3 Newly Listed Altcoins Traders Are Snapping Up During Market Correction

Market dips create buying opportunities—and smart money's already positioning.

While paper hands panic-sell, seasoned traders are accumulating these three freshly listed altcoins that hit exchanges just as volatility spiked. These picks represent calculated bets on projects with strong fundamentals that could outperform during the next rally.

Strategic Accumulation Plays

Traders aren't just throwing darts—they're targeting assets with proven utility and clear roadmaps. Each selection offers something unique: one boasts institutional-grade security protocols, another solves real-world payment friction, and the third's tokenomics prevent whale domination.

Defying Conventional Wisdom

These moves contradict traditional finance logic—where most bankers still think 'blockchain' refers to supply chain management. While Wall Street analysts downgrade crypto exposure, digital asset veterans recognize correction periods as prime accumulation windows.

Positioning for the Rebound

The real test comes when markets stabilize. These newly listed coins—now trading at discounts from their listing prices—could lead the recovery charge. Because nothing makes trad-fi analysts more uncomfortable than retail investors outperforming their hedged portfolios.

1. Avantis (AVNT)

Avantis (AVNT), the utility and governance token of the perps DEX Avantis, was listed simultaneously on Binance, Upbit, and Bithumb in September. This gave AVNT abundant liquidity, with daily trading volume consistently exceeding $1 billion.

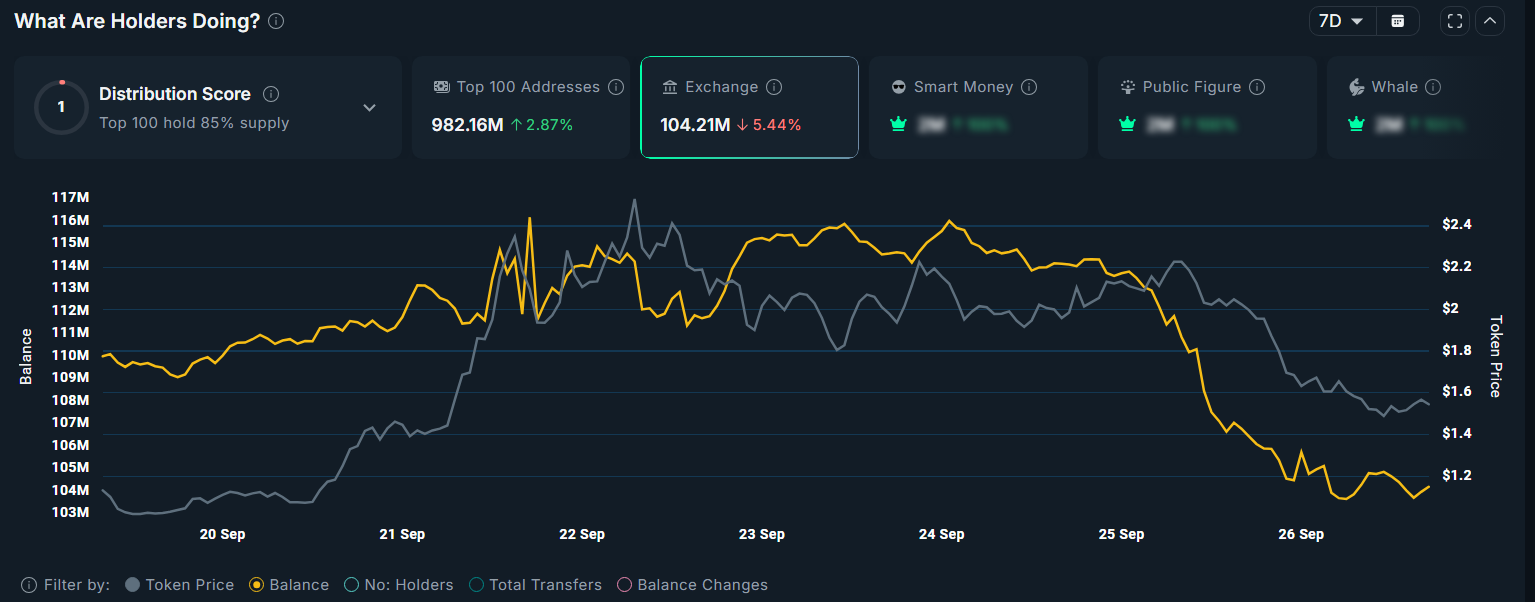

Nansen data shows that AVNT’s exchange reserves fell more than 5.4% in the last week of September, dropping from over 106 million to nearly 104 million. At the same time, the reserves of the top 100 wallets ROSE by 2.87%.

