Bitcoin ETFs See First Outflow in 9 Days—$56 Million Flees as Crypto Rally Stalls

Wall Street’s bitcoin honeymoon hits a snag as ETF inflows reverse course. After eight straight days of bullish momentum, investors yanked $56 million from spot bitcoin ETFs—just as BTC struggles to hold $60K.

Was it profit-taking? Risk-off sentiment? Or just another case of ’buy the rumor, sell the news’ in an asset class where even the ’smart money’ chases momentum like a retail trader hyped on Reddit.

Bitcoin ETFs Face $56 Million Exit Amid Sideways Price Action

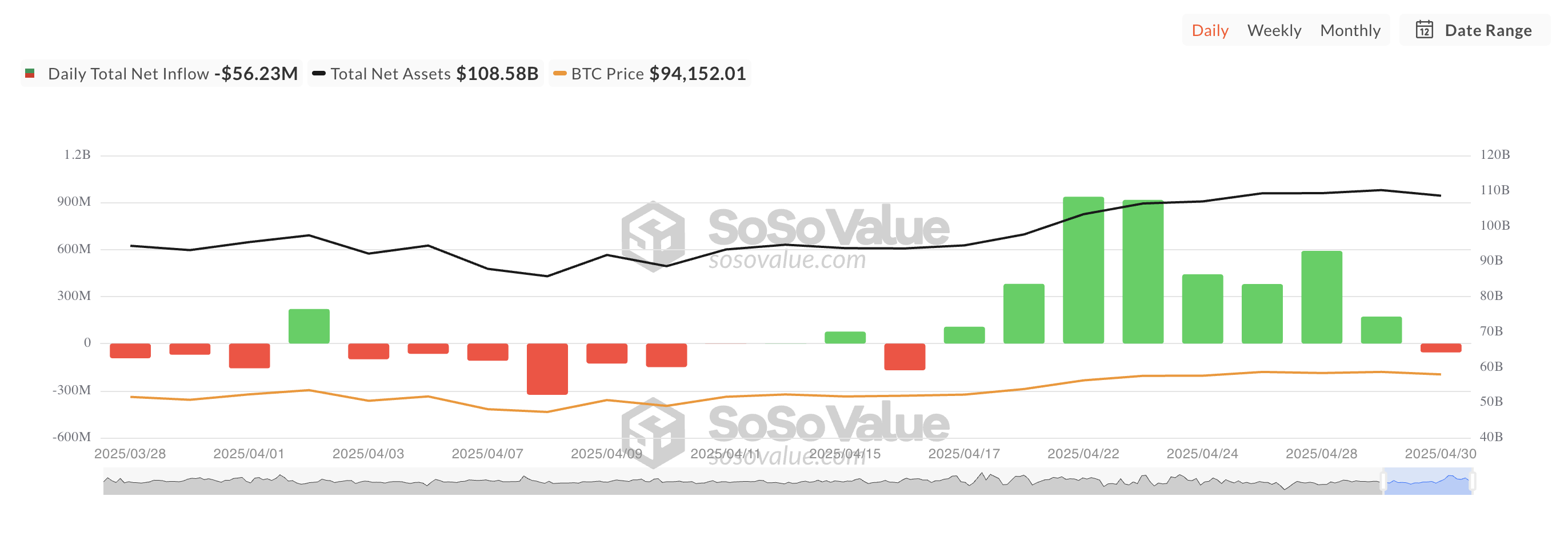

Yesterday, the total net outflow from BTC spot ETFs came to $56.23 million. This sudden shift in funds Flow suggests a potential cooldown in institutional demand following a sustained period of accumulation.

Total Bitcoin Spot ETF Net Inflow. Source: SosoValue

BTC’s price consolidation since April 25 may have prompted this pullback. An assessment of the BTC/USD one-day chart reveals that the leading coin has traded within a narrow range since then, facing resistance at $95,427 and finding support at $93,749.

With BTC consolidating tightly and failing to break key levels, some key investors are opting to de-risk their positions by temporarily withdrawing capital from BTC-backed funds. An extended period of sideways price action comes with uncertainty around short-term momentum, making it harder to sustain the aggressive inflows into BTC ETFs.

On Wednesday, BlackRock’s iShares Bitcoin Trust (IBIT) was the only fund to buck the trend, recording a net inflow of $267.02 million, bringing its total historical net inflow to $42.65 billion.

Fidelity’s FBTC saw a $137.49 million exit from the fund in a single day. Despite the drawdown, FBTC’s total historical net inflow stands at $11.63 billion.

