SEC Crackdown Costs Coinbase Users $90M in Lost Staking Rewards—Regulators Playing ’Protector’ or Profit Killer?

Coinbase’s staking users just got a $90 million lesson in regulatory roulette. The SEC’s heavy-handed restrictions have effectively blocked access to what was once a reliable yield stream—while traditional finance gets to keep playing with riskier instruments (hello, credit default swaps).

Staking Rewards Slashed: What Happened?

The SEC’s war on crypto staking—framed as ’investor protection’—has forced Coinbase to dismantle its retail staking program. Result? A nine-figure hole in users’ potential earnings. Meanwhile, Wall Street’s favorite casinos (sorry, ’markets’) continue unchecked.

Regulatory Hypocrisy or Necessary Guardrails?

Officials claim they’re shielding Main Street from risk. Tell that to the users now missing out on 3-5% APY while inflation eats their cash. Bonus irony: the same regulators greenlighted banks to offer 0.01% ’high-yield’ savings accounts.

The Bottom Line: When protection feels like punishment, maybe it’s not protection at all—just old-fashioned control dressed in bureaucratic jargon.

Coinbase Pushes Back Against Outdated Staking Bans in US States

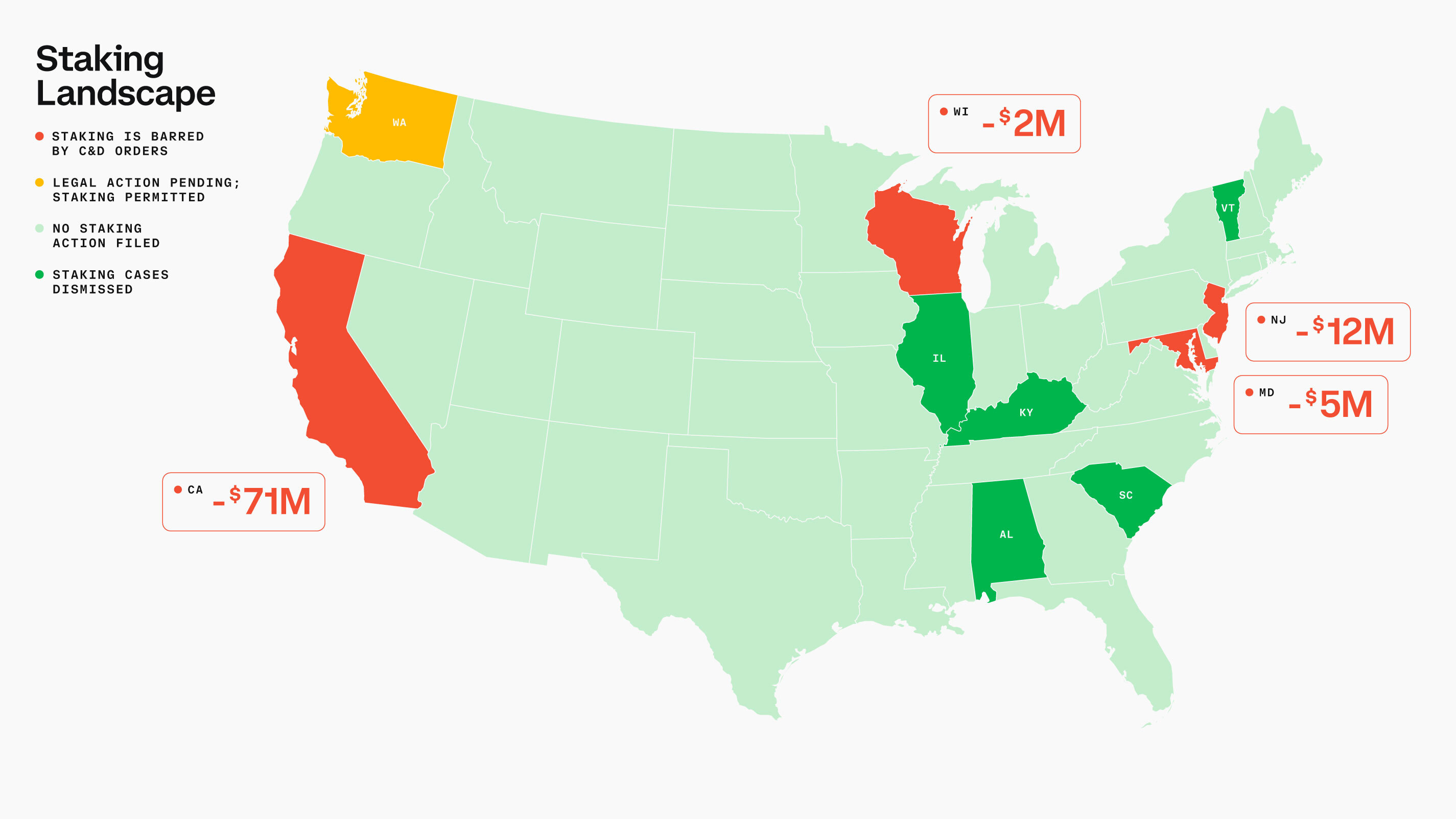

On April 25, Coinbase publicly urged California, New Jersey, Maryland, Wisconsin, and South Carolina to lift their restrictions against its staking services.

According to the exchange, removing these restrictions would align these states with the Securities and Exchange Commission (SEC). Notably, several other states have already abandoned similar efforts.

Earlier this year, the SEC dropped its enforcement action against Coinbase’s staking operations, allowing the exchange to resume its services without federal opposition.

Following the SEC’s move, Illinois, Kentucky, South Carolina, Vermont, and Alabama also withdrew their actions, leaving only a handful of states maintaining restrictions.

Coinbase argues that the holdout states have imposed outdated and misdirected bans. The company stresses that regulators originally designed cease-and-desist orders to combat scams, not legitimate financial services like staking.

Considering this, the firm warned that the financial impact on residents will continue to grow unless the restrictions are lifted soon.

“The holdouts actively harm their consumers by barring their access to SAFE wealth generation tools like staking. They’ve cost these Americans tens of millions of dollars in potential earnings – and counting,” Coinbase’s chief legal officer Paul Grewal said on X.

Beyond lost earnings, Coinbase believes these state-level actions harm consumers by limiting their choices.

The exchange warned that residents might be forced to seek staking options through less secure, lightly regulated platforms. This shift could expose users to higher risks without the protections offered by licensed and established exchanges.

“By singling out Coinbase, these holdout states are arbitrarily picking winners and losers. That’s the job of consumers, not state bureaucrats. Their actions not only deprive consumers of competition and choice, but also push them towards potentially less regulated (or unregulated) staking platforms,” Coinbase stressed

Coinbase also raised concerns about the wider effects on the crypto industry. The ongoing bans, it said, add to the regulatory uncertainty that continues to cloud the US digital asset market.

While the SEC and multiple states have moved toward providing greater clarity, the holdout states risk isolating themselves from the emerging federal framework.

“Against this backdrop, continued litigation by the holdout states is more indefensible than ever. These lawsuits don’t protect consumers – they confuse them and expose them to greater risk,” Coinbase stated.

The exchange urges these states to align with national efforts to modernize crypto regulations.

The firm emphasized that dropping the staking restrictions would benefit residents and promote safer innovation. It added that this move would help create a stronger, more competitive crypto economy in the United States.