ADA Price Prediction 2025: Technical Breakout and Bullish Catalysts Signal Potential 30% Surge

- What Does ADA's Technical Setup Reveal About Its Price Potential?

- How Are Market Fundamentals Supporting ADA's Price Action?

- What Are the Key Price Levels Traders Should Watch?

- Could ADA Really Reach $2 by Year-End 2025?

- How Does ADA Compare to Other Altcoins in Current Market Conditions?

- ADA Price Prediction: Your Questions Answered

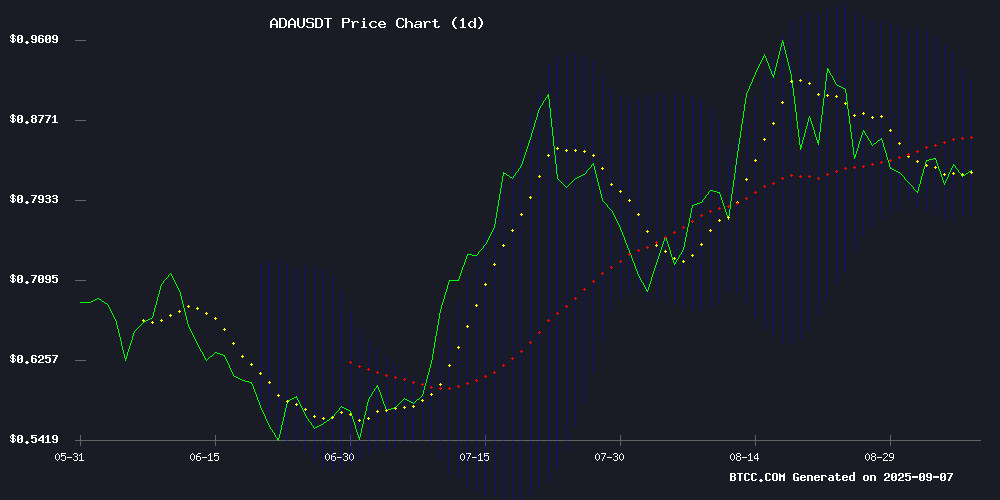

Cardano (ADA) is showing strong bullish signals as we enter September 2025, with technical indicators and fundamental factors aligning for potential upward movement. Currently trading at $0.8283, ADA maintains crucial support above $0.80 while displaying positive momentum across key metrics. The convergence of Federal Reserve policy speculation, whale accumulation patterns, and favorable technical setups creates an intriguing case for ADA's near-term trajectory. Our analysis suggests a possible 11% MOVE toward $0.92 in the coming weeks, with more ambitious targets of $1.20-$2.00 potentially coming into play if current conditions persist.

What Does ADA's Technical Setup Reveal About Its Price Potential?

ADA's current technical landscape presents several encouraging signs for bulls. The cryptocurrency has successfully defended the psychologically important $0.80 support level through multiple tests, establishing it as a critical floor. Looking at the MACD indicator, we see bullish divergence with the MACD line (0.052741) positioned above the signal line (0.028286), while the positive histogram reading of 0.024456 confirms strengthening upward momentum. The Bollinger Bands tell an interesting story - with ADA trading in the lower portion of the range (upper band at $0.9186, lower at $0.7780), there appears to be room for movement toward the middle band resistance.

From my experience watching these patterns, when we see this combination of support holds and momentum indicators turning positive after a period of consolidation, it often precedes meaningful moves. The 20-day moving average at $0.8483 represents immediate overhead resistance - a clean break above this level could open the door to test the upper Bollinger Band around $0.92. According to TradingView data, ADA's RSI sits at a neutral 47, suggesting there's plenty of runway before overbought conditions become a concern.

How Are Market Fundamentals Supporting ADA's Price Action?

The fundamental backdrop for ADA appears increasingly favorable as we navigate Q3 2025. Two major catalysts stand out: Federal Reserve policy expectations and notable whale activity. The growing speculation about potential Fed rate cuts has created tailwinds for risk assets across the board, and cryptocurrencies like ADA are benefiting from this macro shift. It's reminiscent of how crypto markets reacted to dovish Fed pivots in previous cycles - the liquidity implications are hard to ignore.

