$649 Billion in Stablecoins Funneled by Crypto Criminals—And the Banks Still Call Us ’High-Risk’

Stablecoins—the crypto world’s answer to dollar pegs—just got dragged into the spotlight for all the wrong reasons. New data reveals a staggering $649 billion in illicit transactions flowed through these ’safe harbor’ assets last year. Guess the compliance departments at TradFi missed that memo.

How criminals exploit the system: Wash trading, darknet markets, and good old-fashioned money laundering all thrive on stablecoins’ liquidity and pseudo-anonymity. Meanwhile, regulators keep barking up the wrong tree—chasing privacy coins while Tether’s $100B+ empire prints the digital dollars fueling this underground economy.

The irony? Your local credit union will still flag a $5,000 BTC purchase as ’suspicious’ while Wall Street quietly processes billions in fines for actual fraud. Crypto’s not the problem—it’s just the scapegoat for a financial system that never fixed its own plumbing.

Stablecoins and Crypto Crime – A Concerning Trend?

Stablecoins are a vital component of the international crypto ecosystem, but they fulfill a similar role in crime. For example, crypto sleuth ZachXBT alleged last month that North Korean hackers have “epidemic” participation in this space.

Bitrace’s 2024 Crime Report details illicit activities all across the industry, but it focuses specifically on stablecoins.

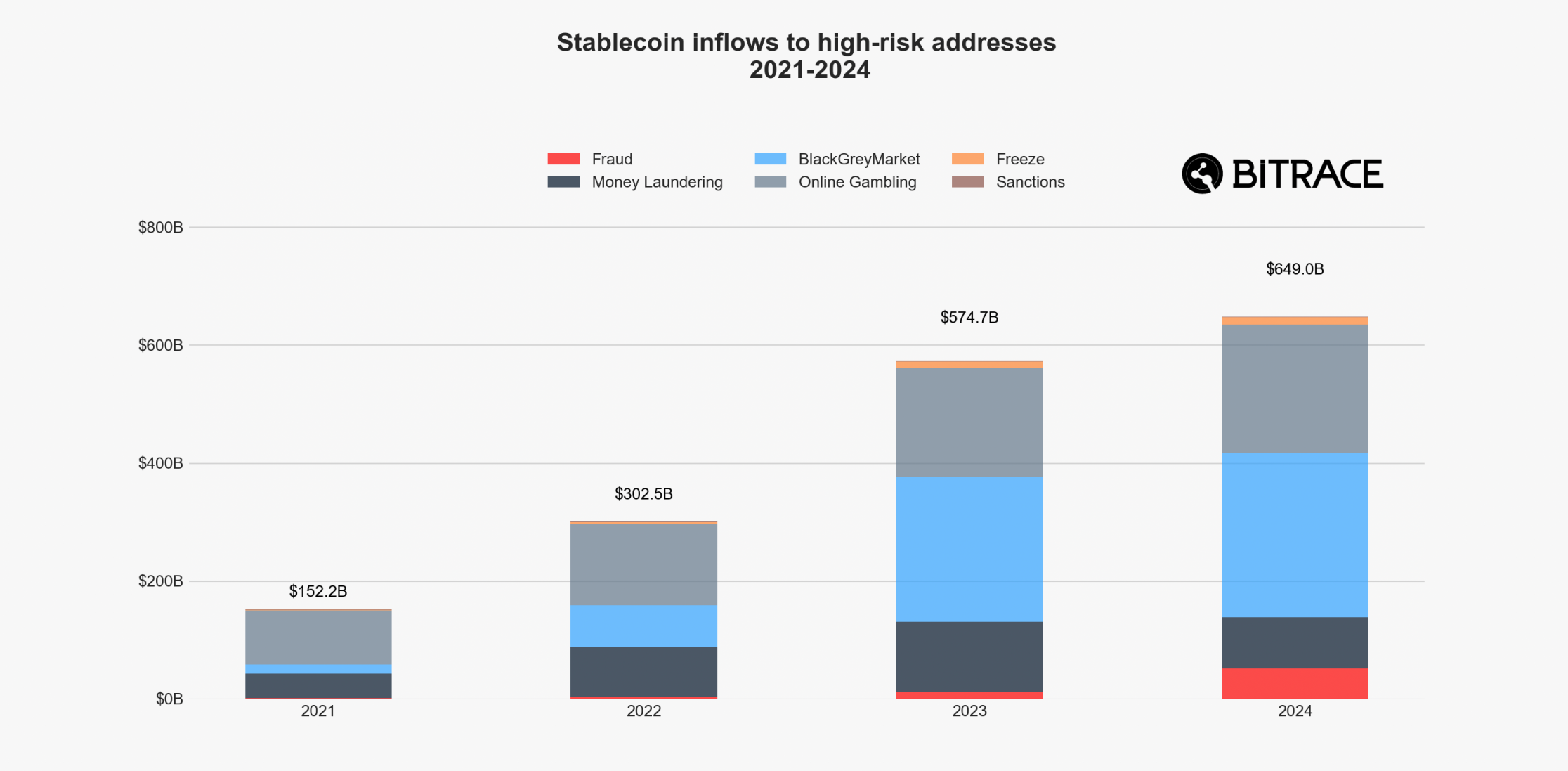

Its data claimed that $649 billion in stablecoins went to high-risk addresses last year, a definite increase from 2023. However, these transactions only amounted to 5.14% of global stablecoin volume, a decrease from 5.94% the previous year.

In other words, the stablecoin sector is growing faster than its usage in crypto crime.

Naturally, Tether makes up the overwhelming majority of these transactions since it’s the most popular stablecoin. Tron and Ethereum were the most popular blockchains for USDT stablecoins, making up around 90% of the crime-related volume.

Ethereum’s presence grew relative to Tron, but the latter blockchain still represents more than 75% of transactions.

Stablecoins in Crypto Crime.

Stablecoins in Crypto Crime.

1/ Since 2022, stablecoins replaced Bitcoin as the preferred currency for illicit transactions. pic.twitter.com/FxExZHQky5

Bitrace’s Crypto Crime Report mostly focused on the stablecoin industry but also covered several other sectors.

For example, illicit trade on the darknet grew by more than $30 billion as vendors switched to DeFi to avoid law enforcement. Crypto gambling is also on the rise, increasing 17.5% to $217.84 billion.

However, the industry is also taking several initiatives of its own. Scams and frauds have ballooned last year, jumping from $12 billion in 2023 to $52 billion in 2024.

Escrow services like Huione play a vital intermediary role, and Tether has been working to freeze its wallets. They’ve only neutralized a tiny fraction of Huione’s trade, but it’s a good start.

Tether and Circle have been active in freezing crypto wallets used by criminals since stablecoins are a lynchpin of this ecosystem.

The quantity of total frozen assets grew by nearly $1 billion in 2024, double the amount of the past three years combined. This is far below the necessary amount, but hopefully these operations can scale up.

To summarize, stablecoins are a thriving component of crypto’s criminal underworld, but enforcement is becoming more determined and sophisticated.

If the industry continues to focus on fighting fraud and money laundering, it could make a real difference. Stablecoin’s legitimate uses dwarf this sector, and criminals’ total market share is decreasing.