Bitcoin’s Bull Run Isn’t Done Yet—Analyst Predicts $108K Surge on Strong Fundamentals

Forget the dip—Bitcoin’s structural tailwinds could send it soaring past six figures, according to one bold forecast. Here’s why the smart money’s betting on a moonshot.

The Halving Effect: With supply cuts baked into the code, scarcity alone might fuel the next leg up. Traders are front-running the math.

Institutional FOMO: BlackRock’s ETF was just the start. Wall Street’s playing catch-up while crypto OGs smirk behind their ledger wallets.

The Cynical Kicker: Sure, $108K sounds crazy... until some hedge fund manager inevitably claims they ’always believed’ after the fact.

Will Bitcoin Reclaim Its All-Time High Again?

Woo shared his insights in a detailed thread on X (formerly Twitter). He believes strong fundamentals support Bitcoin’s bullish trend.

This includes a rising capital inflow into the Bitcoin network, with total and speculative capital flows recently bottoming out. The alignment of these flows creates a solid, bullish environment for the asset.

“BTC fundamentals have turned bullish, not a bad setup to break all-time highs,” he stated.

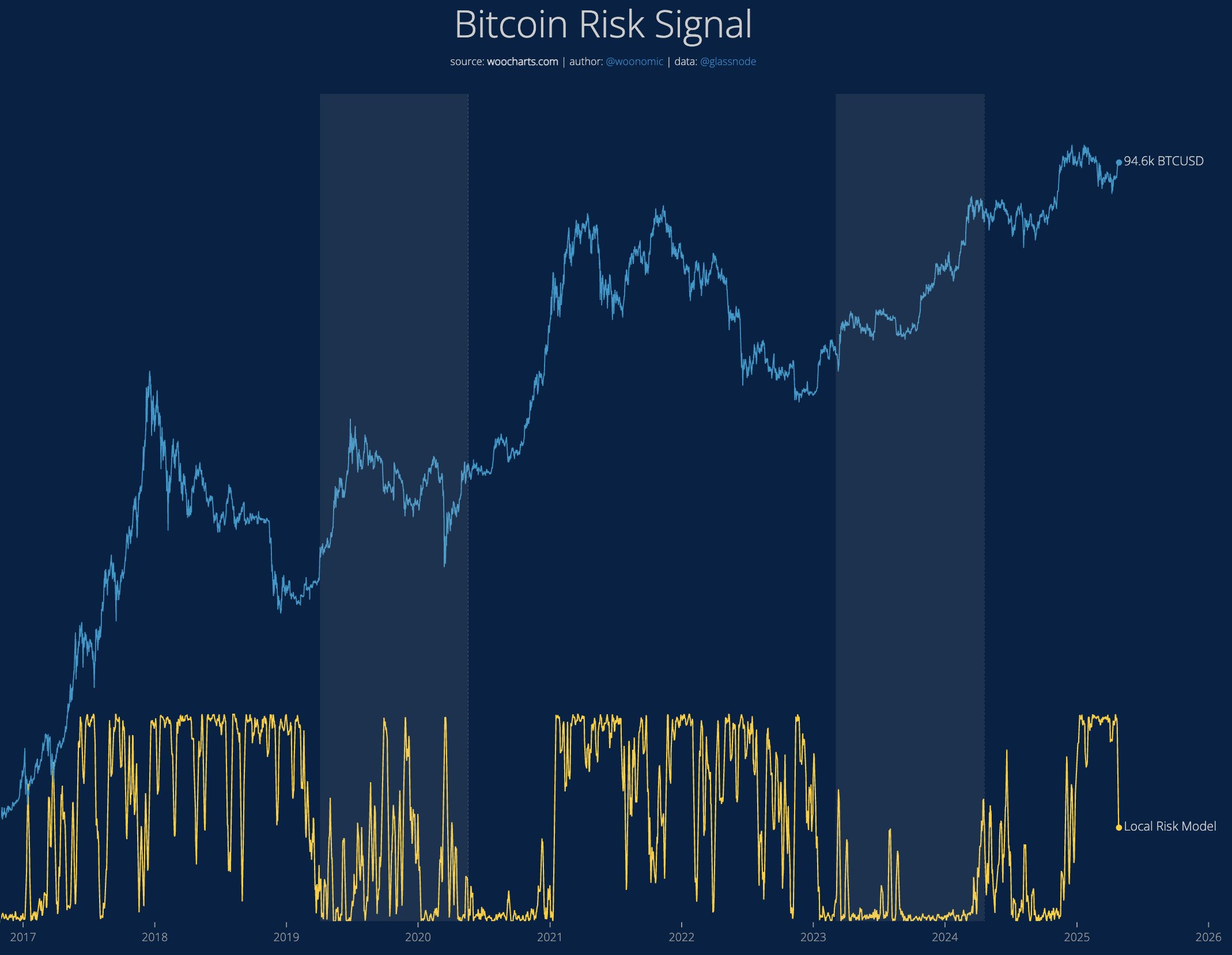

Additionally, WOO highlighted that Bitcoin’s liquidity is deepening, as evidenced by his downward-trending Risk Model. This downtrend suggests market liquidity has returned. Therefore, future price drops will likely be smaller and less severe, reducing the risk of sharp sell-offs.

“All dips are for buying under the present regime. In the very short term, there’s good chances of dips,” Woo asserted.

