Bitcoin Shrugs Off Long-Term Holder Exodus – Is MicroStrategy’s 3% BTC Stake the Secret Sauce?

Bitcoin’s price stability defies another wave of long-term holder exits—while corporate whales like MicroStrategy quietly gobble up supply. Could their 3% stake be the market’s invisible hand?

The Corporate Buffer Effect

While retail investors panic-sell, Michael Saylor’s crypto-hoarding empire now holds a staggering 3% of all circulating BTC. Coincidence that dips keep getting bought? Wall Street would call it ‘strategic accumulation’—crypto natives call it a power play.

Liquidity vs. Leverage

The network absorbs sell-side pressure like a blockchain sponge, but make no mistake: this isn’t organic demand. With institutional players cornering supply, Bitcoin’s ‘decentralized’ narrative faces its most ironic stress test yet.

The Cynical Take

Nothing cures volatility like a few billion dollars of corporate treasury FOMO—just don’t ask what happens when the quarterly earnings call hits. *‘HODL’ sounds better with a Nasdaq ticker, doesn’t it?*

LTH selling without panic?

While Bitcoin has stayed trapped between $100,000 and $110,000 since May, the data showed signs of something deeper.

Source: CryptoQuant

Long-term holders — those who’ve held coins for over six months — have been offloading. Yet, this LTH selling hasn’t rattled the price. Instead, BTC has absorbed the outflow cleanly.

This kind of absorption often shows a healthy market structure and suggests that strong hands are rotating out, and not capitulating.

In fact, it suggests a mid-cycle redistribution—older coins rotating to newer holders without panic. This sort of churn is typically seen before the next leg of a bull run.

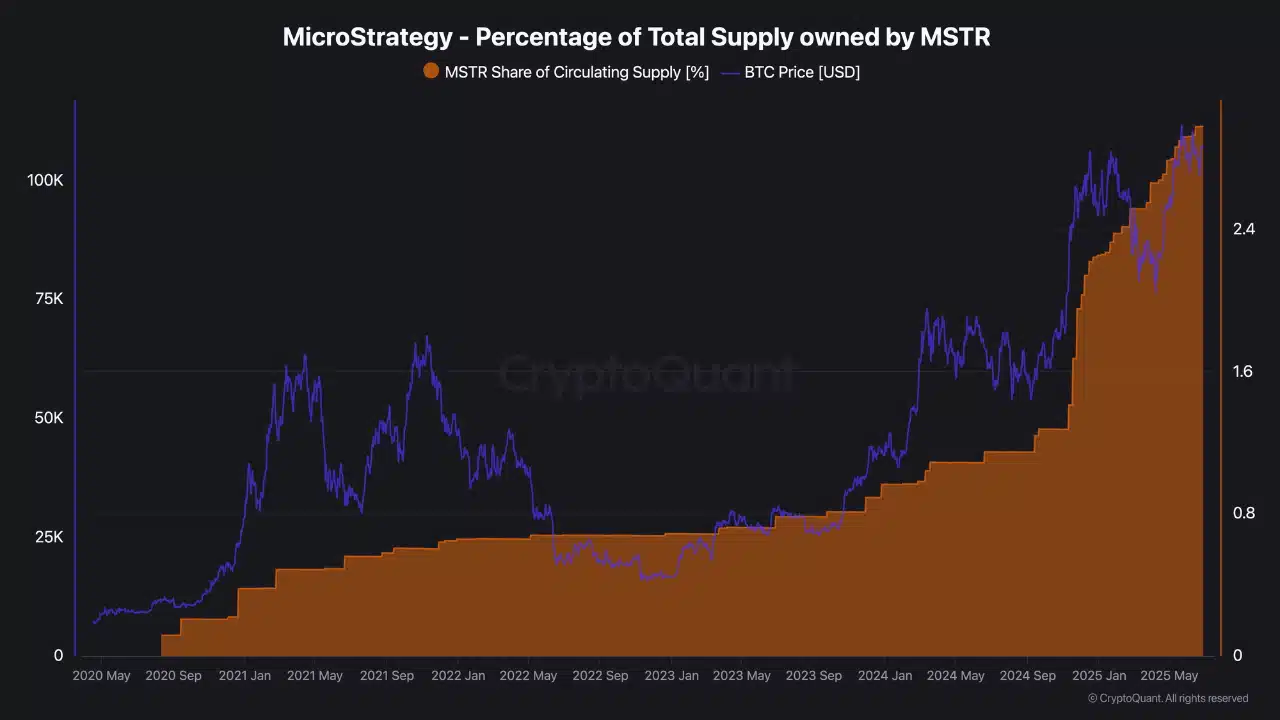

MSTR: 3% of Bitcoin supply is now held by one firm!

Strategy’s latest buy — 4,980 more BTC — brings its total holdings to 597,325 bitcoins, now accounting for 3% of Bitcoin’s circulating supply.

The firm’s pro-cyclical accumulation strategy has intensified over the past two years, aligning its largest purchases with bullish sentiment.

Source: CryptoQuant

CryptoQuant’s chart confirmed the rising share of supply held by MSTR, and while some criticize the centralization risks, many see this as institutional conviction on full display.

July is coming—and so is a breakout?

Historically, July has been one of Bitcoin’s strongest months, with a median return of 8.9% and a positive close in 8 of the last 10 years.

Source: X

This now converges with two major bullish forces: LTHs steadily rotating supply into strong hands, and institutional demand tightening float.

If the market continues absorbing this supply as it has over the past month, a decisive breakout may be in sight.

With July’s track record and current structural support, perhaps a surprise, even for the bulls, is in order.

Subscribe to our must read daily newsletter