STX Defies Gravity With 20% Surge—Short Sellers Left Clutching Air

Stacks (STX) just ripped through bearish sentiment like a hot knife through institutional-grade margarine. While crypto futures traders piled into shorts, the Bitcoin-linked smart contract platform moonwalked past resistance levels.

Anatomy of a contrarian rally: Liquidation cascades met their match as spot buyers absorbed every ask. The ’dumb money’ narrative gets another dent—this time from a protocol most bankers still can’t explain at cocktail parties.

Closing thought: When a token pumping 20% counts as ’market leadership,’ maybe recalibrate what passes for a bull run these days. The casino stays open 24/7.

Stacks (STX) Jumps 20%, But Bearish Traders Dominate

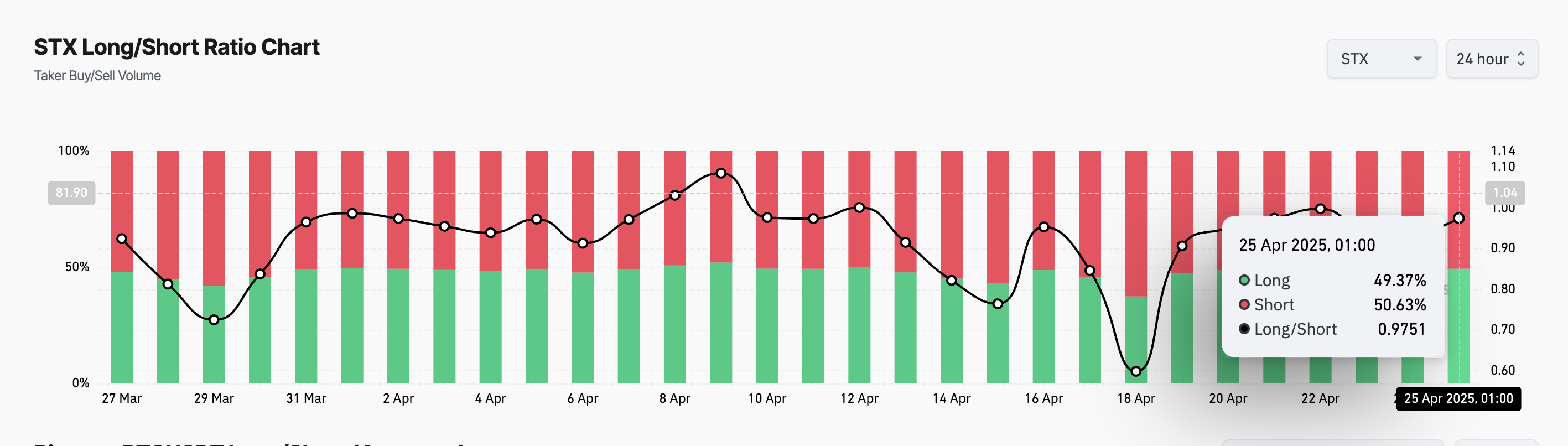

According to Coinglass, STX’s long/short ratio is currently at 0.97, signaling a preference for short positions among its futures market participants.

The long/short ratio measures the proportion of bullish (long) positions to bearish (short) positions in the market. When the ratio is above one, there are more long positions than short ones. This suggests bullish sentiment, with most traders expecting the asset’s value to rise.

Converesly, as with STX, a ratio below one indicates that more traders are betting on a price decline than on an increase. This suggests that many token holders are unimpressed by STX’s double-digit gains over the past day and anticipate a bearish reversal soon.

Moreover, STX’s overbought Relative Strength Index (RSI) supports this bearish outlook. At press time, this momentum indicator is at 74.35 and on an upward trend.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a price decline. Converesly, values under 30 indicate that the asset is oversold and may witness a rebound.

Therefore, STX’s RSI reading confirms that altcoin might be overbought and could witness a price decline in the NEAR term.

Can STX Defy Overbought Signals?

Once buyer exhaustion sets in, STX could shed some of its recent gains. In this scenario, the altcoin’s value could plunge to its year-to-date low of $0.47.

However, an RSI reading above 70 does not always signal an immediate reversal. Strong bullish momentum can sometimes sustain the rally, pushing prices even higher despite overbought conditions.

If demand strengthens, STX’s rally could persist, potentially allowing the token to break above the resistance level at $1.07.