Hyperliquid’s USDH Stablecoin Charges Into Crowded DEX Arena as Competition Heats Up

Another stablecoin enters the fray—but this time it's backed by a decentralized perpetuals exchange.

The DeFi Power Play

Hyperliquid launches USDH directly into the heart of decentralized exchange warfare. The move positions the perpetuals platform to capture more value within its own ecosystem while challenging established stablecoin giants.

Built for Traders, By Traders

This isn't just another algorithmic stablecoin experiment. USDH integrates natively with Hyperliquid's trading infrastructure, offering instant settlements and reduced slippage for perpetual contracts. The stablecoin aims to become the default collateral type across the platform's entire product suite.

Market Impact Assessment

DEX stablecoin volumes have surged 300% year-over-year, creating both opportunity and saturation. USDH enters a market where dominance battles between USDC, DAI, and newer entrants like Ethena's USDE have intensified liquidity fragmentation across chains.

Because what DeFi really needs is another stablecoin—said every finance professional who definitely doesn't have PTSD from Terra's collapse.

The real test begins now: whether traders will actually use USDH for something beyond farming the launch airdrop.

Native Market Launches USDH, Stakes HYPE

On September 27, Native Markets confirmed that USDH is now available on the exchange’s decentralized spot and derivatives markets.

According to the firm, traders can pair the asset against HYPE — Hyperliquid’s governance token — and USDC, giving users a stable unit of account directly integrated into the platform.

The team also locked 200,000 HYPE for three years to activate the listing, a MOVE intended to anchor liquidity and governance alignment.

Ahead of the launch, Native Markets pre-minted $15 million USDH through HyperEVM, coordinating with the network’s Assistance Fund to support initial liquidity.

According to Native Markets, USDH is backed by cash and short-term US Treasuries. The issuer manages reserves through a mix of off-chain holdings and on-chain transparency tools, including oracle feeds that verify real-time balances.

Additionally, a share of returns from these reserves will fund periodic HYPE buybacks, strengthening the token’s economic foundation.

The release follows a governance contest earlier this month in which Native Markets won community approval to issue Hyperliquid’s first stablecoin. The project outperformed proposals from competitors and major issuers like Paxos and Agora.

Hyperliquid’s Dominance Under Threat

USDH’s arrival comes at a time when Hyperliquid is under growing competitive and operational pressure.

In recent weeks, rival exchange Aster — backed by YZi Labs, the family office of Binance founder Changpeng Zhao— has surged in trading activity.

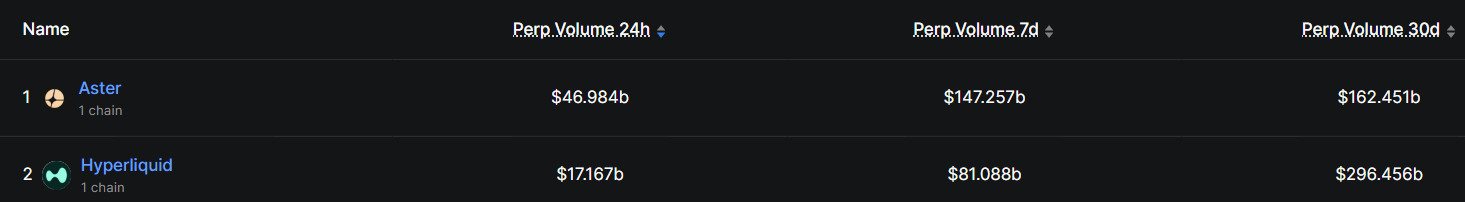

Data from DeFiLlama shows Aster generated $147 billion in perpetual volume over the past week, outpacing Hyperliquid’s $81 billion.

Still, Hyperliquid remains the larger platform on a 30-day basis, recording $296 billion in cumulative volume versus Aster’s $162 billion.

However, analysts at Maelstrom warn that this lead could narrow as a significant token unlock approach.

From November, the DEX platform will gradually unlock roughly 237.8 million HYPE tokens worth about $12 billion over 24 months.

This impending unlock could significantly impact the market performance of a digital asset that has shed more than 20% in the past week.