For many traders, AVNT’s price drop in late September looked like an opportunity to buy and accumulate.

Avantis currently benefits from heightened investor interest in perps DEX tokens, which surged throughout September. Investors often seek out newly launched tokens during emerging trends, hoping to maximize profits.

“Recently, a few friends around me made several million through Binance’s new tokens AVNT and ASTER. Why is the wealth effect so strong? On one hand, HYPE’s strong performance in the market has raised everyone’s expectations. After all, people love to rank competitors in the same sector as 1, 2, 3. Meanwhile, the on-chain derivatives market is still in its early stage,” one trader on X said.

2. Popcat (POPCAT)

Popcat (POPCAT), a meme token on Solana, was first listed on Binance Alpha in April. In September, Bithumb also listed the token, raising expectations that it may soon secure a spot listing on Binance.

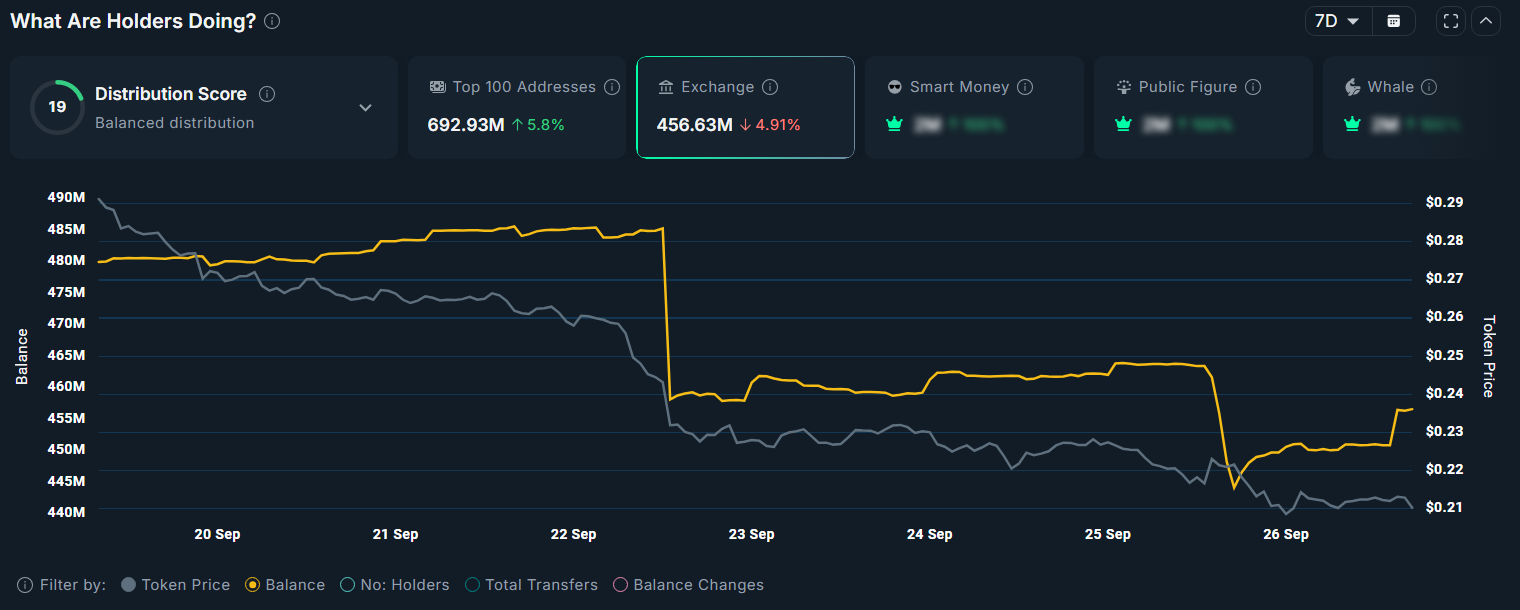

Despite listing news, the token hit a new low since April, dropping to $0.21 after a decline of more than 30% in September.

Even with the downturn, data shows POPCAT’s exchange reserves fell 4.9% last week, from over 485 million to just above 456 million. Meanwhile, top whale wallets increased their holdings by 5.8% over the same period. This suggests accumulation as investors bought the dip.

“21 cent POPCAT is a max opportunity zone. Today, one of the largest Korean exchanges listed it. It is a fully community-owned token with no central entity. Nobody paid for Bithumb. The exchange literally said, ‘This is a good token.’ It accumulated and was then listed. Expect this type of behavior to continue,” investor Alfie said.

