TRON’s $691B USDT Tsunami Collides With BofA’s Stablecoin Ambitions – Crypto’s Next Big Bang?

Stablecoins just went nuclear. TRON’s USDT volume hits $691 billion—while banking giant BofA quietly files stablecoin patents. Coincidence? Hardly.

Wall Street wants in, but can they keep up?

The numbers don’t lie: TRON processed more USDT last quarter than Visa handled in total transactions. Meanwhile, Bank of America’s ‘Project Crypto Ledger’ (real creative, guys) hints at a USD-pegged token. TradFi’s playing catch-up—with training wheels.

Here’s the kicker: decentralized networks are eating legacy finance’s lunch. While banks debate KYC protocols, TRON moves $691B in USDT with fewer hiccups than a wire transfer. The irony? Stablecoins might be the most ‘regulated’ part of crypto now.

One cynical take: BofA’s move reeks of ‘if you can’t beat ’em, print your own.’ But with $691B flowing through TRON alone, the real question isn’t if traditional finance adapts—it’s whether crypto will even notice when they do.

TradFi wades deeper into blockchain waters

Bank of America’s stablecoin ambitions are an important shift in how major banks are approaching digital assets.

Once cautious, the banking giant is now leaning into blockchain as a Core pillar of its future strategy; driven by the promise of faster settlements and competitive pressure from peers.

While earlier talks of partnering with JPMorgan Chase and others have yet to materialize, Bank of America is pushing ahead.

Speaking at a recent Morgan Stanley conference in New York, Bank of America CEO Brian Moynihan shed light on the bank’s shifting stance:

“We’re engaging both across the industry and independently. The technology has been understood for some time-what held us back was the regulatory fog. It wasn’t clear we were even permitted to MOVE forward under existing banking rules.”

TRON: A whale highway for stablecoins

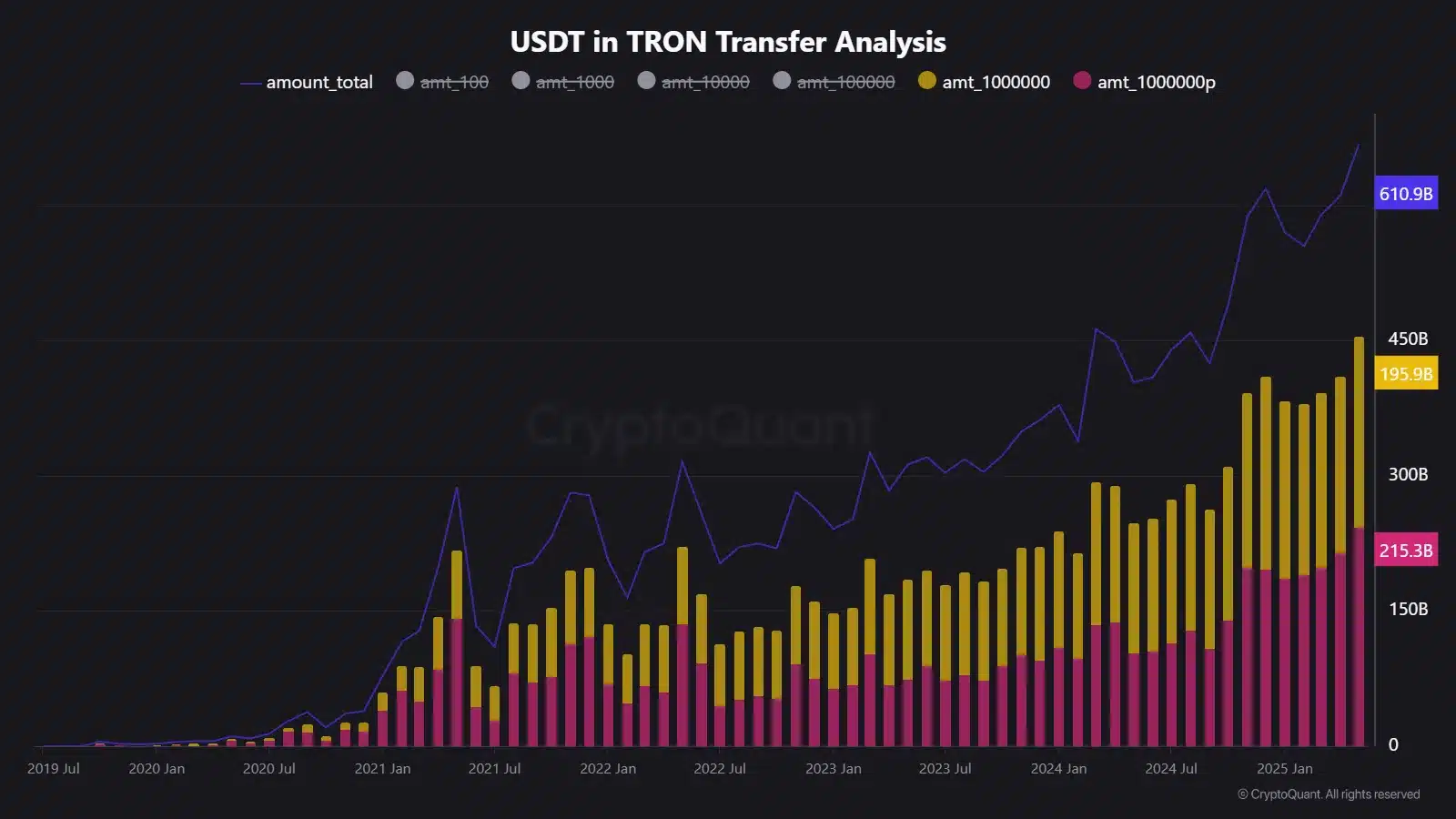

While Wall Street prepares its stablecoin debut, TRON is already in deep — processing a record $694.54 billion in USDT transfers this May alone.