BTC Derivatives Market Shows Mixed Sentiment

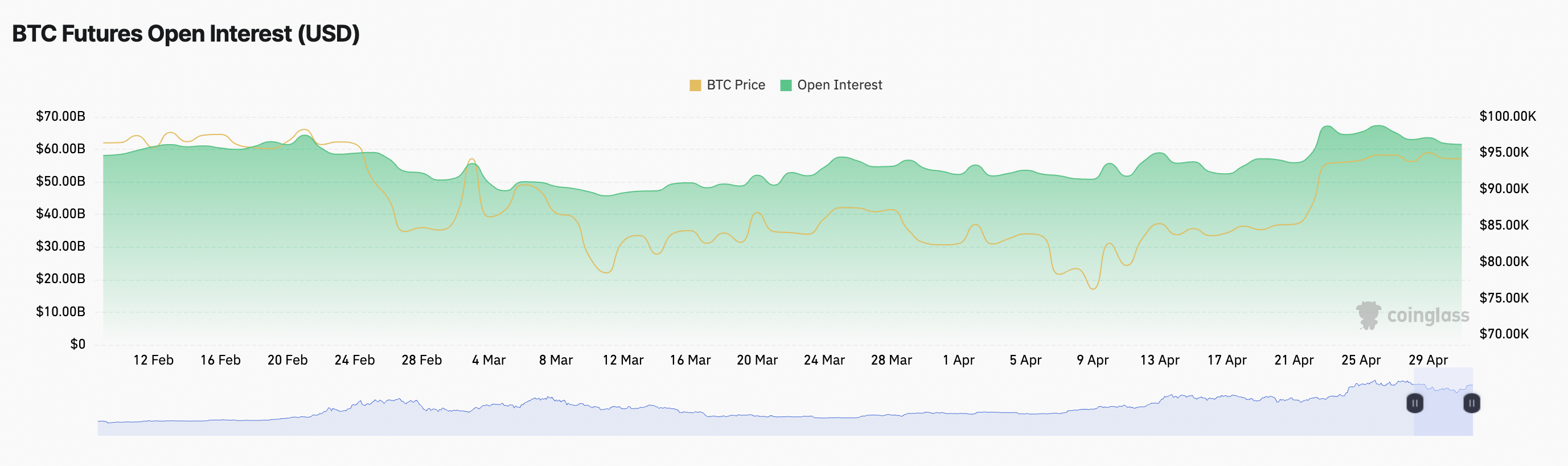

Meanwhile, despite the recent price consolidation, derivatives market data reflect a mixed sentiment among traders. Open interest in BTC futures has declined slightly over the past day, signaling reduced activity.

At press time, this stands at $61.50 billion, noting a 1% dip over the past day. A drop in open interest like this suggests that traders are closing out positions rather than opening new ones. This trend reflects uncertainty or waning conviction in BTC’s short-term price direction.

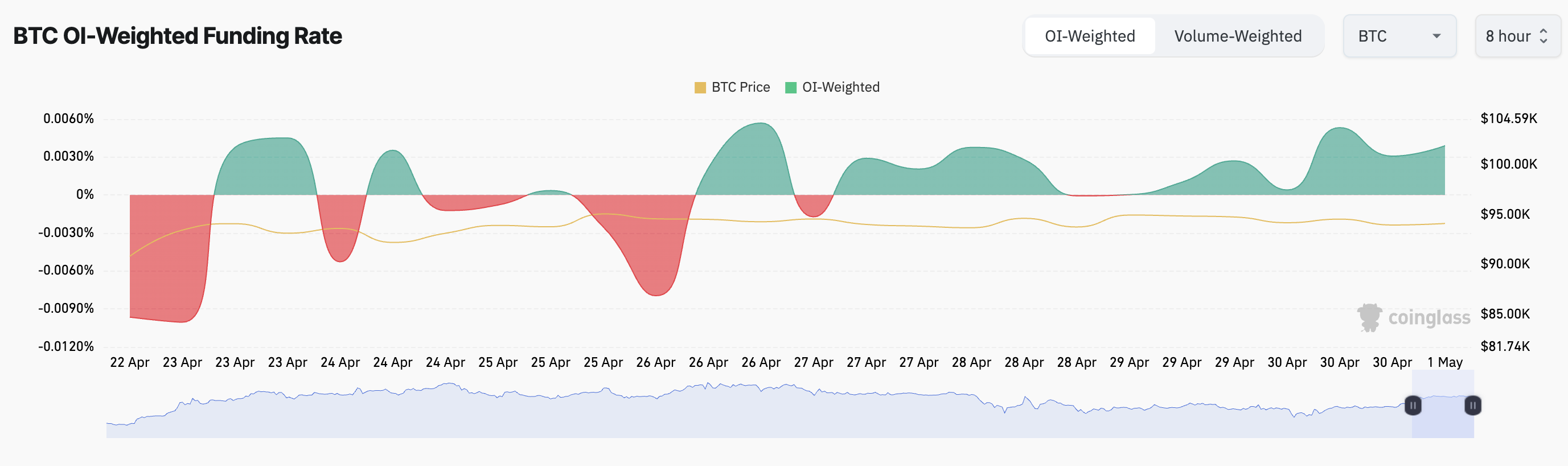

However, the coin’s funding rate remains positive, indicating that long traders are still dominant. As of this writing, this stands at 0.0039%, confirming the preference for long positions over short ones.

