Survey Reveals Colossal Bitcoin Finance (BTCFi) Opportunity Most Investors Are Missing

Bitcoin's financial revolution is leaving billions on the table—and most crypto enthusiasts don't even realize it.

The Sleeping Giant Awakens

Recent data exposes a massive gap in Bitcoin's financial ecosystem. While DeFi exploded on Ethereum, Bitcoin's native financial layer remains dramatically underutilized. The numbers don't lie—this isn't just another niche market, it's the next frontier in digital asset innovation.

Why Traditional Finance Still Doesn't Get It

Wall Street analysts keep chasing the same old patterns while Bitcoin finance quietly builds the infrastructure for the next generation of wealth creation. They're busy calculating traditional metrics while BTCFi protocols are rewriting the rulebook entirely.

Here's the reality: either you're building Bitcoin's financial future, or you're watching from the sidelines as the real revolution happens without you. Because in crypto, the biggest risk isn't volatility—it's obsolescence.

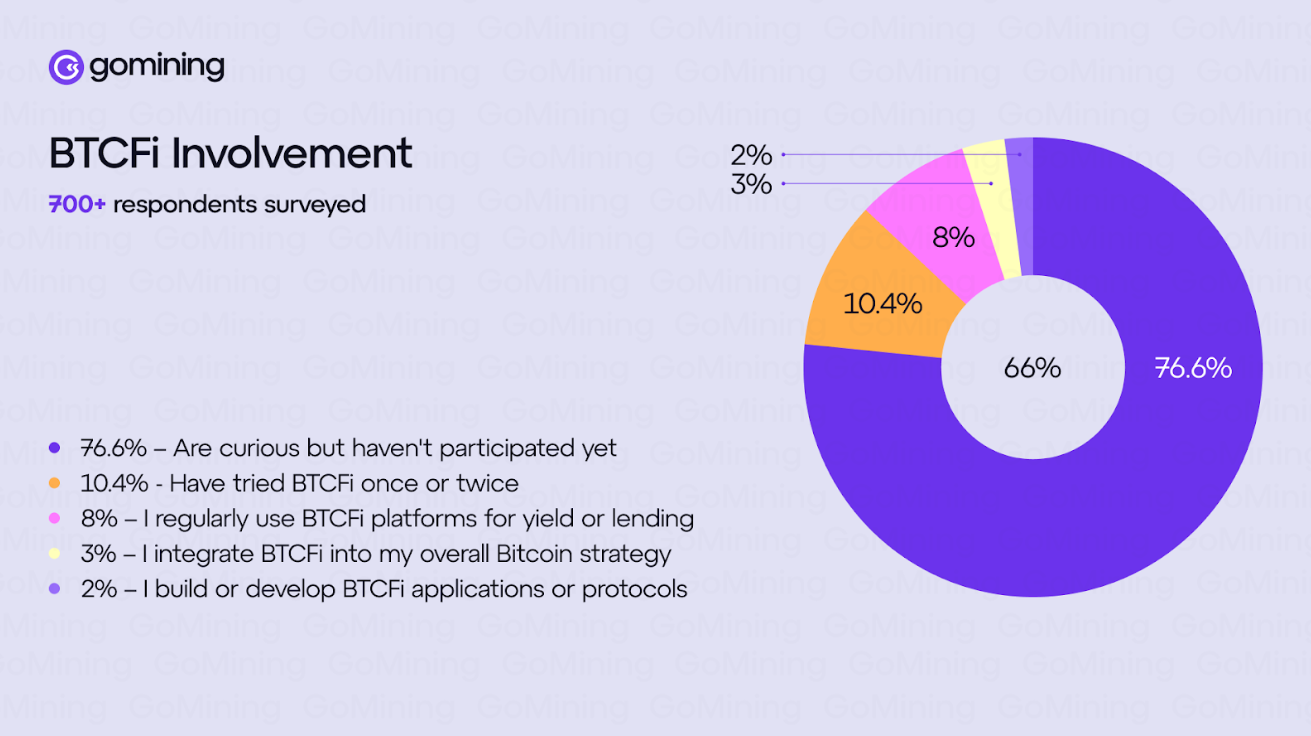

77% of Bitcoin Holders Haven’t Tried BTCFi

This finding highlights a major disconnect between the growing HYPE around BTCFi and its real-world adoption. The sector has attracted significant venture capital and media coverage, yet the majority of its target users remain untouched.

