XRP Price Prediction 2025: Can XRP Hit $4 This Year? Technical Analysis & Regulatory Catalysts

- Current XRP Market Position: Where Are We Now?

- Technical Indicators: What's Driving the Bullish Sentiment?

- Regulatory Catalysts: The October ETF Decision Window

- Exchange Dynamics: Reading Between the Lines

- Historical Context: Learning From Past Cycles

- The $4 Target: Realistic or Overly Optimistic?

- Risk Factors: What Could Derail the Rally?

- Community Developments: The XRP Firewall Initiative

- Conclusion: A Cautiously Optimistic Outlook

- XRP Price Prediction: Your Questions Answered

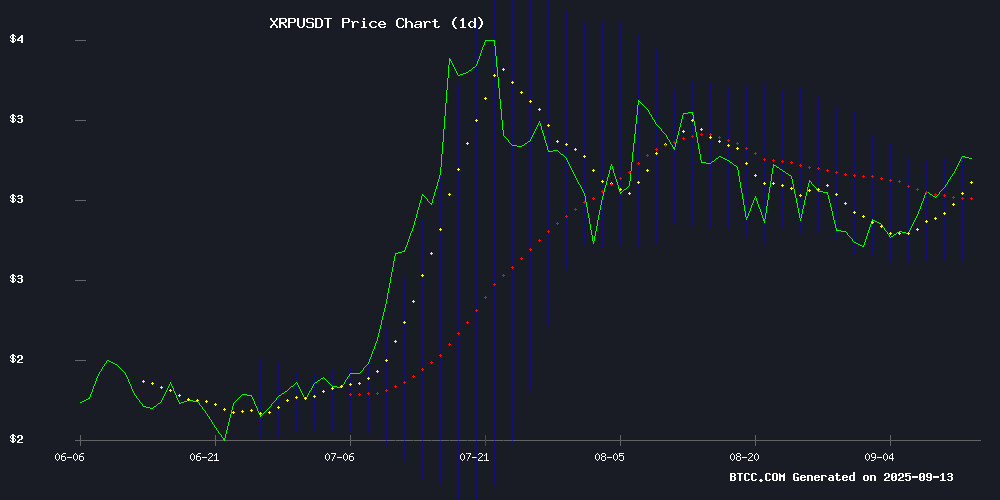

As we approach mid-September 2025, XRP stands at a critical juncture. Currently trading at $3.1152 with bullish technical indicators and multiple regulatory catalysts on the horizon, the crypto community is buzzing with speculation: can XRP reach $4 before year-end? Our analysis combines technical indicators, market sentiment, and upcoming regulatory decisions to paint a comprehensive picture of XRP's potential trajectory. With a 13% weekly surge, strong technical positioning above key moving averages, and the looming October ETF decision window, all eyes are on this digital asset that continues to defy market headwinds.

Current XRP Market Position: Where Are We Now?

As of September 14, 2025, XRP is trading at $3.1152, comfortably above its 20-day moving average of $2.9071. The token has shown remarkable resilience, bouncing back from a mid-summer slump to post consistent gains throughout August and early September. Trading volume has surged 38% in the past 24 hours to nearly $6 billion, indicating strong market participation. What's particularly interesting is how XRP has maintained its position NEAR the upper Bollinger Band at $3.1191, typically a sign of strong buying pressure. The MACD indicator shows mixed signals (-0.0118 | 0.0622 | -0.0740), suggesting we might be at an inflection point where momentum could shift decisively in either direction.

Source: BTCC Trading Platform

Technical Indicators: What's Driving the Bullish Sentiment?

The technical setup for XRP appears increasingly favorable. A golden cross formation has emerged on the eight-hour chart as the 23-day moving average crossed above the 50-day MA - a classic bullish signal that historically precedes upward momentum. The token has established strong support around $2.70, having tested this level multiple times since July without breaking down. On the upside, resistance at $3.08 has become the key level to watch - a decisive break above this could open the path toward $3.30 and potentially $3.40.

Notably, short-term holder activity has surged, with Glassnode data showing a 38% increase in holdings among investors with 1-3 month time horizons. This cohort's growing dominance often signals impending volatility, but their current accumulation pattern (rather than distribution) suggests confidence in near-term appreciation. The daily Relative Strength Index (RSI) remains in favorable territory at 62, avoiding overbought conditions despite the recent price surge.

Regulatory Catalysts: The October ETF Decision Window

The most significant fundamental factor looming over XRP is the SEC's October decision window for multiple spot XRP ETF applications. Between October 18-25, the regulator must rule on proposals from Grayscale, 21Shares, Bitwise, and other major firms. Polymarket traders currently price in a 93% probability of approval by year-end, echoing the sentiment that preceded ethereum ETF approvals.

John Squire, a prominent XRP analyst with 500K followers, notes: "The SEC's consolidation of decision timelines places unusual emphasis on this two-week window. While approval WOULD create structural demand, history suggests such milestones often precede volatile price action rather than sustained rallies." The market appears to be pricing in asymmetric upside potential ahead of these decisions.

