Federal Reserve Chairman Anticipates Relaxation of Cryptocurrency Banking Regulations, Maintains Stance Against Interest Rate Reductions in May

The Chair of the Federal Reserve has indicated a potential easing of regulatory constraints on cryptocurrency-related banking activities, signaling a shift in policy approach toward digital assets. However, officials have clarified that no reductions in benchmark interest rates are planned for the upcoming May meeting, reflecting a cautious monetary stance amid prevailing economic conditions.

Fed’s Powell Maitains a Hawkish Outlook

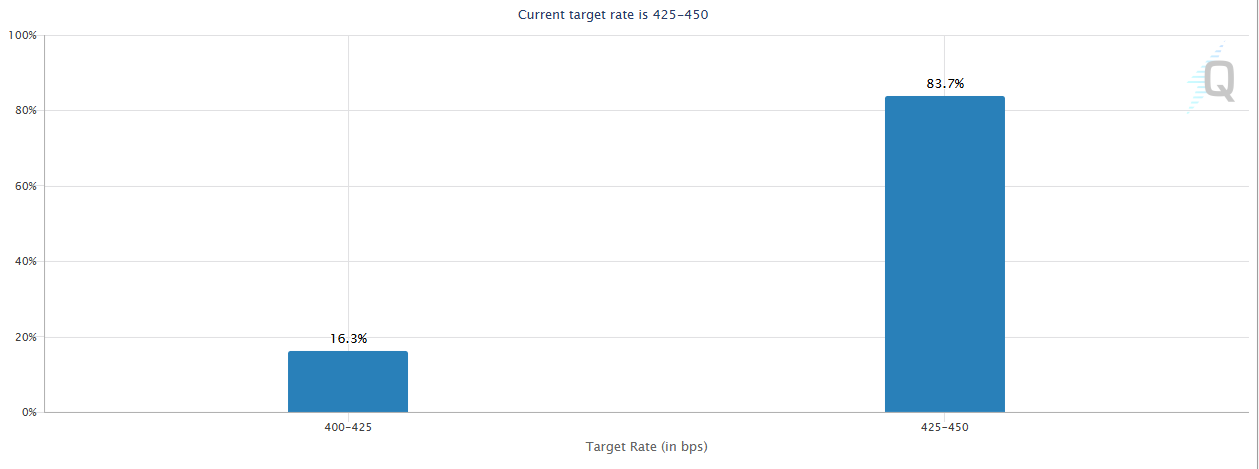

Powell’s remarks come as market expectations for a May rate cut have collapsed, with CME FedWatch data pricing in just a 16% chance. US equities dipped modestly following the speech. The equity market currently reflects investor disappointment over the lack of dovish signals.

“We should not rush to lower interest rates,” Powell said. “We have every reason to wait for more clarity before considering any changes to Fed policy.”

The crypto market, however, remained relatively steady. Rate cut optimism had already been priced out after last week’s hawkish FOMC minutes and cooler-than-expected CPI print.

Fed’s Interest Rate Cut Probability for May. Source: CME FedWatch

Fed’s Interest Rate Cut Probability for May. Source: CME FedWatch

Powell also offered direct comments on digital assets.

“Cryptocurrency is becoming more popular. A legal framework for stablecoins is a good idea.”

He added that the Federal Reserve supports relaxing certain banking regulations on crypto. The Feds agree that the sector is maturing and requires more defined oversight rather than constraint.

The dual message—no imminent policy easing but a positive outlook for crypto regulation—was met with a muted response across digital asset markets.

Bitcoin hovered near $84,500, showing resilience despite risk-off sentiment in equities. Powell acknowledged that economic growth had likely slowed at the start of 2025 and warned that Trump’s tariffs are a “key source of uncertainty.”

He also noted the Fed is not close to ending quantitative tightening and may need to make difficult policy choices if inflation resurges.

While the Fed reaffirmed its readiness to provide dollar liquidity to global central banks if needed, Powell dismissed the idea of a Fed “put.” He said the central bank’s independence is “a matter of law.”

For crypto markets, the regulatory tone was a silver lining in an otherwise hawkish macro environment.