$61 Billion in Bitcoin Nears Break-Even as Bullish Signals Flash Green

Nearly 3 million BTC last moved below $30,000—and they’re about to go into the black. On-chain data shows early accumulation patterns mirroring 2020’s pre-bull run activity.

Whales are circling: Tether’s USDT minting spree just added $2B in dry powder. Meanwhile, Wall Street analysts still can’t decide if crypto is ’digital gold’ or a ’speculative asset’—classic hedge fund whiplash.

The takeaway? When this much dormant supply wakes up hungry, markets tend to move. Fast.

Bitcoin Investors Are Eager For Profits

The MVRV (Market Value to Realized Value) ratio has recently bounced off the mean line of 1.74, which is historically a strong point of confidence for Bitcoin. When this ratio rebounds from the 1.74 level, it often signals the early stages of a bull market. This market structure closely mirrors the one seen during the previous consolidation phase in 2024, which culminated in a peak during the yen-carry-trade unwind in August.

Following this, Bitcoin experienced a sharp price jump in September 2024, validating the bullish signal provided by the MVRV ratio. As Bitcoin’s price approaches this key level once again, there is potential for similar price action.

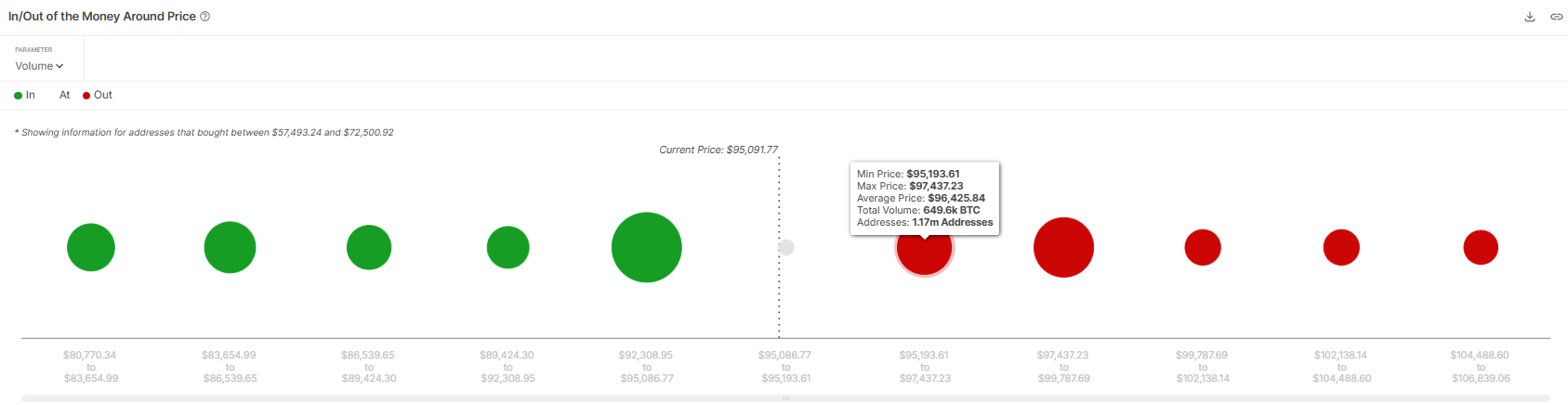

Bitcoin’s overall macro momentum is also supported by strong demand from investors. According to the IOMAP (In/Out of the Money Around Price) data, approximately 649,600 BTC, valued at over $61.6 billion, were purchased between $95,193 and $97,437. This large accumulation by investors establishes a solid support level for Bitcoin, should BTC holders refrain from selling immediately to break even. BTC could rise further if greed drives these investors to hold instead of selling immediately.

Combined with the early signs of a bull market with demand for gains, Bitcoin could reach the $98,000 resistance, validating the profitability of the $61.6 billion worth of BTC bought at these levels and securing the range as support. The increasing number of buyers in this range creates a strong foundation for Bitcoin’s price to surge further.

