Ethereum Price Prediction 2025: Will ETH Shatter $4,000 as Bullish Momentum Accelerates?

- ETH Technical Analysis: Bullish Signals Everywhere

- Why Ethereum's Rally Might Have Legs

- Potential Roadblocks to Watch

- Expert Price Targets

- Ethereum FAQ: Your Burning Questions Answered

Ethereum (ETH) is riding a wave of bullish momentum in July 2025, currently trading at $3,779 with technical indicators suggesting potential for further upside. The BTCC analyst team notes key drivers including institutional interest from Pantera Capital, a resurgent NFT market, and upcoming network upgrades like the Fusaka hard fork. While short-term pullback risks exist due to overheated futures markets, validator support for gas limit increases and whale accumulation paint an optimistic picture for ETH's trajectory toward $4,200 resistance.

ETH Technical Analysis: Bullish Signals Everywhere

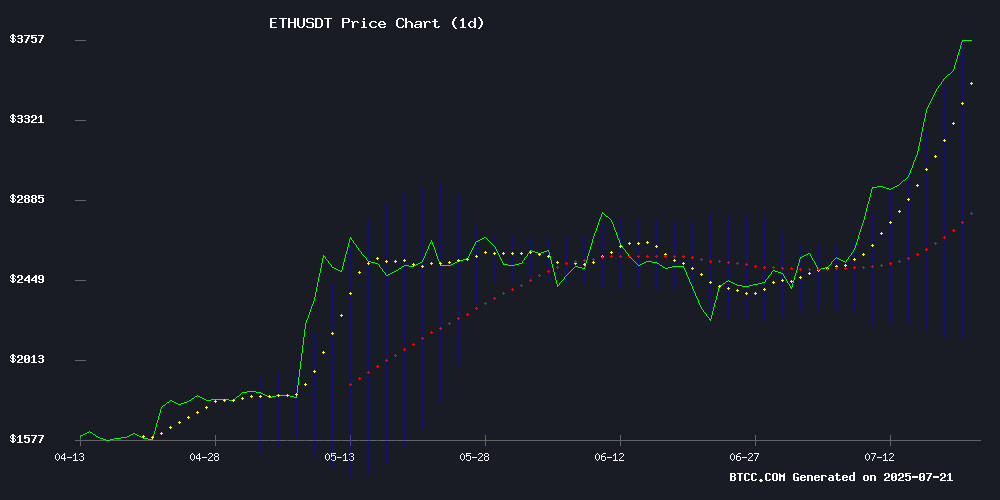

As of July 21, 2025, ethereum is trading at 3779.08 USDT on BTCC exchange - a whopping 25% above its 20-day moving average of 3009.08. The MACD histogram shows narrowing bearish divergence (-169.12), hinting at potential trend reversal. What's really catching traders' attention? ETH is dancing near the upper Bollinger Band (3862.63) while maintaining healthy distance from the middle band (3009.08).

Why Ethereum's Rally Might Have Legs

Institutional Money Flooding In

The Ether Machine's upcoming $1.5B public listing (holding 400,000 ETH) reads like a Wall Street endorsement of Ethereum. Backed by Pantera Capital and Kraken, this "digital oil" play could attract more conservative investors who've been sitting on the crypto sidelines.

NFT Market Waking From Coma

After months of stagnation, blue-chip NFTs like CryptoPunks and Pudgy Penguins posted 15-20% gains overnight. A whale dropping $5.87M on 45 Punks isn't just nostalgia - it's capital signaling confidence in ETH's ecosystem.

Network Upgrades Ahead of Schedule

The Fusaka hard fork's November target includes EIP-7825 security enhancements. More immediately, validators are pushing gas limits toward 45M (currently 37.3M), which could reduce those annoying $50 transaction fees during DeFi surges.

Potential Roadblocks to Watch

Before you mortgage your dog for ETH, consider:

- RSI at 72 - technically overbought territory

- 95% of ETH holders in profit - prime conditions for sell-offs

- Derivatives volume dominance - leverage can cut both ways

Trump's portfolio being 93% ETH is either genius or concerning - with that guy, who really knows?

Expert Price Targets

BTCC's Olivia sees two scenarios:

| Scenario | Target | Catalyst |

|---|---|---|

| Bull Case | $4,200 | ETF approvals + Fusaka success |

| Bear Case | $3,200 | Futures unwinding + macro downturn |

Ethereum FAQ: Your Burning Questions Answered

Is Ethereum still a good investment in 2025?

With institutional adoption accelerating and real-world use cases expanding beyond speculation, ETH remains a cornerstone crypto holding. That said, dollar-cost averaging beats trying to time this volatile market.

How high can ETH realistically go?

Technical analysis suggests $4,200 is within reach if current momentum holds. The 2021 ATH of $4,891 could come into play if the stars align with ETF approvals and successful network upgrades.

Should I worry about Ethereum's gas fees?

Layer 2 solutions have already alleviated much of the pain, and the proposed gas limit increase to 45M would further improve throughput. This isn't your 2021 Ethereum anymore.