3 Altcoins Hitting Overbought Territory as May 2025 Kicks Off

Crypto markets roar into May with these three altcoins flashing red-hot RSI signals—just as Wall Street ’experts’ start recycling their ’this time it’s different’ scripts.

BNB: Binance’s powerhouse token defies gravity (and common sense) with a 14-day RSI punching above 80.

Solana: The ’Ethereum killer’ now needs to kill its own momentum after a 35% monthly pump.

Avalanche: Institutional darling? More like institutional FOMO as AVAX tests ATHs while dev activity flatlines.

Proceed with caution—these charts aren’t just overbought, they’re overcooked.

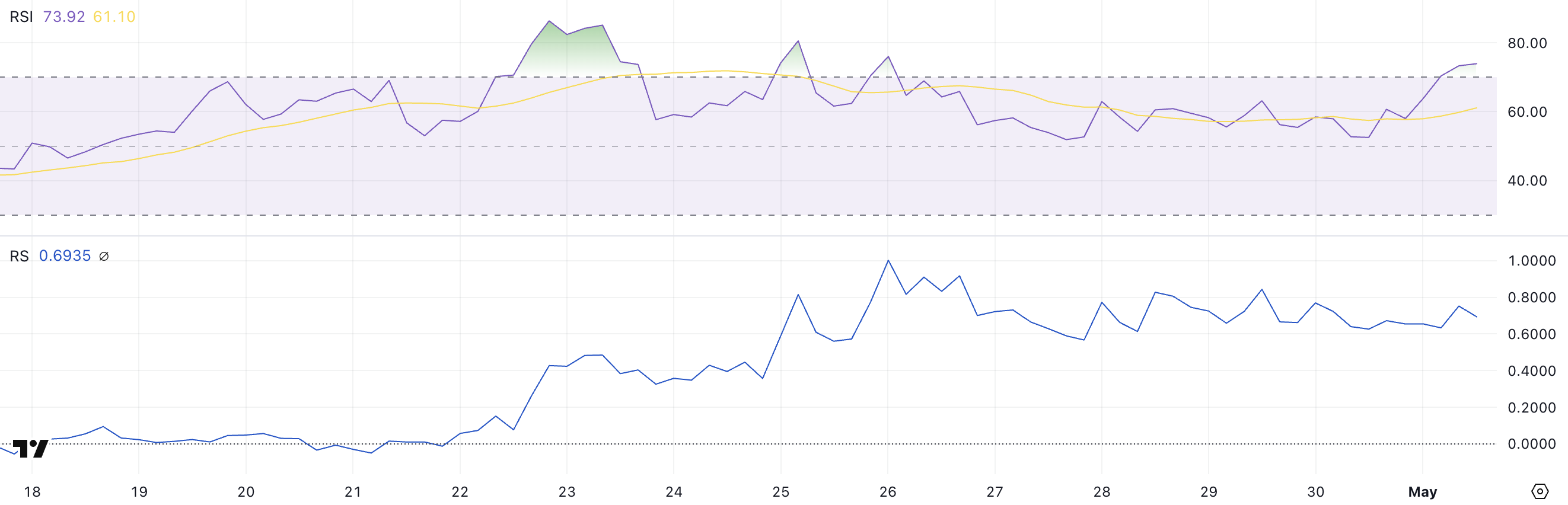

AIXBT

AIXBT, one of the most recognized crypto AI agents tokens, has emerged as a top performer, surging nearly 40% in the last 24 hours and over 95% in the past seven days.

This explosive rally places AIXBT among the best-performing altcoins of the week, drawing increased attention from traders and speculators.

However, technical indicators suggest the token may be entering overheated territory, warranting caution in the short term.

The Relative Strength Index (RSI) is a momentum indicator that moves from 0 to 100. Values above 70 mean the asset is overbought and may pull back. Values below 30 suggest it’s oversold and could rebound.

Relative Strength (RS) compares a token’s performance to a benchmark. RS above 1.0 means outperformance. Below 1.0 means underperformance. AIXBT has an RSI of 73.92 and an RS of 0.69. That technically makes it overbought, but still lagging behind the broader market.

This shows that AIXBT’s rally has been sharp, but not strong relative to other assets. The surge may be driven more by short-term speculation than sustained market strength.