Exchange Dynamics: Reading Between the Lines

Exchange reserve data presents a mixed picture. Binance's XRP holdings surged by 43 million tokens last week, while Bybit's nearly doubled to 380 million. Such movements typically signal potential selling pressure, yet XRP's price dipped only 0.61% on the day of largest inflows, showing remarkable resilience. The spot taker CVD metric reveals sell-dominant activity since late July, but the absence of panic selling suggests holders remain confident.

On BTCC, one of Asia's leading crypto exchanges, XRP trading volumes have consistently ranked in the top 5 throughout September, with particularly strong activity during Asian trading hours. This institutional interest could provide a solid foundation for future price appreciation.

Historical Context: Learning From Past Cycles

XRP's current technical setup bears similarities to its position in early 2023 before its last major bull run. The token is emerging from a prolonged consolidation phase (July-August 2025) where it traded between $2.70-$3.07, much like the $0.30-$0.55 range it occupied for most of 2022. The current golden cross formation last appeared in November 2024, preceding a 28% rally over the following six weeks.

However, history also cautions against unbridled optimism. XRP has historically shown explosive moves followed by extended consolidation - the 1200% gain from October 2023 to March 2024 was followed by five months of sideways movement. This pattern suggests that even if $4 is reached, investors should prepare for potential volatility afterward.

The $4 Target: Realistic or Overly Optimistic?

Reaching $4 from current levels would require approximately 28.4% appreciation. While significant, this isn't unprecedented for XRP - the token gained 32% in a single week back in March 2025. The combination of technical strength and fundamental catalysts makes this target plausible, though not guaranteed.

Key levels to watch:

| Price Level | Significance |

|---|---|

| $3.08 | Immediate resistance, breakout could accelerate momentum |

| $3.40 | Psychological resistance, previous swing high |

| $3.66 | Technical target representing 20% upside |

| $4.00 | Round number resistance, would represent new yearly high |

The path to $4 would likely require: 1) A clean break above $3.08 with strong volume, 2) Positive developments in the October ETF decisions, and 3) Sustained buying pressure from both retail and institutional investors. While challenging, the current setup suggests these conditions could materialize.

Risk Factors: What Could Derail the Rally?

Several factors could prevent XRP from reaching $4: Regulatory setbacks in October, broader market downturns, or unexpected whale selling could all apply downward pressure. The SEC has already delayed decisions on multiple spot XRP ETF applications, including Franklin Templeton's filing now pushed to November. Each delay tests investor patience and could trigger short-term selloffs.

Exchange reserve buildups also warrant monitoring. While recent inflows haven't immediately impacted price, sustained accumulation could eventually lead to selling pressure. Additionally, the XRP community should watch Bitcoin's movements closely - as the market leader, BTC's performance often dictates overall crypto market sentiment.

Community Developments: The XRP Firewall Initiative

Beyond price action, the XRP Ledger community is making strides in security with the proposed XLS-86 Firewall amendment. This suite of defensive tools aims to combat escalating scam activities that have plagued the network. Vet, a decentralized unique node list validator, recently teased this update as a potential game-changer in fraud prevention.

The timing is crucial - following malicious packages infiltrating the xrpl.js library earlier this year, enhanced security could boost investor confidence. As the saying goes in crypto: "Nothing pumps a coin like not getting hacked." A more secure network could provide fundamental support for XRP's price appreciation.

Conclusion: A Cautiously Optimistic Outlook

While $4 represents a significant psychological and technical barrier, XRP's current technical strength combined with upcoming regulatory catalysts make this target achievable by year-end 2025. The October ETF decision window looms as the most significant near-term catalyst, with technical indicators suggesting the token is well-positioned to capitalize on positive developments.

However, investors should maintain realistic expectations and prepare for volatility. The path to $4 likely won't be linear, and setbacks in either the regulatory or technical arenas could delay or derail this target. As always in crypto markets, risk management remains paramount.

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

XRP Price Prediction: Your Questions Answered

What is the current price of XRP?

As of September 14, 2025, XRP is trading at $3.1152 with a 24-hour trading volume of $6 billion across major exchanges including BTCC, Binance, and Kraken.

Can XRP really reach $4 in 2025?

While not guaranteed, technical analysis suggests XRP could reach $4 by year-end if current support holds and upcoming regulatory decisions prove favorable. The token would need to appreciate approximately 28.4% from current levels.

What are the key dates to watch for XRP?

The October 18-25 SEC decision window for spot XRP ETF applications is the most critical near-term date range, followed by November 14 for the Franklin XRP ETF decision.

Is now a good time to buy XRP?

With XRP trading above key moving averages and showing bullish technical signals, many analysts view current levels as attractive for long-term investors. However, always assess your risk tolerance and conduct thorough research before investing.

What could prevent XRP from reaching $4?

Negative regulatory developments, broader market downturns, or significant whale selling could all create headwinds for XRP's price appreciation. Technical failure to break through $3.08 resistance would also delay upward momentum.