On the whale activity front, we've observed some eye-popping accumulation patterns. Over 150 million ADA has flowed into whale wallets in recent weeks according to CoinMarketCap data, representing significant buying pressure at current levels. This isn't just random retail speculation - when large holders make moves of this magnitude, it typically signals confidence in the asset's medium-term prospects. The timing is particularly interesting as it coincides with ADA's successful defense of the $0.80 support level.

Charles Hoskinson, Cardano's founder, recently stirred excitement with his "gigachad bull run" prediction, tying it to expected monetary policy easing and regulatory developments. While founder enthusiasm should always be taken with a grain of salt, the technical and on-chain data does suggest there might be something to this optimism.

What Are the Key Price Levels Traders Should Watch?

For those monitoring ADA's price action, several critical levels deserve attention:

| Price Level | Significance | Probability |

|---|---|---|

| $0.80-$0.81 | Critical support zone | High |

| $0.8483 | 20-day MA resistance | Medium-High |

| $0.9186 | Upper Bollinger Band | Medium |

| $1.20 | 30% rally target | Medium |

| $2.00 | Analyst year-end projection | Low-Medium |

Michaël van de Poppe, a respected crypto analyst, has identified $0.74 as an attractive entry point if we see deeper pullbacks, though current price action suggests this level might not be tested in the near term. The $0.85 level represents immediate resistance - a decisive break above this could accelerate moves toward higher targets. On the flip side, losing $0.80 support WOULD likely trigger stops and could see ADA test lower support zones.

Could ADA Really Reach $2 by Year-End 2025?

The $2 price target being floated by some analysts certainly raises eyebrows, but let's examine the case for and against this ambitious projection. On the bullish side, we have several factors working in ADA's favor: the symmetrical triangle pattern forming on higher timeframes (typically a continuation pattern), increasing whale accumulation, and potential macro tailwinds from Fed policy. The TD Sequential indicator recently flashed a buy signal on daily charts, adding to the technical case.

However, reaching $2 would require approximately a 140% increase from current levels - no small feat even in crypto land. While possible, this would likely require perfect alignment of several factors: continuation of whale accumulation, a dovish Fed pivot materializing, and broader altcoin market strength. The more conservative (and perhaps more likely) scenario would see ADA test the $1.00-$1.20 range first, with $2 coming into play if these levels are convincingly breached.

One interesting development worth noting is the growing institutional interest in ADA through products like those offered on BTCC. While retail often drives crypto narratives, institutional flows can provide the sustained buying pressure needed for more extended moves. This is something I'll be watching closely in the coming weeks.

How Does ADA Compare to Other Altcoins in Current Market Conditions?

ADA's performance needs to be viewed in the context of the broader altcoin market. While Bitcoin and ethereum often lead the charge, coins like ADA can deliver outsized returns when market conditions align. What's interesting about ADA's current setup is that it's showing relative strength while not being overextended - a sweet spot for traders looking for opportunities.

We're seeing some rotation into altcoins as Bitcoin's dominance shows signs of peaking, and ADA appears well-positioned to benefit from this shift. The project's continued development progress (though sometimes criticized for its pace) provides fundamental support that many "hype coin" competitors lack. That said, traders should remain aware that altcoin moves can be more volatile and subject to sudden reversals when market sentiment shifts.

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

ADA Price Prediction: Your Questions Answered

What is the current ADA price and key support level?

As of September 2025, ADA is trading at $0.8283 with crucial support established at the $0.80 level. This price floor has been tested multiple times and held, making it a critical level for maintaining bullish momentum.

What technical indicators suggest ADA could rally?

Several indicators point to potential upside: the MACD shows bullish momentum (0.052741 above signal line), Bollinger Bands suggest room to move higher, and the TD Sequential recently triggered a buy signal on daily charts.

How might Federal Reserve policy impact ADA's price?

Growing speculation about Fed rate cuts could provide tailwinds for risk assets like ADA. Historically, dovish Fed policy has correlated with crypto market strength due to increased liquidity and risk appetite.

What are realistic price targets for ADA in 2025?

Near-term, $0.9186 (upper Bollinger Band) represents an 11% upside target. More ambitious projections suggest $1.20 (30% rally) or even $2.00 by year-end, though higher targets would require sustained favorable conditions.

Why is whale activity important for ADA's price action?

Whale accumulation of over 150 million ADA signals strong institutional interest, which can provide underlying support and potentially drive prices higher as large holders reduce available supply.