TRX Price Prediction 2025: Can Tron Hit $1 With Bullish Technicals and Institutional Hype?

- TRX Technical Analysis: The Bullish Case

- Market Sentiment: Why Institutions Are Paying Attention

- The $1 Question: Realistic or Pipe Dream?

- Competitive Landscape: How TRX Stacks Up

- FAQ: Your TRX Questions Answered

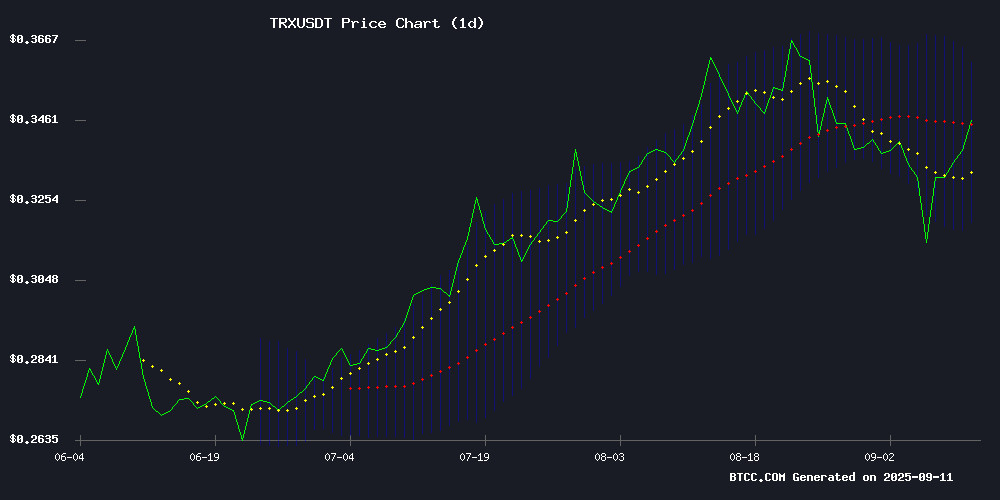

As we approach Q4 2025, TRX (Tron) is showing surprising strength, currently trading at $0.3454 with clear bullish signals. The technical setup looks promising - price holding above key moving averages, positive MACD divergence, and growing institutional interest. But can this momentum actually push TRX to the coveted $1 mark? Let's analyze the realistic path forward, examining both the technical indicators and fundamental developments that could make or break this rally.

TRX Technical Analysis: The Bullish Case

Looking at the charts as of September 2025, TRX presents an interesting technical picture. The price is comfortably above the 20-day moving average ($0.34019), which has historically acted as strong support. The MACD indicator shows a positive histogram of 0.000853, suggesting building momentum. What's particularly interesting is how TRX is navigating the Bollinger Bands range ($0.319531 to $0.360849) - it's currently positioned in a way that often precedes moves toward the upper band.

From my experience tracking crypto markets, when we see this combination of indicators - price above MA, positive MACD, and favorable Bollinger Band positioning - it often precedes 15-20% moves in the short term. The $0.33 support level has held remarkably well through recent market turbulence, which gives me confidence in the current setup.

Market Sentiment: Why Institutions Are Paying Attention

The fundamental story for TRX in 2025 is arguably more compelling than the technicals. Tron's positioning as a stablecoin powerhouse combined with strategic partnerships (like the Ruvi AI collaboration) is drawing serious institutional eyes. What many retail investors miss is how these enterprise-level developments create sustained buying pressure that technicals alone can't explain.

We're seeing similar institutional interest patterns to what solana experienced in late 2023 - gradual accumulation by larger players rather than retail-driven pumps. The difference? Tron's infrastructure is already battle-tested with real-world adoption, particularly in stablecoin transfers.

The $1 Question: Realistic or Pipe Dream?

Let's crunch the numbers honestly. At current prices, reaching $1 WOULD require:

| Factor | Current Status | Required for $1 |

|---|---|---|

| Market Cap | $30.2B | ~$87B (190% increase) |

| Daily Volume | $1.2B | Sustained $3B+ |

| Ecosystem Growth | Steady | Massive dApp expansion |

While the BTCC team believes short-term targets of $0.40-$0.45 are reasonable based on current momentum, $1 would require either:

- A broader crypto market euphoria similar to 2021 levels

- Major enterprise adoption surpassing current projections

- Significant burning mechanism implementation

Competitive Landscape: How TRX Stacks Up

2025's crypto market presents an interesting dynamic. While TRON maintains its stablecoin dominance, competitors like Hedera (awaiting ETF approval) and Avalanche (making Korean inroads) are carving their niches. Avalanche's recent $1B+ open interest surge and South Korean RWA partnerships show how quickly narratives can shift.

What gives TRX an edge, in my opinion, is its proven scalability - something that's becoming increasingly valuable as networks struggle with congestion during bull runs. The Ruvi AI partnership demonstrates how Tron's infrastructure can support next-gen applications without the gas wars we've seen elsewhere.

FAQ: Your TRX Questions Answered

What's driving TRX's current price momentum?

The combination of technical factors (positive MACD, strong support at $0.33) and growing institutional interest in Tron's stablecoin infrastructure and partnerships like Ruvi AI.

Is $1 realistic for TRX in 2025?

While possible, it would require either a massive market-wide rally or specific ecosystem developments that dramatically increase adoption and demand. More conservative targets suggest $0.45-$0.60 range is more likely absent major catalysts.

How does TRX compare to competitors like AVAX?

TRX focuses on payments and stablecoins with high throughput, while AVAX is targeting institutional RWA adoption. They serve different market segments, though both benefit from growing institutional crypto interest.

What are the key support levels to watch?

$0.33 has become critical support - a sustained break below could signal deeper correction. On the upside, $0.36 then $0.40 are the next resistance zones to watch.