Bitcoin Price Forecast 2025-2040: Technical Breakouts, Halving Cycles, and the Institutional Adoption Wave

- Bitcoin Technical Analysis: The Battle at $120K

- Market Sentiment: Institutional Tsunami vs. Technical Headwinds

- Long-Term Price Drivers Through 2040

- Macroeconomic Crosscurrents

- Historical Precedents and Future Projections

- Frequently Asked Questions

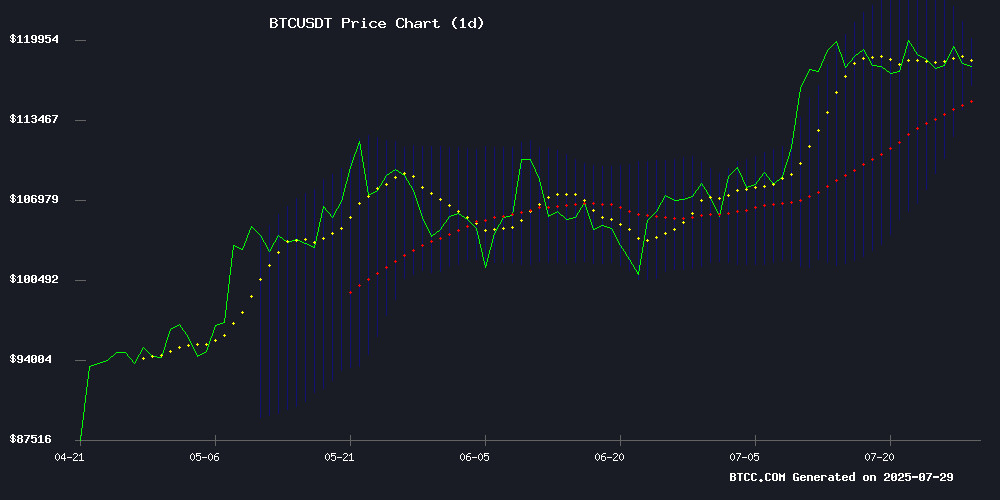

Bitcoin Technical Analysis: The Battle at $120K

As of July 2025, bitcoin is consolidating below its 20-day moving average (118,189 USDT) with Bollinger Bands tightening between 116,299 and 120,079 USDT. The MACD histogram shows bullish divergence (-1,308 vs -3,338), suggesting accumulation despite the ranging price action. "This is classic consolidation after a 40% quarterly rally," notes the BTCC research team. "The 116,300 support has held through three retests, while 120,000 remains the line in the sand for bulls."

Market Sentiment: Institutional Tsunami vs. Technical Headwinds

Spot Bitcoin ETFs now hold 1.29M BTC ($150B AUM), absorbing 6% of circulating supply. Yet Galaxy Digital's recent 80,000 BTC liquidation triggered a 7% pullback—a reminder that institutional flows cut both ways. The market faces three competing narratives:

- ETF Demand: BlackRock's IBIT alone adds ~2,000 BTC daily

- Halving Supply Shock: Daily issuance dropped to 450 BTC post-April 2024

- Technical Resistance: $120K marks the 1.618 Fibonacci extension of the 2022-2023 bear market

Long-Term Price Drivers Through 2040

Bitcoin's quadrennial halvings create predictable supply shocks, while adoption follows an S-curve:

| Year | Key Catalysts | Price Range (USDT) |

|---|---|---|

| 2025 | ETF maturation, post-halving revaluation | 90,000-130,000 |

| 2030 | Next halving (2028), sovereign adoption | 250,000-400,000 |

| 2035 | Network effects, fiat debasement hedge | 600,000-1M |

| 2040 | Full monetization, global reserve asset | 1.5M+ |

Macroeconomic Crosscurrents

The 90-day US-China tariff truce (July 2025) has boosted risk assets, with Bitcoin benefiting from:

- Dollar weakness (DXY -2.3% MTD)

- Institutional rebalancing (Gold -4% vs BTC +18% Q2)

- Miner capitulation ending (Hash ribbons recovery)

Yet risks persist—the SEC delayed TRUMP Media's Bitcoin ETF to September, while Binance whale deposits ($1.2B July 25) hint at distribution. "It's a tug-of-war between spot buyers and derivatives liquidations," observes veteran trader @BTC_Technician.

Historical Precedents and Future Projections

Bitcoin's 2028 halving will reduce block rewards to 1.5625 BTC—a 50% drop from current levels. Past cycles suggest:

With only 21 million BTC ever to exist and 19.5 million already mined, the scarcity argument grows louder each cycle. As MicroStrategy's Michael Saylor recently quipped: "Bitcoin is the only asset where the supply curve is perfectly inelastic—demand shocks manifest entirely in price."

Frequently Asked Questions

What's the most realistic Bitcoin price target for 2025?

The 90,000-130,000 USDT range accounts for both technical resistance levels and ETF inflow projections. CoinMarketCap data shows institutional buyers typically accumulate below 1.2x the 200-week moving average (currently ~95,000).

How does the 2028 halving differ from previous cycles?

With institutional infrastructure now mature (ETFs, regulated custody), the 2028 halving will test whether traditional capital flows can offset reduced miner selling pressure. The block reward drops to just 1.5625 BTC—equivalent to $187,500 at 120,000/BTC.

Could Bitcoin really reach $1 million by 2035?

In a hyper-bitcoinization scenario where BTC captures 10% of global money supply (~$12T), the network value WOULD approach $1.2T—or ~$57,000 per BTC. The $1M thesis requires either mass adoption as collateral or extreme fiat debasement.

What's the biggest threat to Bitcoin's long-term price appreciation?

Regulatory crackdowns pose existential risks, though the ETF approvals suggest growing acceptance. Technological obsolescence (quantum computing?) remains a distant concern. More immediately, prolonged bear markets could delay adoption timelines.