This bullish sign indicates that despite BTC’s price stagnancy, many of its futures traders are still opening bets in favour of a price rally.

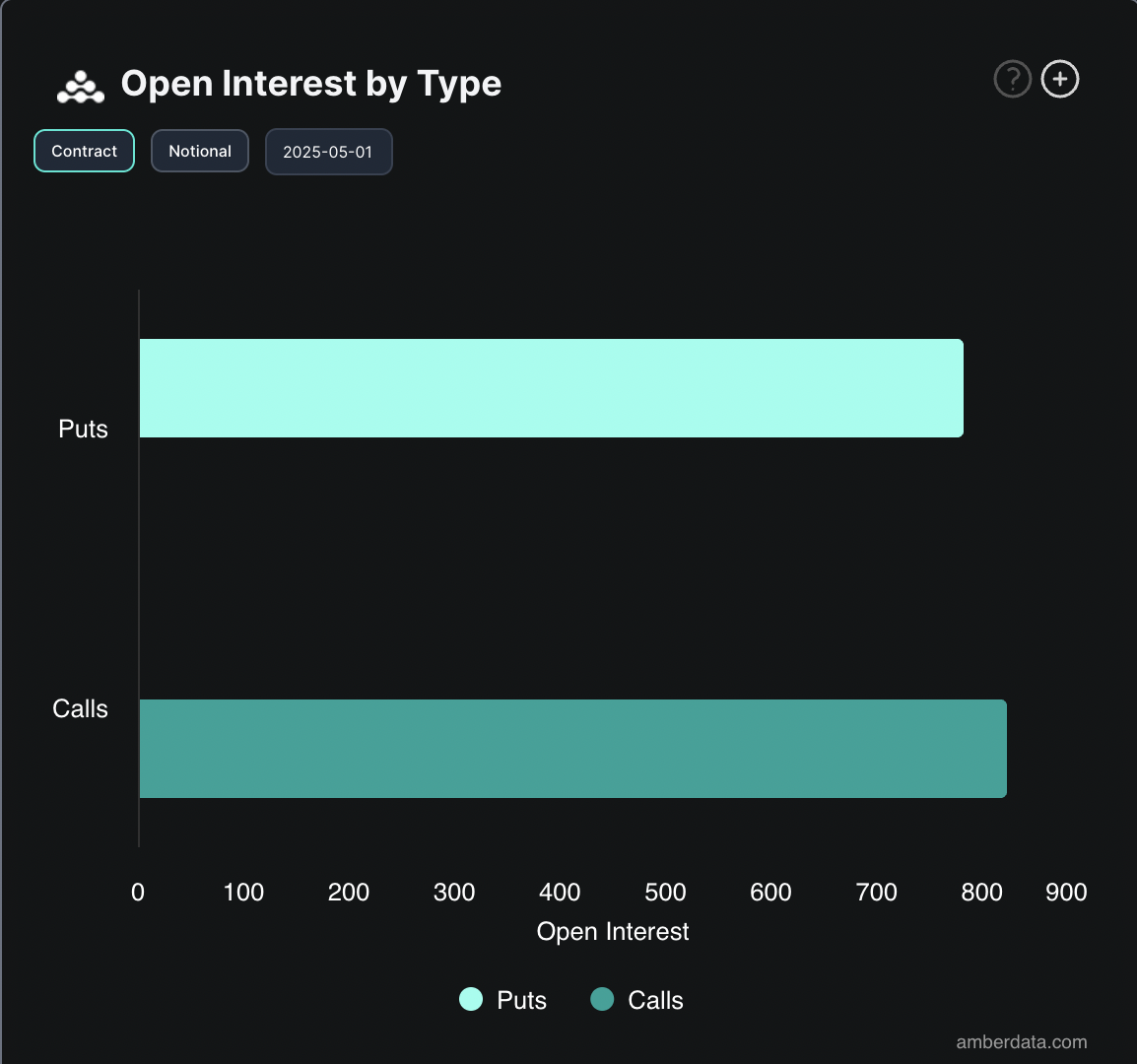

Additionally, the options market shows a higher volume of call contracts than puts, a sign that some market participants will continue to bet on an upward breakout in the NEAR term.

The pullback in ETF inflows may reflect profit-taking after a strong April performance, but data from both futures and options markets suggest investors are not turning bearish just yet.