Ethereum Whale Doubles Down: $18M Staked at a Loss While Retail Flees – Who’s Smarter?

Whales vs. minnows: A $18M bet defies market panic.

While retail investors dump ETH in a bearish frenzy, one deep-pocketed player just locked up a fortune at a loss. Is this diamond-handed conviction—or another case of 'smart money' playing a different game?

The whale move: Staking $18M as ETH bleeds.

No one throws good money after bad—unless they know something you don’t. This whale’s contrarian play clashes with retail’s fire-sale mentality, sparking debates from Crypto Twitter to Wall Street chatrooms.

Retail’s revenge? Paper hands meet whale psychology.

Mainstreet investors are cutting losses like Black Friday shoppers, while institutions might be accumulating quietly. Classic ‘buy when there’s blood in the streets’—or just another hedge fund tax write-off in progress?

Closing shot: In crypto, the ‘dumb money’ often follows the smart… until the smart money follows the dumb. Place your bets.

Dormant Ethereum whale stakes $18 million worth of ETH

With ethereum failing to break through higher resistance levels, large holders are avoiding closing their positions.

According to Onchain Lens, a dormant whale returned to the market after 1.2 years and staked 7,182 ETH tokens worth $18.08 million via Lido Finance.

Interestingly, these tokens were originally withdrawn from Binance at $22.96 million, marking an unrealized loss of $4.87 million.

Rather than selling at a loss, the whale opted to earn yield, signaling confidence in Ethereum’s long-term upside.

In a ranging market, such strategic staking acts as a hedge, reducing idle risk and suggesting bullish intent. This sentiment is felt across the market by Ethereum’s large holders.

Whale herd gathers again

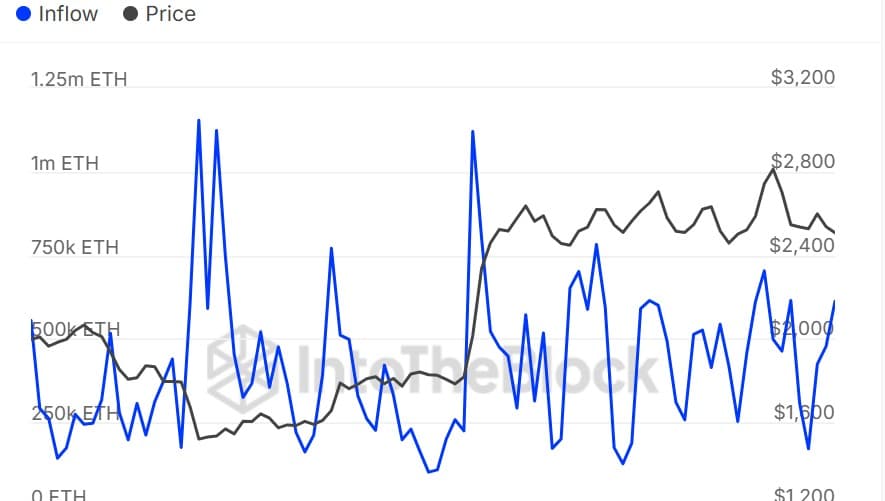

Source: IntoTheBlock

Data from IntoTheBlock confirmed that Ethereum whales accumulated 613,000 ETH in just 24 hours.

Such a massive buying spree signals growing confidence among large holders, especially since Whale Netflow remained positive over the past three days.

Retail sentiment diverges…

Although Ethereum whales are showing confidence in the market, other market participants are not yet convinced.

Looking at the altcoin’s exchange activity, ETH is recording more inflows than outflows, reflecting a higher selling activity.

Source: CryptoQuant

As such, there are more investors, especially retail, sending their ETH into exchanges, indicating a disconnection in market behavior between whales and retail.

According to CryptoQuant, Exchange Netflow stood at a positive 46.9K ETH over the last three days.

The discrepancy paints a classic divergence—whales are accumulating, but the broader crowd is bracing for a dip.

Will ETH’s $2.4K hold?

Amid this, ETH indicators add to the caution, as evidenced by Stoch RSI and RVGI.

Since making a bearish crossover a week ago, Stochastic RSI has declined to hit oversold territory around 8 from a high of 72.

Such a strong decline signals strong downward pressure, with sellers dominating the market. This bearishness was validated by another crossover on RVGI, confirming a potential breakdown below critical support.

Source: TradingView

Should momentum continue to slip, Ethereum risks losing support at $2,438—a level aligned with its 50-day Simple Moving Average.

Breaching this zone could open the gates for a fall toward $1,200, marking a major bearish breakdown.

Subscribe to our must read daily newsletter