STBL Plunge Triggers Insider Trading Suspicions – Is This a Controlled Demolition?

Markets reel as algorithmic stablecoin STBL tanks 42% in 3 hours—just as whale wallets mysteriously offloaded $28M worth. Regulators circle.

Behind the bloodbath: On-chain sleuths spot 9-figure dumps from 'VC-affiliated' addresses hours before the crash. The usual 'market conditions' excuse isn't flying this time.

Damage control mode: Foundation blames 'oracle malfunction,' but traders aren't buying it. Literally. STBL now trades at $0.61 despite $1 peg promises.

Bonus jab: Another day, another 'decentralized' project where insiders magically sidestep losses. At least the SEC gets fresh ammo for its stablecoin crackdown.

Who Sold — and Why Did the Market React So Sharply?

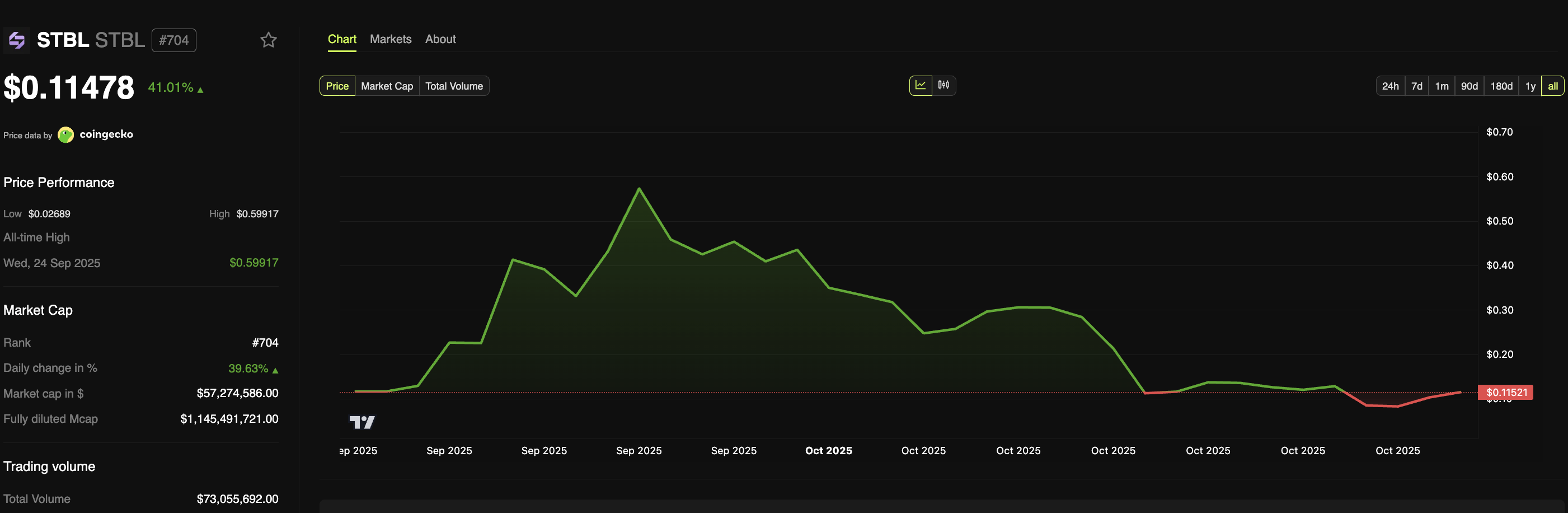

Within just a month of its launch, STBL, the token of the stablecoin protocol of the same name, has plunged more than 80% in value. Data from BeInCrypto shows that STBL hit an all-time high around $0.60, then dropped to a low of about $0.0797 before recovering slightly to $0.11478. At this price, STBL’s market cap hovers NEAR $58 million.

According to Bubblemaps, on-chain data revealed that at least five large addresses sold all of their STBL holdings, pocketing roughly $17 million in profits. Notably, these same five addresses were linked to early STBL trading activity in September — when they collectively earned over $10 million during the token’s launch phase.

This pattern has sparked speculation within the crypto community about potential insider trading or coordinated sell-offs. Some X users described these accounts as “snipers,” implying algorithmic or insider-led operations rather than normal market participants.

“I don’t like these snipers; they could be insiders or maybe not, but they’ve dragged my $STBL portfolio DEEP underwater. Anyway, luckily, the bastard is out, and I still have enough stablecoin outside to buy some more at the current bottom,” one trader wrote.

While some observers labeled the sellers as casual traders, STBL’s CEO Avtar Sehra pushed back, asserting these were “orchestrated and professional accounts,” citing the Bubblemaps findings.

STBL’s team has publicly denied any internal involvement in the sell-off. In a statement, they emphasized that treasury operations remain transparent and that no team allocations or vesting schedules have changed:

“We’re focused on building the protocol and adoption with the community. Allocations/vesting are unchanged. Furthermore, any tokens vesting this quarter won’t be minted and will not enter circulation.” STBL shared.

