Government Shutdown Throws Curveball at September CPI Data as Fed Considers Rate Cut Timing

Fed's favorite inflation gauge faces unprecedented disruption as political gridlock threatens economic visibility.

The Data Blackout

September's Consumer Price Index release hits a government-shaped roadblock just as Federal Reserve officials prepare for potential rate adjustments. Critical inflation metrics vanish behind the shutdown curtain, leaving policymakers flying blind during crucial decision-making periods.

Market Reactions Brewing

Traders scramble for alternative data sources while the traditional economic calendar goes dark. The timing couldn't be worse—with inflation trends showing mixed signals and employment data already painting a confusing picture.

Fed's Dilemma Deepens

Central bankers now face the ultimate test: proceed with planned rate decisions based on incomplete information or delay critical monetary policy moves until the political theater concludes. Either way, markets brace for volatility spikes.

Because nothing says 'stable financial system' like politicians playing chicken with economic data—Wall Street's favorite reality show continues, now with extra uncertainty and your retirement funds as the grand prize.

CPI Report Takes Center Stage as Shutdown Halts Other Key Economic Data

No other major reports, including jobs and retail sales data, will be published until the shutdown ends. However, something will occur differently, with the CPI data coming only five days before the Fed’s October 29 meeting.

“Something unusual is happening this week… Not only is it 5 days before the October 29th Fed meeting,” wrote Adam Kobeissi.

The US CPI report is typically released once a month, usually on or around the 10th to 13th of the following month. For example, the August CPI data was released on September 11. Meanwhile, the July CPI came in on August 12.

By convention, CPI data is released on a Tuesday or Wednesday at 8:30 a.m. ET by the Bureau of Labor Statistics (BLS). This makes Friday releases extremely rare; the last time was January 2018.

As for timing relative to Federal Reserve meetings, CPI usually comes out 1–2 weeks before the Fed’s Federal Open Market Committee (FOMC) meeting. This gives policymakers enough time to analyze the data alongside other indicators before deciding on interest rates.

Against these backdrops, the timing has fueled speculation of a bullish inflation print. This could potentially set the stage for another rate cut. The Fed’s next MOVE is now almost entirely on this single inflation reading.

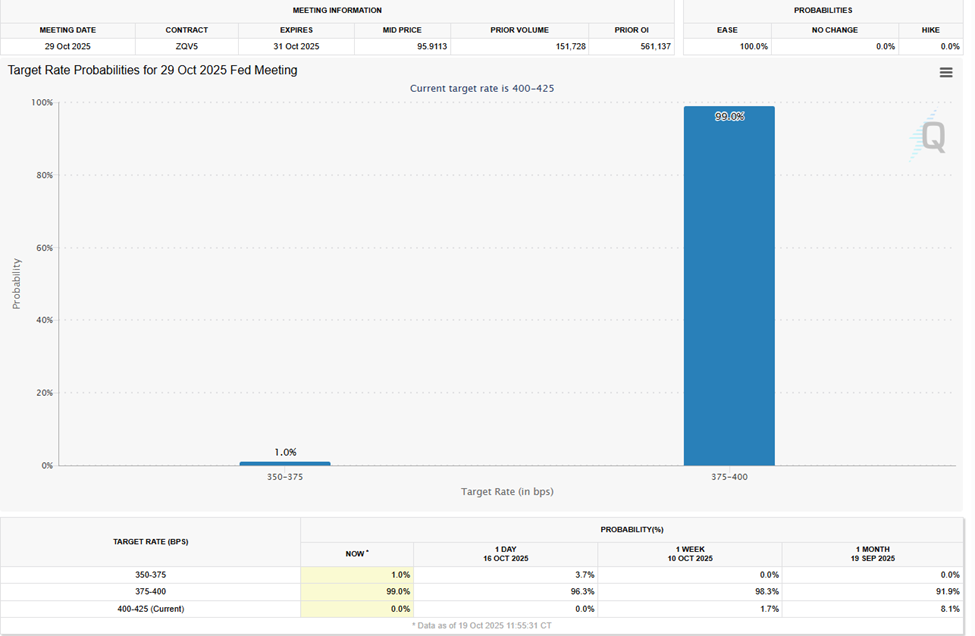

With markets pricing in a near-certain 0.25% rate cut, investors are closely watching whether softer CPI data could push policymakers toward a more aggressive 0.5% reduction.

“Right now, there’s about a 99% probability of a 0.25% cut…If it comes in lower than expected, the chances of a 0.5% rate cut could increase,” one user remarked.

Inflation, Shutdown, and the Fed’s Dilemma

According to analysts surveyed by MarketWatch, the September CPI report is expected to show consumer prices continuing to rise. However, it could be at a slower pace than in August. Such a signal WOULD mean inflationary pressures may be easing.

Yet the broader picture remains uncertain. The ongoing government shutdown has disrupted data collection and added a LAYER of political and fiscal tension that could shape the Fed’s risk calculus.

Without updated readings from the labor and retail sectors, policymakers may rely on partial or outdated data when assessing whether inflation is slowing enough to justify continued easing. Friday’s release potentially is the only clear data point before the Fed’s decision next week.

Meanwhile, Fed officials have signaled growing concern over a weakening labor market, supporting the rate cuts. However, a hotter-than-expected CPI print could complicate the outlook, forcing the central bank to weigh inflation risks against the possibility of stalling growth.