Bitcoin’s Bull Run Sparks Market Split: Miners Ramp Up, Traders Tap the Brakes

BTC’s latest surge hits $65K—miners double down on rigs while derivatives traders hedge like it’s 2021 all over again.

Who’s right? The guys printing money from silicon, or the suits playing with leverage? Place your bets.

Bonus jab: Wall Street still can’t decide if crypto is ’digital gold’ or a high-beta gamble—so they’ll keep trading both sides until the SEC makes up their mind.

Miners Bet on BTC Upside as Reserve Jumps from Yearly Low

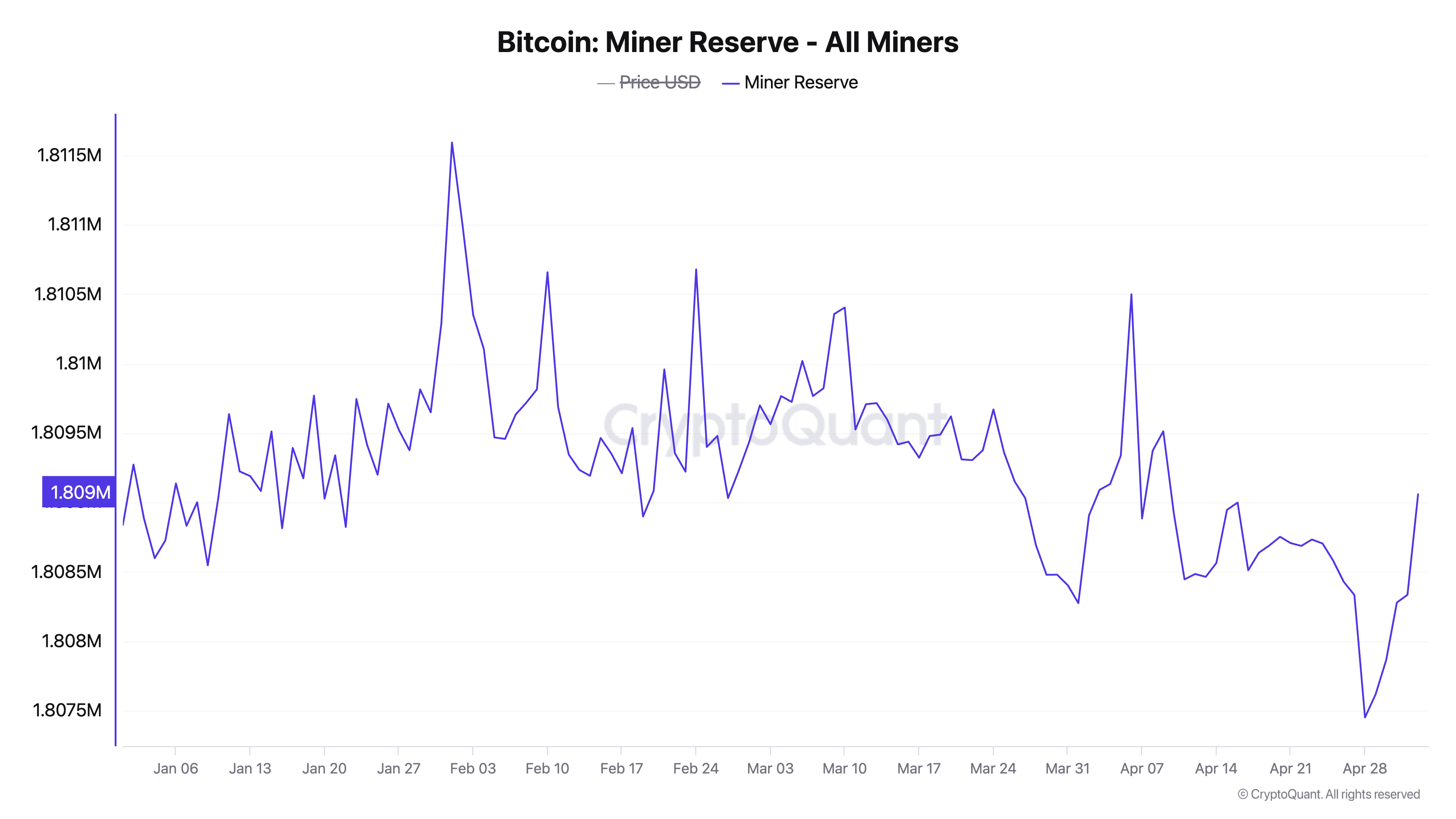

According to CryptoQuant, Bitcoin’s miner reserve, which had been in a sustained downtrend, began to rise on April 29, shortly after BTC closed above the $95,000 threshold.

