC currently trades at $94,598, having flipped the $95,000 price mark into a resistance level. With growing bearish sentiment, the king coin could extend its decline to $92,048.

If the bulls cannot defend this resistance, the price could plummet below $90,000 to trade at $87,908.

However, this bearish outlook could be invalidated if the bulls regain market control. In that case, BTC could regain, soar above $95,000, and rally toward $96,187.