Bitcoin Mining Difficulty Dips From ATH – Why Miners Are Doubling Down Instead of Quitting

Bitcoin''s mining difficulty just took a rare step back—but don''t expect miners to retreat. Here''s the inside scoop on why they''re digging in deeper.

The Difficulty Drop: A Brief Respite

After hitting record highs, Bitcoin''s mining difficulty eased slightly. Normally, that''d signal a chance to breathe. Instead? Miners are ramping up operations like it''s 2021.

Hashrate Wars: Survival of the Fittest

Efficiency is the new battleground. Older rigs are getting scrapped while industrial-scale operations pounce on the dip—turning temporary relief into long-term advantage.

The Cynical Take

Wall Street still thinks Bitcoin mining is about ''printing money.'' Meanwhile, pros know it''s a high-stakes game of musical chairs—with electricity bills.

Bottom line? This isn''t a retreat. It''s a strategic repositioning before the next rally. And yes, your portfolio probably still isn''t ready.

The cost of Bitcoin mining in 2025

Despite Bitcoin’s price hovering above $105K, profitability is increasingly elusive for many miners. The April 2024 halving reduced the block rewards to 3.125 BTC, slashing revenue overnight.

Source: CryptoQuant

Meanwhile, energy costs and infrastructure demands continue to climb, raising the operational breakeven point.

The Bitcoin network’s hashrate recently topped 1 zetahash per second, intensifying competition and making it harder for smaller players to stay viable.

Difficulty remains NEAR peak levels, acting as a constant barrier to entry… and survival.

Public miners defy the odds

While smaller miners face growing pressure, public firms like Marathon Digital and CleanSpark are expanding aggressively.

In May, Marathon mined 950 BTC—a 35% increase from April—despite market volatility and rising network difficulty. CleanSpark also gained ground, producing 694 BTC, up 9% month over month.

Both companies have significantly scaled operations, with CleanSpark’s hashrate reaching 45.6 EH/s. Their size and strategic execution are helping them thrive, even as profit margins tighten across the mining sector.

Bitcoin treasury shift

A new trend is taking shape: public miners are hoarding.

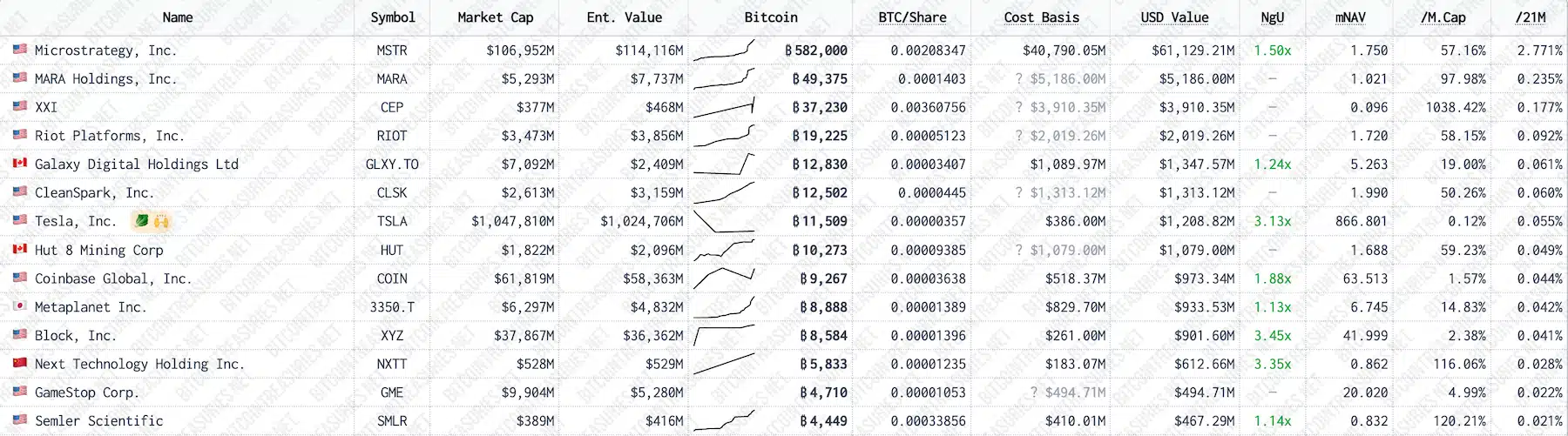

Source: bitcoin Treasuries

MARA now holds over 49,000 BTC and confirmed it sold none in May. CleanSpark has joined the ranks, amassing 12,502 BTC in total holdings.

This shows growing conviction in BTC’s long-term value and a broader corporate strategy to align with Bitcoin’s monetary ethos.

Subscribe to our must read daily newsletter