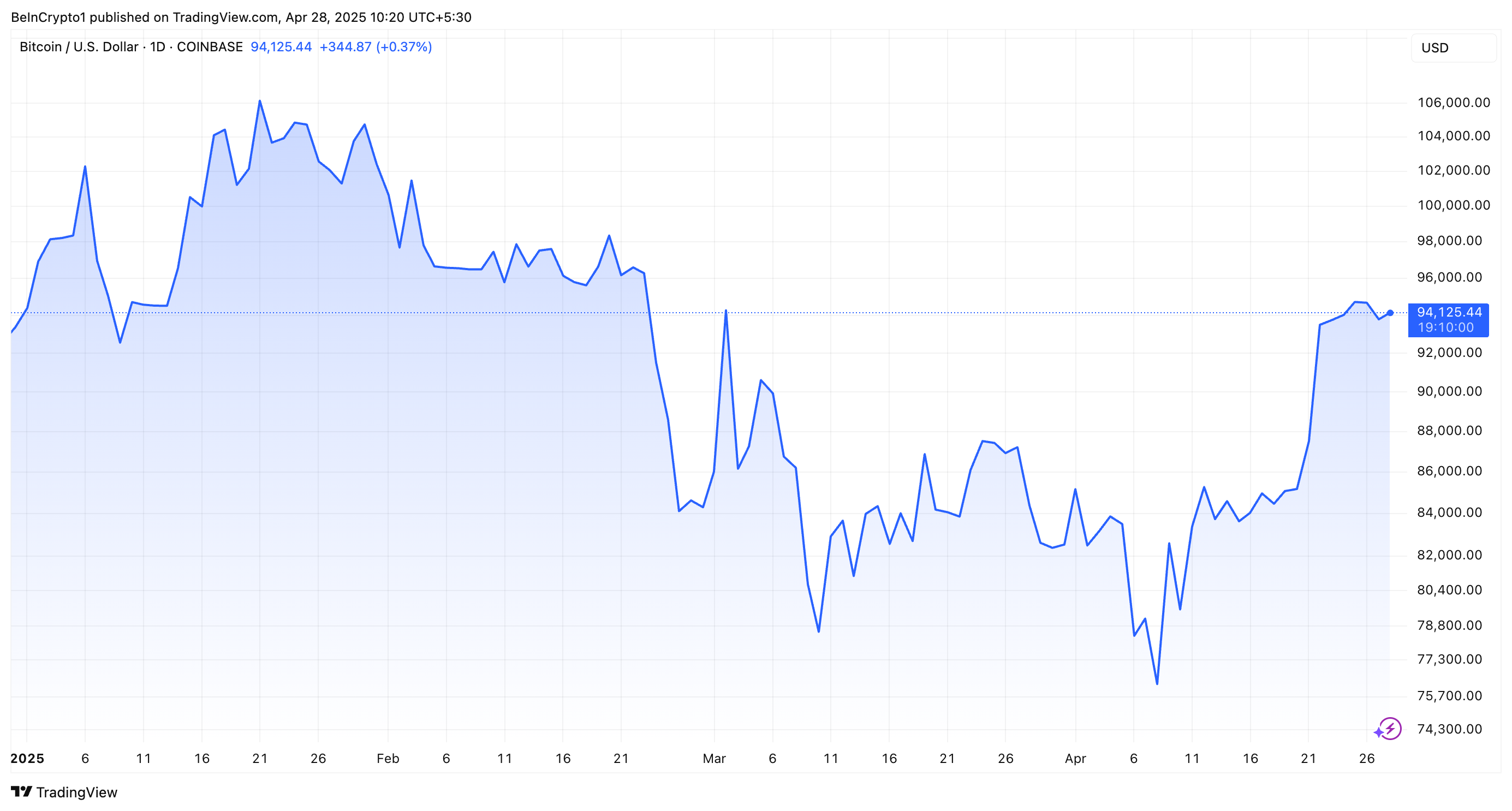

The analyst further noted that Bitcoin has already reclaimed medium-term price targets of $90,000 and $93,000. In addition, a new interim target at $103,000 has formed, suggesting that Bitcoin will likely reach this level before pushing toward the $108,000 all-time high.

He clarified that these targets are supported by sustained capital inflows rather than mere speculative trading, strengthening the case for a durable upward trajectory.

Despite the optimistic long-term outlook, Woo cautioned that short-term challenges may arise. Bitcoin’s on-chain Volume Weighted Average Price (VWAP) is currently at +3 standard deviations.

This implies that the coin’s current price is far above its typical range. When an asset moves this far above its average, it’s considered overextended.

“It’ll be hard to move upwards with decent momentum due to overextension,” Woo explained.

According to Woo, this metric indicates that upward momentum may be limited in the NEAR term. Instead, the most likely outcomes are moving sideways or a slow, gradual increase rather than a fast rally.

Previously, BeInCrypto outlined three major signals that strengthen the case for Bitcoin’s recovery. In April, Bitcoin reestablished its inverse relationship with the falling US Dollar Index (DXY) and decoupled from the NASDAQ.

Meanwhile, long-term investors are actively accumulating coins. Together, these three divergences signal growing market confidence and hint at a potential major Bitcoin rally. In fact, BTC’s recent market performance also reinforces this outlook.

BeInCrypto data showed that the coin’s value has recovered by 7.7% over the past week. At the time of writing, Bitcoin traded at $94,125, representing a minor downtick of 0.07% over the past day.