Bitcoin Whales Back in the Black—May’s Sell-Off Fears Defanged | Weekly Whale Watch

Big money’s flipping bullish again. After weeks of sideways action, Bitcoin’s whale wallets are back in profit territory—just as the dreaded ’Sell in May’ chorus starts up.

These deep-pocketed players now hold an average 12% unrealized gain, per on-chain data. That’s enough to make even the most jaded trader reconsider dumping positions before summer doldrums hit.

Key metrics to watch: Exchange inflows remain muted (for now), while dormant coin movements suggest some early profit-taking. But with macro uncertainty lingering, this could be the calm before either a breakout or another round of ’max pain.’

Closing thought: Nothing brings out diamond hands like watching Wall Street hedge against inflation with—wait for it—more Bitcoin futures. The irony writes itself.

Short-Term Bitcoin Whales Return to Profit

Short-term whales are addresses that have held Bitcoin for under six months. These whales are now sitting in aggregate profit as BTC outpaces their average realized price.

Historically, when these participants cross into profitability, they tend to pause or reduce selling pressure.

CryptoQuant’s Short/Long-Term Whale Realized Price chart shows the orange line (short-term whale cost basis) rising toward the white market price curve in recent weeks.

It confirms that most short-term holders would net gains if they sold at current levels.

On-chain data reinforce the significance. Funding rates on perpetual swaps remain deeply negative, indicating heavy short positions poised for a potential squeeze if buying continues.

Meanwhile, long-term holders have steadily rebuilt their accumulation. Also, the network hash rate topped a record at 1.04 ZH/s this month.

These metrics signal miners and patient investors are confident in sustaining the rally’s trajectory.

Seasonal and Macro Dynamics Bolster Outlook

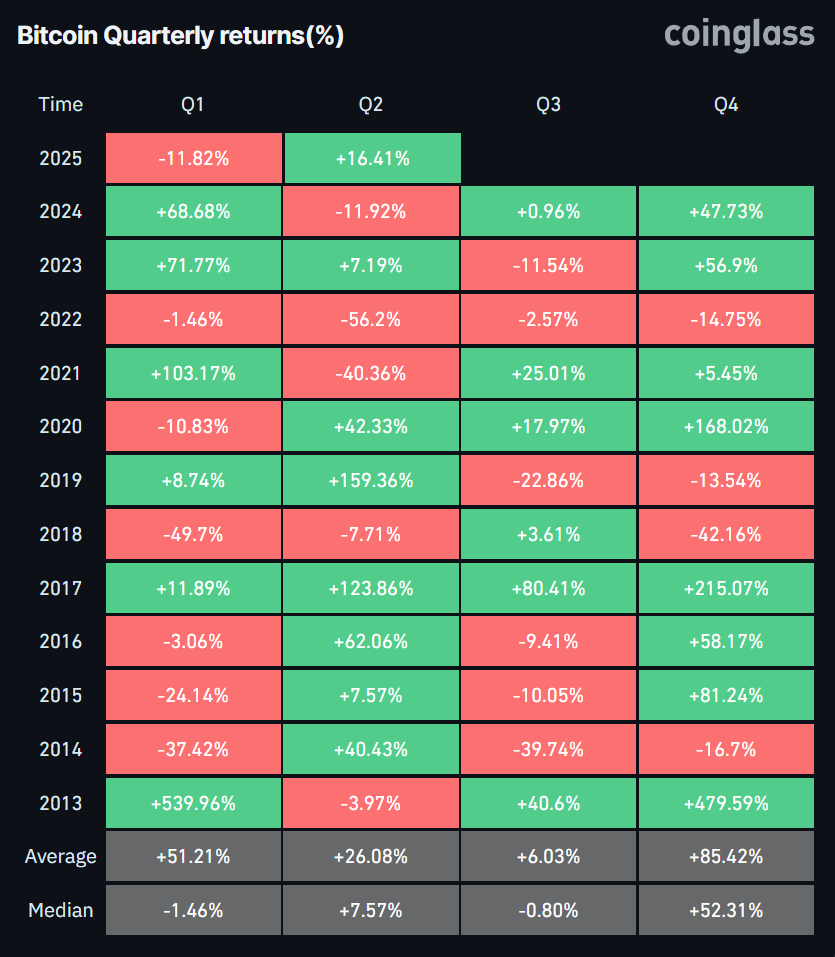

Seasonal trends often cool summer rallies. Historically, Bitcoin gained 26% in Q2 on average, but the median has been just 7.6% since 2013. Sharp drops—like the 56.2% plunge in Q2 2022—have occurred.

Q3 is usually weaker, averaging 6% returns and a slightly negative median. As May nears, many brace for the “sell in May” effect seen in equities, where the S&P 500 has returned only 1.8% from May through October since 1950.

Macro factors also matter. US inflation has eased to 2.4%, and markets now expect Fed rate cuts later in 2025.

A weaker dollar boosts risk assets like Bitcoin. Spot Bitcoin ETFs saw $3 billion in net inflows in late April, showing strong institutional demand.

Overall, whale profits, healthy on-chain signals, and supportive macro trends underlie Bitcoin’s rally.

Yet seasonal headwinds and derivative imbalances remain. Traders should set clear risk limits and watch funding rates and economic news this summer.