BTC Price Aims At Breakout

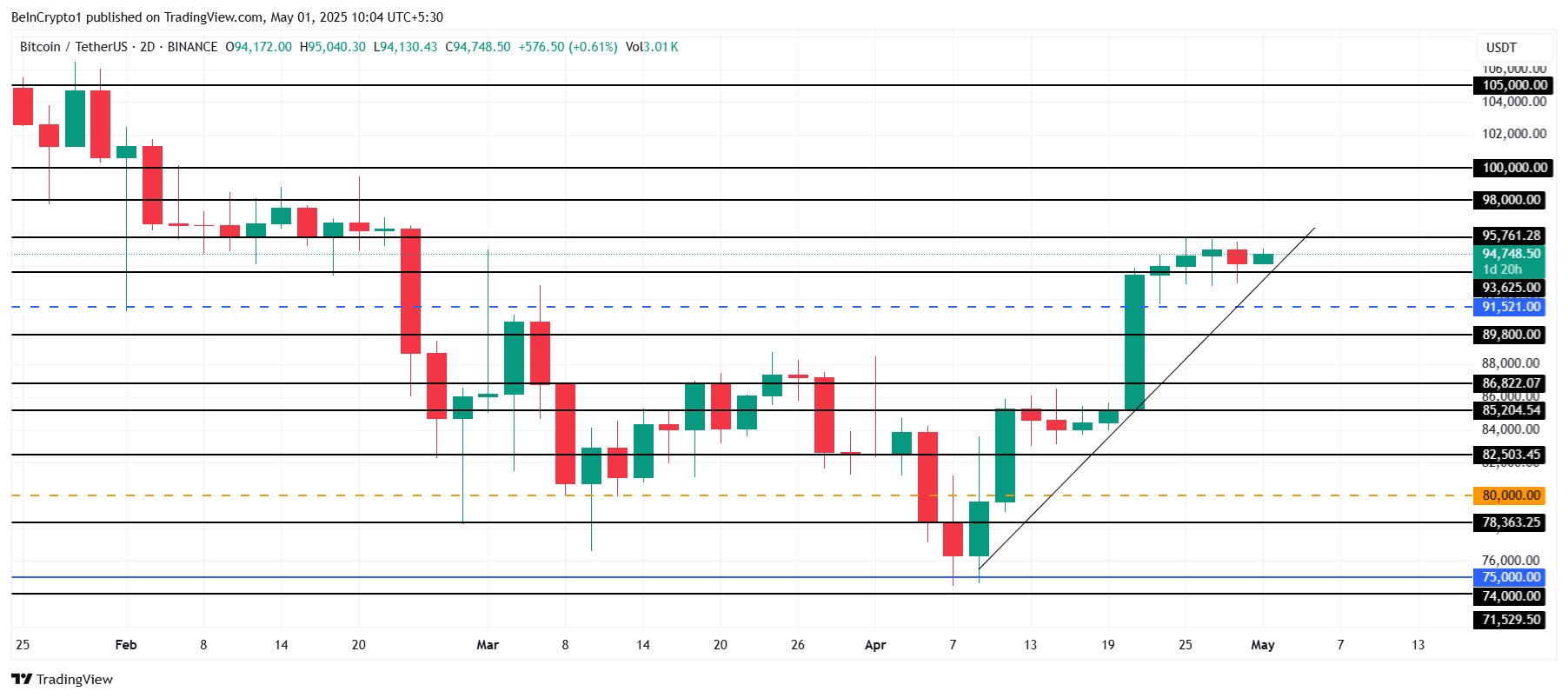

Bitcoin’s price has shown a short-term uptrend over the past three weeks, currently trading at $94,748. Although Bitcoin has been consolidating below the $95,761 level for the past week, it is poised for a possible surge. The positive momentum indicates that Bitcoin may break through the current resistance and continue its upward trajectory.

If Bitcoin manages to secure $95,761 as support, it could begin its climb toward $98,000. Breaking this resistance would open the path for Bitcoin to target the next key level of $100,000, which remains a major psychological barrier for investors. With strong support levels and positive market sentiment, Bitcoin could reach these milestones sooner than expected.

However, if Bitcoin fails to breach $95,761 and falls through the support at $93,625, it could face a decline to $91,521. This drop would invalidate the short-term bullish outlook, signaling potential market weakness. A reversal at these levels would require close monitoring of market conditions to determine the next potential price movements.