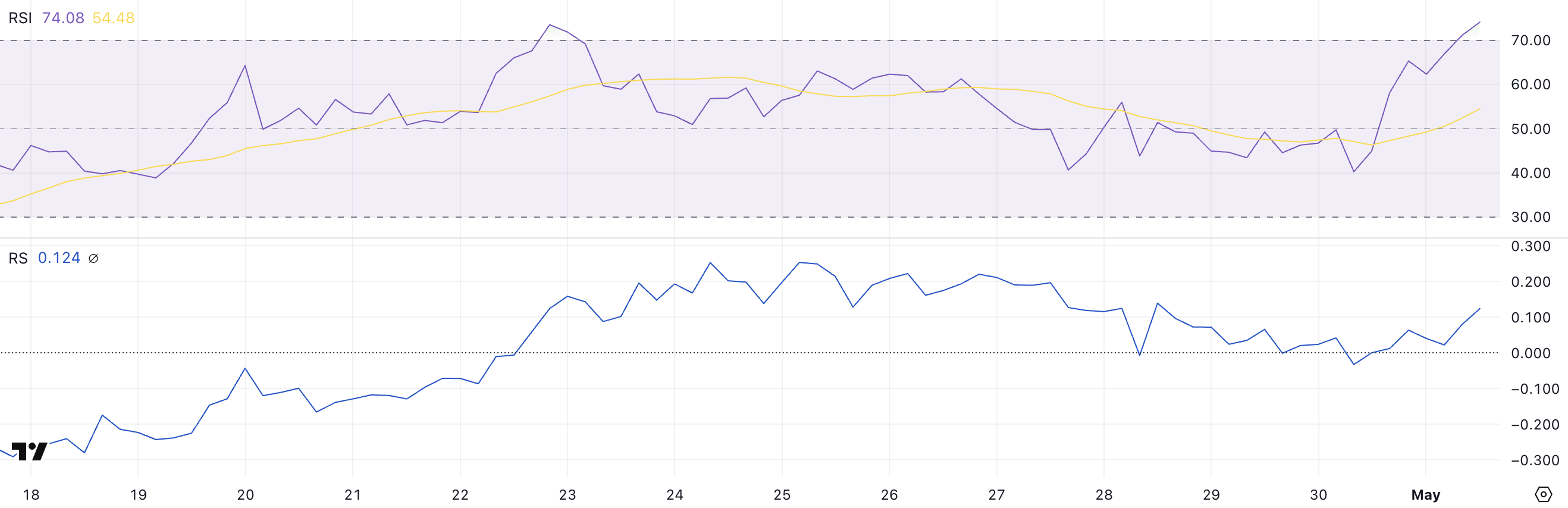

Echelon Prime (PRIME)

Echelon Prime has surged 33% in the last 24 hours, making it one of the day’s top-performing altcoins.

Its trading volume has exploded by 276%, reaching nearly $16 million—an indication of heightened trader interest and momentum.

However, while the price action is impressive, technical indicators are flashing caution in the short term.

PRIME’s Relative Strength Index (RSI) currently sits at 74, firmly in overbought territory. At the same time, its Relative Strength (RS) is just 0.124.

This combination—high RSI and low RS—suggests the recent rally may be unsustainable.

While there’s strong short-term demand, the token lacks confirmation from relative market strength, making PRIME vulnerable to a sharp correction if buying pressure fades.

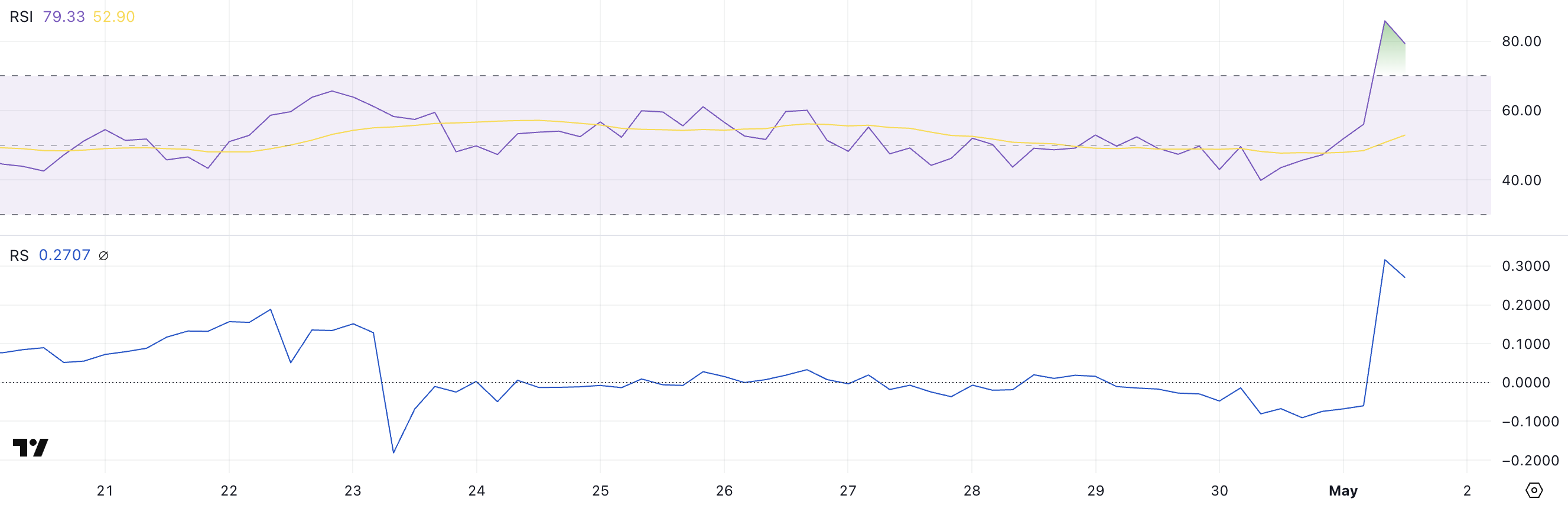

Balancer (BAL)

Balancer has jumped over 41% in the last 24 hours, supported by a sharp rise in trading activity, with volume climbing to $53 million.

The price surge places BAL among the strongest-performing altcoins in the market. However, technical indicators suggest the rally may be overextended despite the breakout.

BAL’s Relative Strength Index (RSI) is at 79.33, signaling extreme overbought conditions. Meanwhile, its Relative Strength (RS) stands at just 0.27, indicating it is still underperforming relative to the broader market.

This combination—very high RSI and low RS—often points to an unsustainable move driven more by hype than underlying strength.

Without relative outperformance to support the momentum, BAL could be at risk of a near-term pullback once buying pressure cools.