According to CryptoQuant, nearly 60% of that volume came from whale transactions over $1 million, totaling $411.2 billion. tron now leads all blockchains in stablecoin dominance, holding over $75 billion in TRC-20 USDT.

Source: CryptoQuant

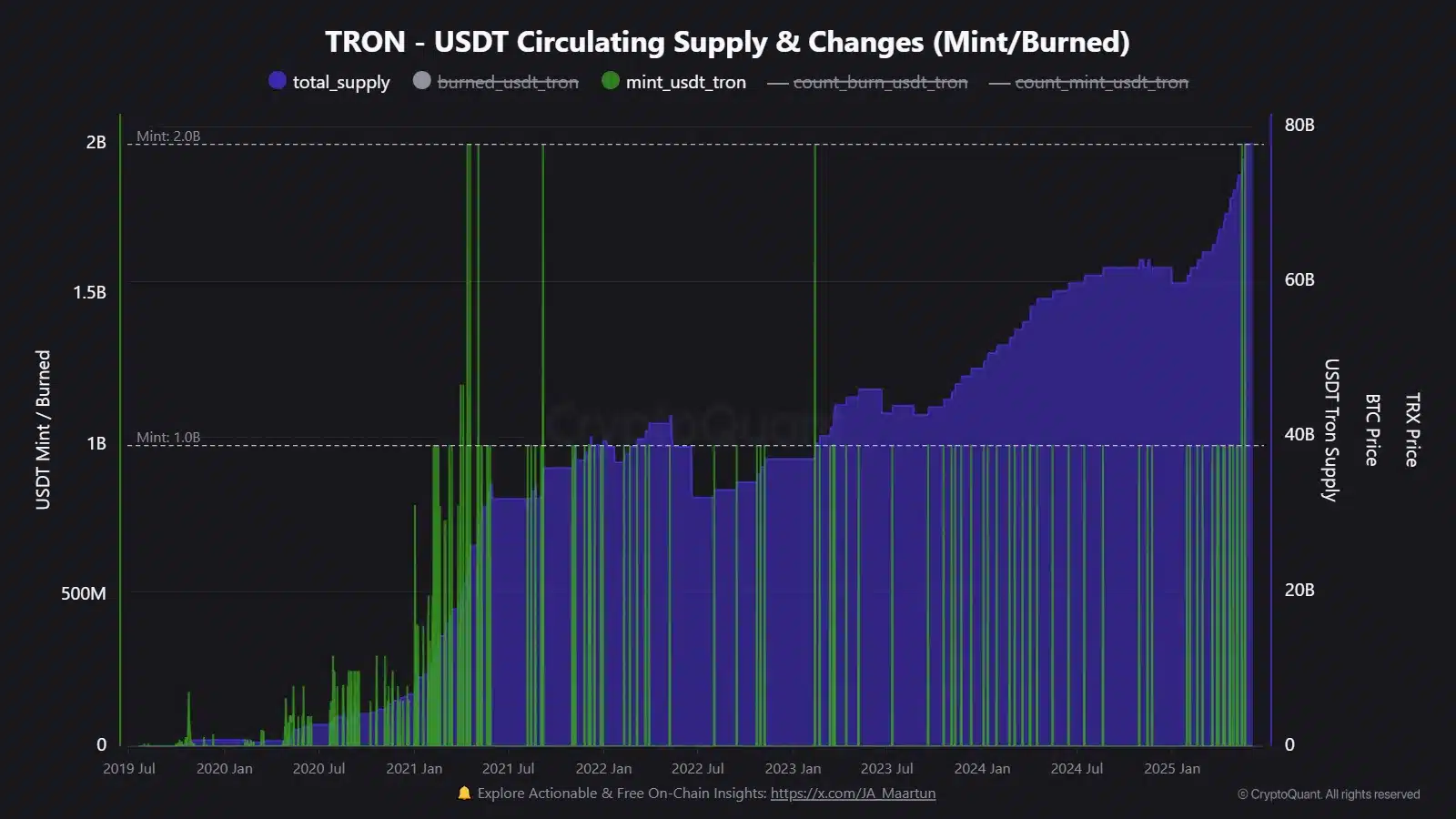

With 17 separate $1 billion-plus mints already in 2025, the network’s pace shows no signs of slowing.

Its 10.5 billion cumulative transactions highlight one thing clearly: when it comes to moving big money fast, crypto whales are choosing TRON.

Source: CryptoQuant

Broader stakes

The stablecoin race is now influencing global finance and monetary policy.

In emerging markets, dollar-pegged stablecoins like USDT are gaining traction for remittances and inflation hedging, effectively exporting the U.S. dollar.

Meanwhile, the Fed is under mounting pressure to clarify its oversight role.

During congressional hearings in early June, lawmakers reignited debate over stablecoins’ potential risks to financial stability, citing their growing influence on Treasury markets.

At the same time, global central banks are accelerating CBDC pilots… making it clear that the future of digital money is no longer theoretical.

Subscribe to our must read daily newsletter