Despite the turmoil, STBL announced its intention to mint 100 million USST in Q4. The MOVE raised concerns that an increased token supply could add further selling pressure, especially amid shaken investor confidence. Previously, as BeInCrypto reported, the STBL team also said that they will open a USST repurchase and staking program at the end of October, aiming to restore liquidity and stabilize the token value.

Technical Analysis: Accumulation Zone or Dead-Cat Bounce?

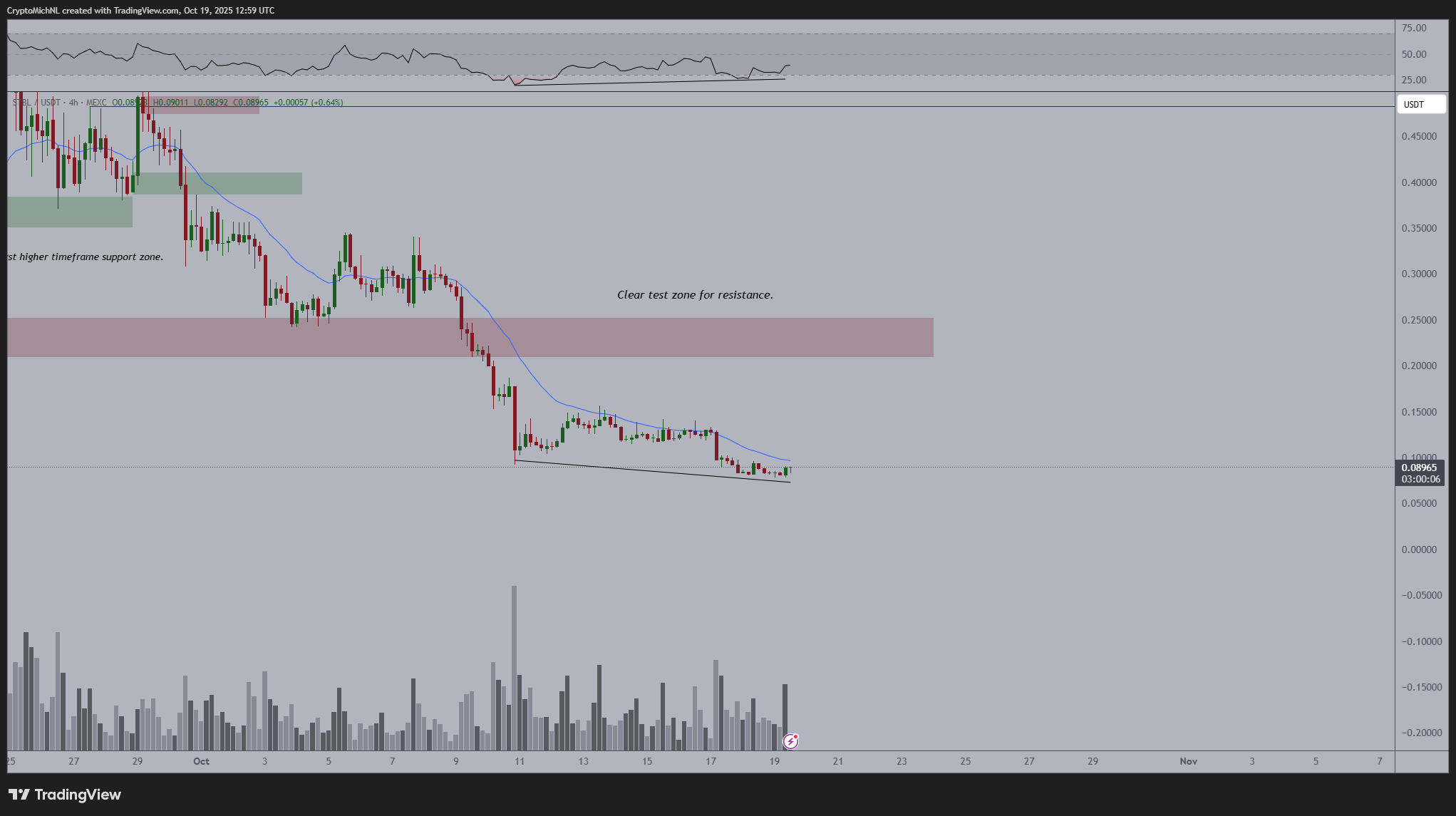

According to crypto analyst Michaël van de Poppe, the current price action may represent a key accumulation phase, as STBL forms a technical bottom near $0.09–$0.10. He suggests that if sentiment improves, the token could rebound toward the $0.17–$0.20 resistance range — previous support levels now flipped into resistance.

However, Michaël van de Poppe also cautioned that a sustained uptrend can only occur if market volume recovers and fresh capital returns to the project. Until then, STBL’s fate remains uncertain — teetering between a cautious rebound narrative and the shadow of a credibility crisis.