Other investors noticed that Binance wallets sent 16 million Popcat to an entirely new address. That address later interacted with major exchanges Bithumb and Bybit, suggesting rising trading activity.

This raised hopes that the token could soon see large transactions fueling upward momentum.

3. Troll (TROLL)

This week, Coinbase announced the listing of TROLL, giving the meme token access to U.S. investors and expanding liquidity. After the listing, CoinMarketCap reported that Coinbase accounted for more than 24% of TROLL’s daily trading volume.

TROLL is also included in the Binance Alpha program. Coinbase’s listing has fueled investor hopes that Binance may soon add TROLL to its spot listings.

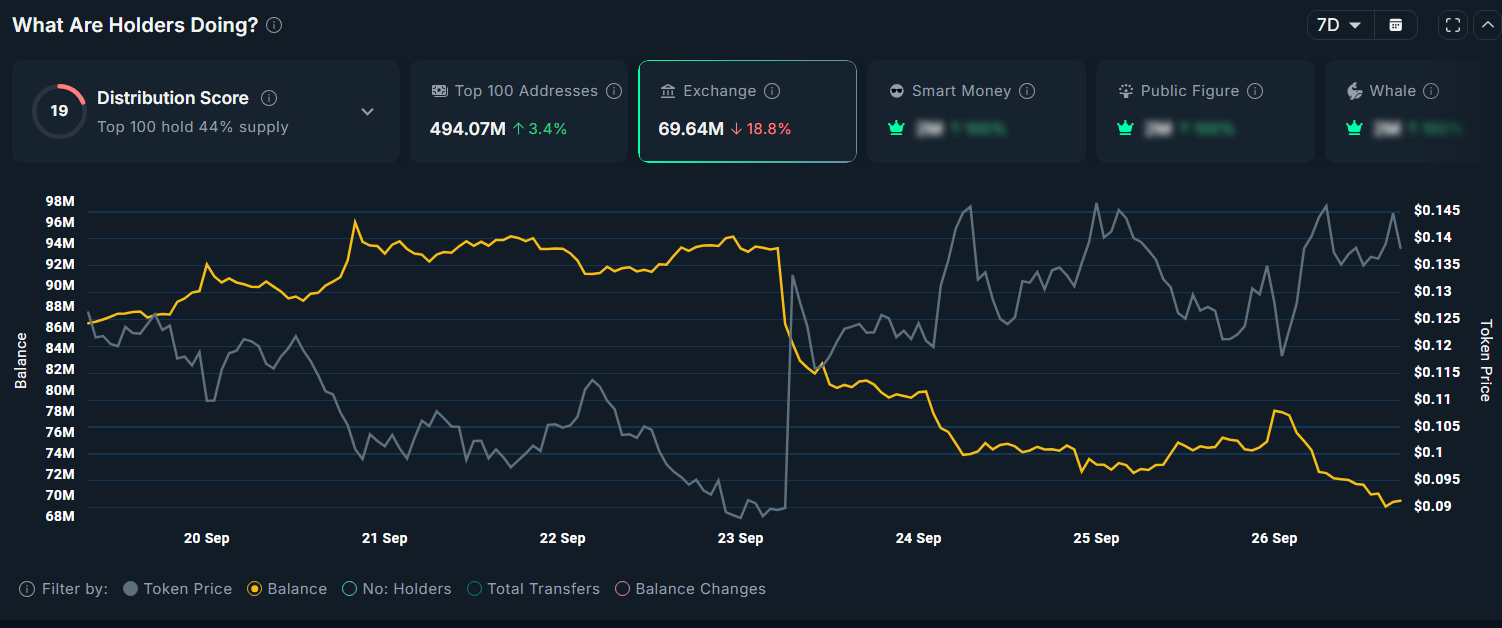

In the short term, Nansen data shows TROLL’s exchange reserves dropped 18.8% this week, while top whale wallets increased their holdings by 3.4%. On-chain movements point to active accumulation as investors wait for the next catalyst.

Community engagement data also highlights growing attention to TROLL. Stalkchain reported that in the past 30 days, the $TROLL community created about 304,000 posts on X.

In the last 30 days, the $TROLL community has made around 304K posts on X

That is a strong indicator of community activity and attention. pic.twitter.com/GTY2idv5wJ

As a meme token, attention is critical. The rising spotlight on TROLL suggests a potentially positive scenario.

These three altcoins highlight a clear trend in late September: investors are gravitating toward newly listed tokens and positioning themselves in emerging narratives such as perps DEX.