Ethereum Price Prediction 2025: Will ETH Hit $5,000 This Year Amid Bullish Fundamentals?

- Ethereum Technical Analysis: Bullish Signals Emerge

- Institutional Adoption Reaches New Highs

- Corporate ETH Accumulation Accelerates

- Network Activity Hits Record Levels

- Exchange Outflows Signal Institutional Demand

- Ethereum Price Outlook: Path to $5,000?

- Frequently Asked Questions

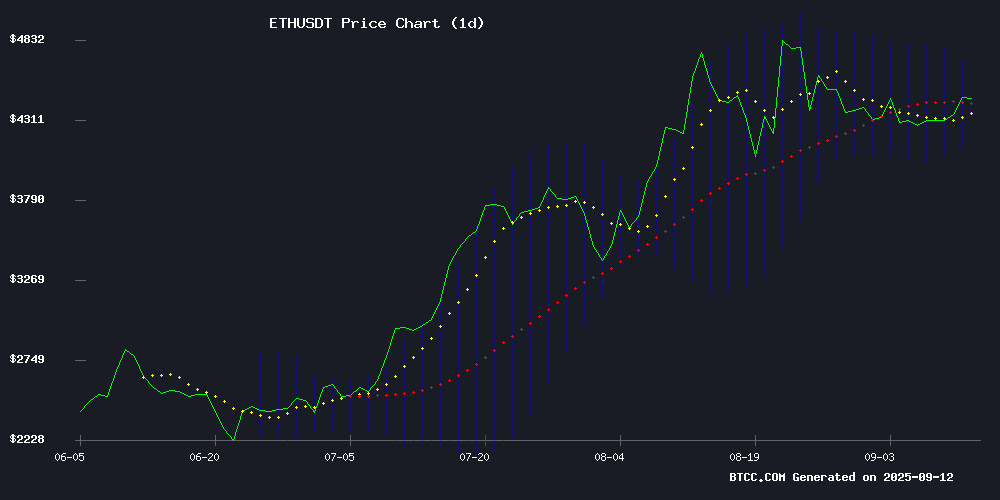

Ethereum (ETH) is showing strong bullish signals in September 2025, trading comfortably above $4,400 with technical indicators pointing to potential upside. The cryptocurrency has demonstrated remarkable resilience despite market volatility, supported by growing institutional adoption, record network activity, and increasing staking participation. Our analysis examines ETH's path to $5,000 through multiple lenses - from technical setups to fundamental drivers like Starknet's 300% transaction surge and $7.45 billion in tokenized Treasuries. While short-term resistance at $4,646 may cause consolidation, the overall outlook remains positive for Ethereum's price trajectory through year-end.

Ethereum Technical Analysis: Bullish Signals Emerge

As of September 12, 2025, ETH trades at $4,452.65, maintaining position above its 20-day moving average ($4,402.68) - a key support level that has held firm throughout August. The MACD indicator shows positive momentum at 25.69, while Bollinger Bands suggest ETH is comfortably trading within its upper range ($4,646.06) and lower band ($4,159.31).

"The technical setup remains constructive," notes the BTCC research team. "ETH has consistently found support above $4,400, though traders should watch the $4,646 resistance level closely. A decisive break above this point could open the path to $5,000."

Institutional Adoption Reaches New Highs

Tokenized U.S. Treasuries on ethereum have quietly become one of crypto's most significant narratives, reaching a record $7.45 billion in late August 2025. This marks a threefold year-over-year expansion, driven largely by offerings from traditional finance giants like BlackRock's BUIDL fund and Fidelity's Ethereum-based products.

The appeal lies in solving legacy Treasury market inefficiencies - slow settlements, excessive intermediaries, and fragmented access. Tokenization enables instantaneous settlement, 24/7 markets, and fractional ownership of fundamentally risk-free assets.

Corporate ETH Accumulation Accelerates

SharpLink's aggressive ETH accumulation strategy has turned heads, with the publicly traded firm now holding over 837,230 ETH (worth $3.7 billion) - representing 0.69% of circulating supply. Co-CEO Joseph Chalom positions this as a long-term reserve strategy rather than speculative trading.

"When institutions realize they can reduce capital requirements and settlement risk through Ethereum, adoption becomes inevitable," Chalom told Decrypt. SharpLink's stance counters concerns about corporate ETH hoarding creating sell-side pressure, with the company emphasizing they are "accumulators, not sellers."

Network Activity Hits Record Levels

Ethereum's fundamentals show remarkable strength, with Starknet (an Ethereum Layer-2 scaling solution) seeing daily transactions surge 300% in the past month - from 150,000 to nearly 900,000 daily. This growth reflects both increased adoption from existing users and new wallet creation.

Staking activity has also reached new peaks, with over 36.1 million ETH (nearly 30% of circulating supply) now locked in staking contracts. At current prices, this represents a $158 billion commitment from institutional and retail participants.

Exchange Outflows Signal Institutional Demand

Recent blockchain data reveals $342 million worth of ETH (78,229 coins) withdrawn from Kraken within a 10-hour window, moved to four newly created wallets. Such large-scale exchange outflows typically indicate institutional accumulation and can create favorable conditions for price appreciation by reducing available supply.

The market appears poised for volatility, with ETH trading above $4,430 as analysts watch for a decisive close above $4,500 - a level that could catalyze fresh all-time highs.

Ethereum Price Outlook: Path to $5,000?

ETH currently trades in a narrow range between $4,200 support and $4,600 resistance. Technical indicators suggest:

| Metric | Value | Signal |

|---|---|---|

| Current Price | $4,452.65 | Bullish |

| 20-Day MA | $4,402.68 | Support Level |

| MACD | 25.69 | Positive Momentum |

| Bollinger Upper | $4,646.06 | Resistance Level |

While short-term resistance around $4,646 may cause consolidation, Ethereum's underlying fundamentals - including institutional demand, staking growth, and network activity - position ETH favorably for potential movement toward $5,000 in the coming months.

Frequently Asked Questions

What is Ethereum's current price prediction for 2025?

Based on current technical indicators and fundamental factors, analysts project Ethereum could reach $5,000 by year-end 2025, with potential to test $8,000 if current momentum continues. However, this depends on maintaining support above $4,200 and breaking through resistance at $4,646.

Why is institutional adoption of Ethereum growing?

Institutions are drawn to Ethereum for several reasons: its role in tokenizing traditional assets like U.S. Treasuries (now $7.45B on Ethereum), its established position in DeFi and NFTs, and the efficiency gains from using blockchain for settlements and transactions compared to legacy systems.

How does staking affect Ethereum's price?

With over 36.1 million ETH (30% of supply) now staked, this effectively removes coins from circulation, reducing selling pressure. The $158 billion value staked also demonstrates strong long-term commitment from investors, which can support price stability and growth.

What are the risks to Ethereum's price growth?

Key risks include: profit-taking when ETH supply in profit approaches 95%, regulatory uncertainty around tokenized assets, macroeconomic factors affecting risk assets, and potential technical rejection at resistance levels like $4,646.

How does Starknet's growth impact Ethereum?

Starknet's 300% transaction surge demonstrates healthy Layer-2 ecosystem growth, which reduces congestion and fees on Ethereum mainnet while increasing overall network utility - factors that ultimately benefit ETH's value proposition.