Ethereum’s $2.4K Showdown: Foundation Dumps While Whales Gobble Up – Who Wins?

Ethereum teeters at a pivotal $2.4K mark—foundation wallets bleed while crypto whales feast. A classic tug-of-war between institutional exits and big-money accumulation.

Who’s calling the shots?

Retail investors left scratching their heads as the ‘smart money’ plays chess with ETH’s price. The foundation’s sell-off sparks FUD, but whale wallets scream conviction. Meanwhile, Wall Street still thinks blockchain is a type of ski binding.

Will $2.4K hold or fold? The market’s waiting—but not holding its breath.

Whales scoop up ETH on the quiet

While ethereum has failed to record significant gains over the past month, whales took the opportunity to accumulate.

Source: CryptoQuant

Large holders have accumulated 1.49 million ETH over the past month, raising their total balance by 3.72%. In fact, this wasn’t just a one-off, either.

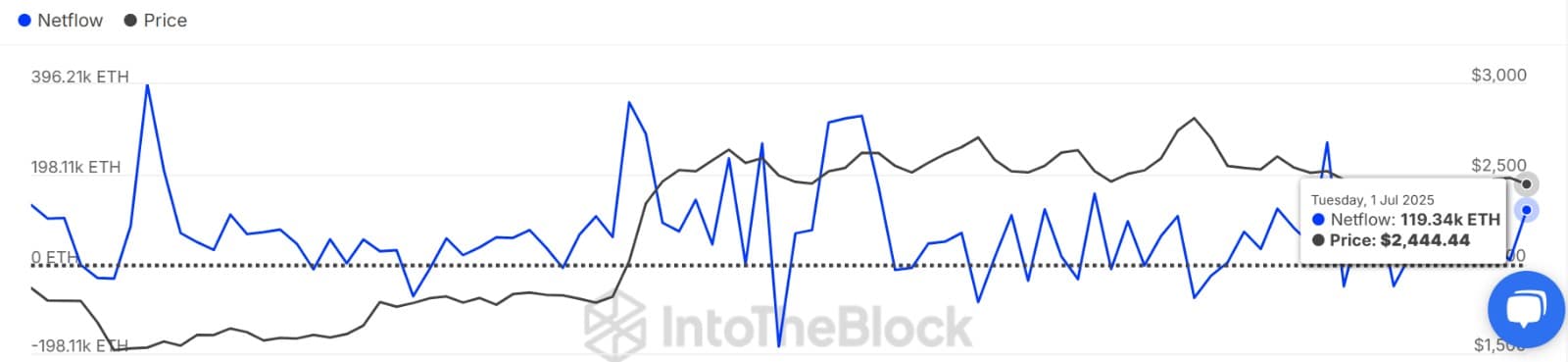

On the 1st of July, whale purchases hit 704K ETH, outpacing the 585K ETH sold, leading to a jump in Large Holders’ Netflow from 9.8K to 119.3K.

Source: IntoTheBlock

Naturally, this kind of net inflow signals accumulation. When whales buy more than they sell, it often means they’re positioning ahead of a move.

But wait!

Surprisingly, while whales are aggressively accumulating other players, including institutions and small-scale investors, are selling.

Take the Ethereum Foundation, for example. As reported by Lookonchain, the organization has been transferring 1,000 ETH worth $2.46 million daily to Multisig.

So far, they have offloaded a whopping total of 13k ETH worth $32 million.

This divergence raises a key question: Is this just profit-taking or a cautious shift?

Retail is sending ETH to exchanges

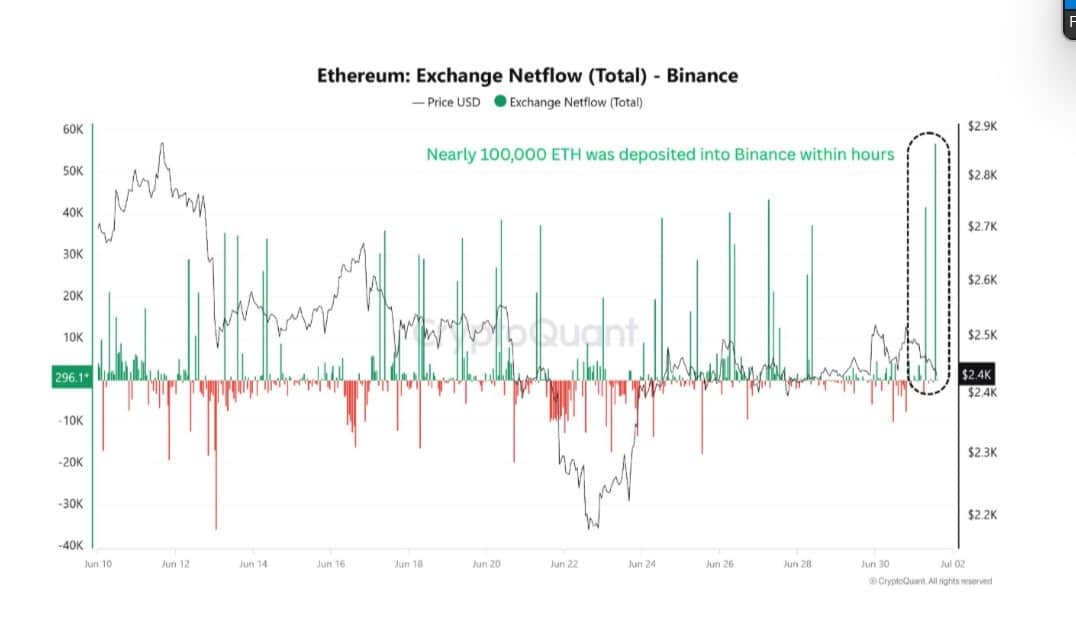

Source: CryptoQuant

On top of that, CryptoQuant data showed a significant spike in Ethereum’s Exchange Inflows. Binance alone saw 100K ETH worth $250 million enter its reserves in a single day.

Large Exchange Inflows typically suggest an increase in Ethereum reserves held on exchanges. Historically, such movements precede short-term price declines, especially if accompanied by low capital inflow.

The two conflicting paths for Ethereum

As observed above, while whales accumulate, other market players are selling. This accumulation provided a strong support floor, contrasting with small-scale investors who have been taking profit.

This tug-of-war has pushed Ethereum into a state of indecision.

Source: TradingView

The altcoin’s RSI Divergence Indicator hovered around 48.62 at press time.

At these levels, this momentum indicator suggested that markets are in a cool-down period, waiting for the next catalyst.

Therefore, the next MOVE depends on who finishes the battle strongly between the accumulating addresses and the profit takers.

If buyers continue while sellers exhaust, the altcoin will reclaim $2548 and eye a breakout to $2.7k.

However, if sellers outweigh buyers, Ethereum could decline to $2,372, breaching the lower boundary of the consolidation.

Subscribe to our must read daily newsletter