The GoMining survey reveals that interest in BTCFi’s Core offerings—yield and liquidity—is high, but trust remains the critical barrier.

Around 73% of respondents said they want to earn yield on their bitcoin through lending or staking, and 42% expressed interest in accessing liquidity without selling BTC.

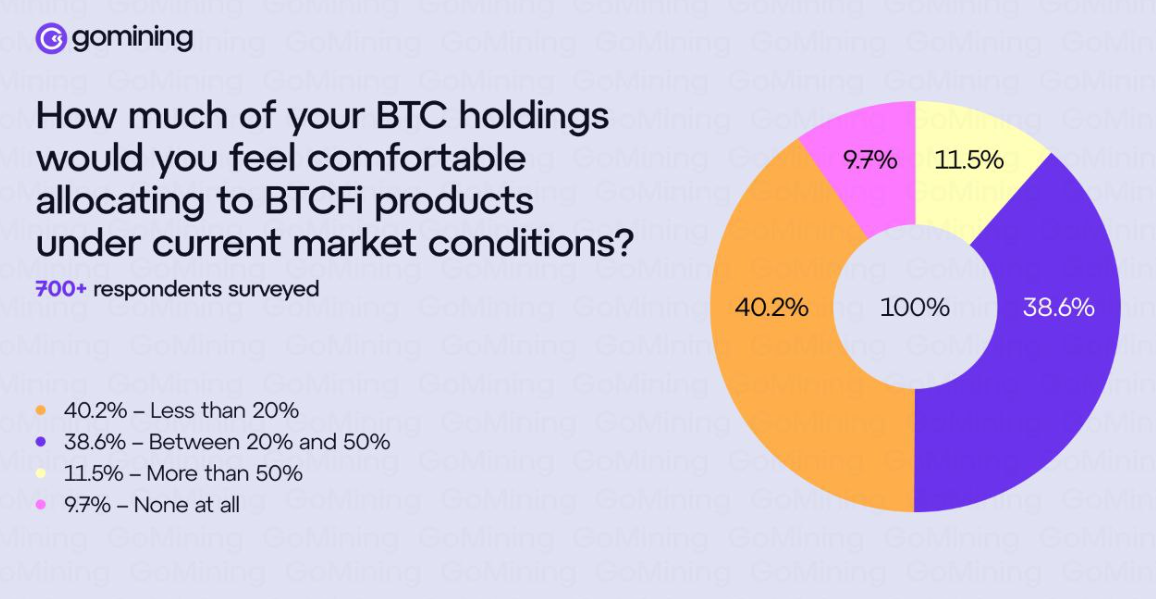

However, more thanto BTCFi products.

This conservative stance reflects broader trust and complexity issues facing the industry.

“Although the majority of Bitcoin investors hold it in store for future valuation boost, the asset has more liquidity to power the next generation of DeFi applications. While the corporate adoption of Bitcoin as a treasury asset is growing, the coin can act as much more than a HODL asset. BTCFi will offer new potential use cases — earning, borrowing, and spending,” said Mark Zalan, CEO of GoMining.

A Bitcoin Education Problem

Perhaps the most revealing figure is that.

Despite millions in venture funding and an increasing number of conferences, BTCFi’s message has yet to reach its CORE audience—Bitcoin holders themselves.

Industry experts argue this is not a user failure but a communication failure. BTCFi platforms have largely replicated Ethereum’s DeFi model, assuming familiarity that many Bitcoin investors simply do not have.

Different Users, Different Expectations

The survey supports a growing view that.

While ethereum users embrace experimentation and composability, Bitcoin holders prioritize security, regulation, and simplicity.

This difference explains why Bitcoin ETFs and custodial platforms have achieved mass adoption while BTCFi remains niche.

The timing of these findings is critical. Bitcoin’s surge to an all-time high reflects renewed institutional and retail interest in BTC.

“At $125,559, many still consider Bitcoin undervalued, drawing on its superior technology, Wall Street adoption, and its limited supply. The Bitcoin price outlook is benefiting from the September interest rate cut, the current US government shutdown, and the expanding M2 global money supply,” Zalan told BeInCrypto.

Yet, the survey shows the financial LAYER around Bitcoin remains underdeveloped.

If even a fraction of holders deploy their BTC into yield or liquidity protocols, the BTCFi sector could unlock billions in dormant capital.