Institutional Tsunami Hits Bitcoin: Is 2025 the Year of the Macro-Driven Mega Rally?

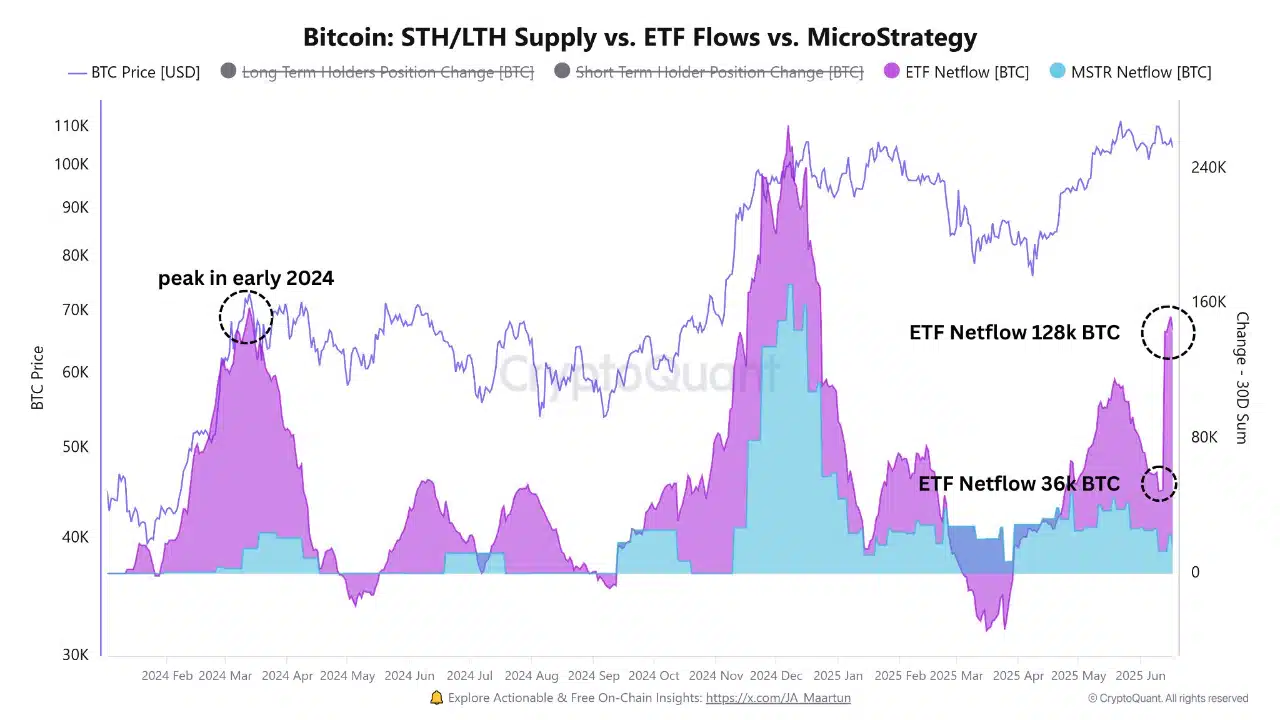

Wall Street's whales are circling Bitcoin again—and this time, they've brought bigger bags. After a quiet 2024, institutional inflows are surging at levels not seen since the last halving cycle. But will macro trends actually fuel the fire this time?

The institutional FOMO is real

BlackRock's ETF crossed $25B AUM last week. MicroStrategy just added another 5,000 BTC to its war chest. Even pension funds—yes, those dinosaurs—are dipping toes in. Yet somehow, Goldman still calls it a 'speculative asset.'

Macro winds shifting?

With the Fed's rate-cut pantomime dragging into Q3 and the dollar looking shaky, Bitcoin's 'digital gold' narrative is getting fresh oxygen. Funny how traditional finance rediscovers hard money only when their own system creaks.

The cynical take

Let's be real—these are the same institutions that mocked crypto in 2020. Now they'll pump it, dump it, and lobby to regulate it. But for traders? Just ride the wave... and sell before they do.

Source: CryptoQuant

Bitcoin scarcity intensifies

BTC’s Stock-to-Flow ratio surged to 2.12 million, reflecting a 133.34% increase and reinforcing the asset’s scarcity narrative.

New supply is lagging far behind circulating stock, signaling strong accumulation behavior. Therefore, the shift aligns with long-horizon investment strategies by institutional players seeking asymmetric upside.

Historically, such drastic rises in the ratio have typically preceded major bull runs driven by supply shocks.

Source: CryptoQuant

Has the balance of power shifted?

Transaction Count by Size showed a steep decline across lower-value bands, with the $1–$10 tier down 38.26%.

Meanwhile, the $1M–$10M band grew by 5.35%, confirming that whales have taken control of market flow. Naturally, this shift suggests a structural pivot—less noise, more conviction from deep-pocketed players.

Source: IntoTheBlock

Overheating or speculative conviction?

The Bitcoin NVT ratio skyrocketed to 824, a level rarely seen in previous cycles. This signals that market cap is outpacing transaction throughput, a potential sign of short-term overvaluation.

However, seen alongside ETF inflows and whale positioning, the spike likely reflects strategic holding, not speculative euphoria.

So, while it’s elevated, this may point to delayed distribution, not immediate downside.

Source: Santiment

Are short-term holders giving up as long-term conviction takes over?

The 0–1 day Realized Cap HODL Wave has plunged to 0.187%, its lowest reading in weeks.

This drop reveals that short-term holders are retreating, with fewer participants engaging in quick sell-offs.

Instead, BTC appears increasingly held by long-term believers, reinforcing the scarcity dynamic already echoed in ETF and S/F data. As quick flips vanish, the market tilts toward structural strength.

Source: Santiment

Bottom line

ETFs and whales appear to be preparing for liftoff.

The alignment of deep-pocket inflows, shrinking retail presence, rising scarcity, and long-term holding behavior reflects strategic conviction, not short-term speculation.

While metrics like NVT suggest temporary overheating, they are offset by clear signs of supply tightening.

As long as these structural dynamics persist, Bitcoin’s bullish momentum remains well-supported—and institutional capital could be the catalyst that sustains the rally.

Subscribe to our must read daily newsletter