For context, the reserve had dropped to a year-to-date low of 1.80 million BTC just a day earlier before reversing course and showing signs of accumulation.

Bitcoin’s miner reserve tracks the number of coins held in miners’ wallets. It represents the coin reserves miners have yet to sell. When it falls, miners are moving coins out of their wallets, usually to sell, confirming growing bearish sentiment against BTC.

Conversely, when this metric rises, as it is now, it suggests miners are holding onto more of their mined coins, often reflecting growing confidence in the BTC’s future price appreciation.

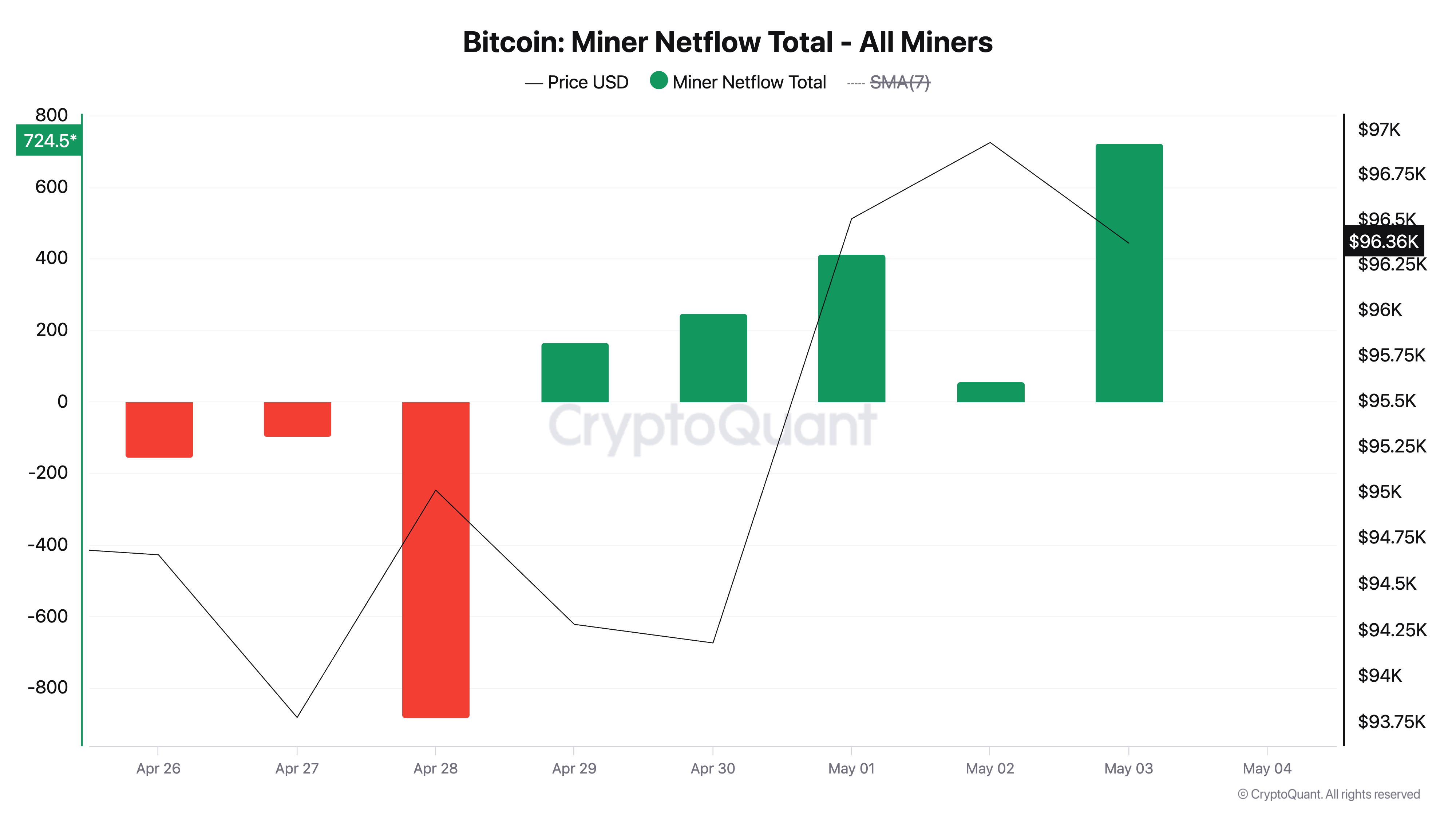

Moreover, the bullish shift in miner sentiment is further supported by the positive miner netflow recorded since April 29. This signals that more coins are being put into miner wallets rather than offloading to exchanges.

Such behavior reflects confidence in further upside, as miners, often seen as long-term holders, are choosing to accumulate rather than liquidate.

There Is a Catch

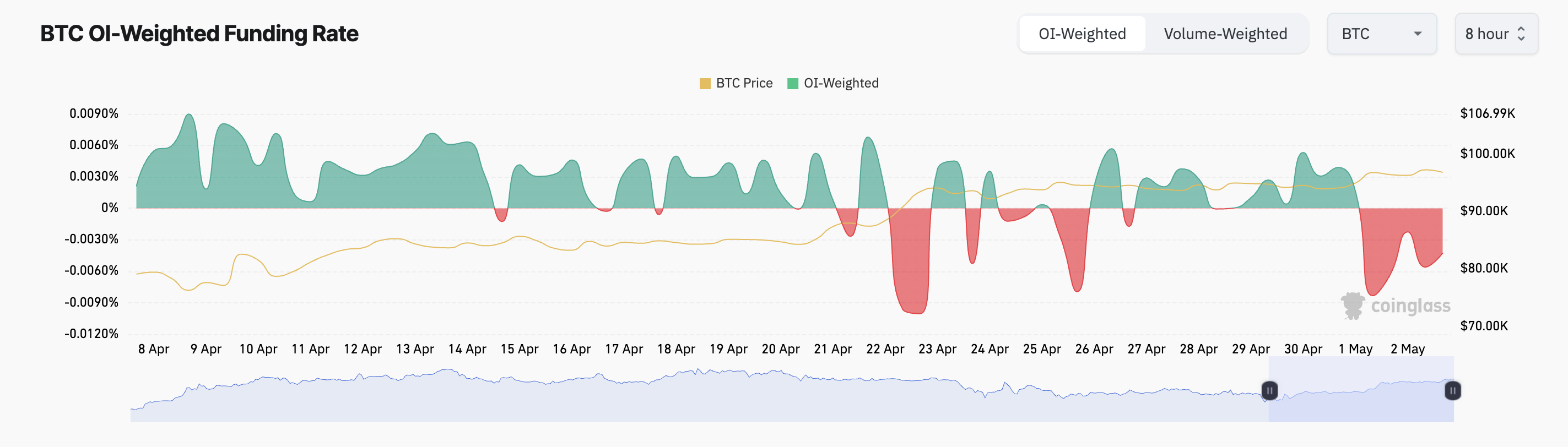

However, the sentiment is not universally bullish. While BTC miners are stepping back from selling, derivatives data tells a different story.

In the futures market, BTC’s funding rate has remained negative since the beginning of May, a sign that a significant portion of traders are betting on a near-term price correction. At press time, the coin’s funding rate is -0.0056%.

The funding rate is a periodic payment exchanged between long and short traders in perpetual futures contracts to keep the contract price aligned with the spot price.

When it is positive, it means traders holding long positions are paying those with short positions, indicating that bullish sentiment dominates the market.

On the other hand, a negative funding rate like this signals more short bets than long ones, suggesting bearish pressure on BTC’s price.

Breakout or Breakdown as Traders and Miners Diverge

While miner behavior may point to renewed confidence, the steady bearish sentiment in derivatives suggests that traders remain wary of a potential pullback.

If coin accumulation strengthens, BTC could extend its gains, break above the resistance at $98,515, and attempt to regain the $102,080 price mark.

However, if the bearish bets against the leading coin win and witness a shortfall in demand, its price could fall below $95,000 to reach $92,910.