ARB Crypto Holds Strong at $0.30, Rockets 21% – Is $0.40 the Next Target?

ARB defies the bears with a jaw-dropping 21% surge—holding $0.30 like a seasoned trader clutching their last leveraged long. Can this altcoin sustain momentum and punch through $0.40?

The $0.30 fortress stands

After weeks of sideways action, ARB’s defense of $0.30 triggered a violent upside breakout. The move caught short-sellers off guard—because nothing terrifies crypto skeptics like price discovery.

21% rally: FOMO or fundamentals?

The double-digit surge smells like speculative frenzy, but let’s not pretend traders care about whitepapers when charts go vertical. With liquidity flooding back into altcoins, ARB’s next test is converting hype into higher highs.

$0.40 or bust?

If ARB clears $0.40, it could trigger a cascade of algorithmic buys—because nothing says 'healthy market' like bots chasing momentum. But watch for profit-taking: even in crypto, gravity eventually wins. (Except when it doesn’t—this is finance, after all.)

Demand for Arbitrum soars

Before the recent upswing, sellers had controlled the market for five straight days, with sell volume consistently outpacing buys. But that changed dramatically in the last 24 hours.

On the 30th of June, buyers returned with strength. According to Coinalyze, Arbitrum recorded $148 million in buy volume versus $132 million in selling volume, signaling a clear shift in market momentum.

Source: Coinalyze

The $16 million delta points to aggressive accumulation of the altcoin by investors.

Such a spike in buying activity typically reflects fresh capital inflows, as buyers rush in to take advantage of lower prices.

Amid this surge in demand, the altcoin’s netflow dropped sharply—down to -362.9k at the time of writing—indicating more tokens were being withdrawn from exchanges than deposited.

Source: CoinGlass

Often, when exchange withdrawals outpace deposits, it reflects substantial accumulation and potential selling pressure. Historically, such a market setup has preceded higher prices as downward pressure on prices dwindles.

Derivatives markets are even more bullish

Significantly, examining the derivatives market, we determine that these investors rushed into the market to take strategic positions.

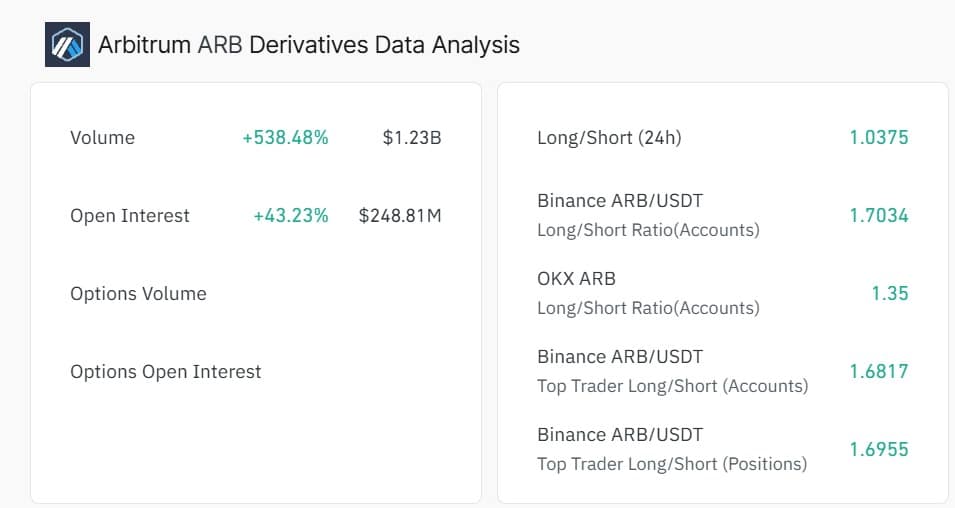

According to CoinGlass data, Arbitrum’s Open Interest surged 43.2% to $248.8 million, while Derivatives volume jumped 538.4% to $1.23 billion.

Source: CoinGlass

At the same time, the altcoin’s long-short ratio spiked to 1.037. This confirms that these investors entered the market to take long positions.

It’s worth noting that when Open Interest rises while investors are going long, these investors anticipate prices to rise further.

Is ARB finally ready to rally, or just a fluke?

According to AMBCrypto’s analysis, Arbitrum’s recent price uptick was primarily driven by speculative buyers.

As a result, the altcoin’s MACD surged to -0.0057, at press time, after making a bullish crossover, signaling strong upward momentum and its continuation potential.

Source: TradingView

Furthermore, at the time of writing, the Relative Strength Index (RSI) surged to 57, edging into bullish territory. This suggests that buyers are dominating the market, especially after rising from 45.

That said, with buyers taking charge while upward momentum is strengthening, they set ARB for more gains.

Therefore, if buyers continue at this speed, Arbitrum could reclaim $0.39 and flip $0.40. But if the bull’s conviction wanes and sellers retake the market, ARB will retrace to $0.30 support.

Subscribe to our must read daily newsletter