AI16Z Rockets 15% in a Day – FOMO Fuel or Legit Breakout?

Another day, another crypto moonshot. AI16Z just ripped past resistance with a 15% surge—enough to make even the most jaded trader glance up from their latte. But here’s the million-Satoshi question: is this the start of a sustained rally or just another pump before the dump?

The chart tells a bullish story—for now. That double-digit leap puts AI16Z near June highs, and you can already smell the leverage building in perpetual swaps. Yet anyone who’s survived a crypto cycle knows these vertical moves often end in tears (or margin calls).

Meanwhile, the ’fundamentals’ crowd will point to the project’s AI buzzword compliance as justification. Because nothing pumps bags like slapping ’machine learning’ on a whitepaper—just ask the 2023 NFT AI metaverse gamblers. Their Lambos are probably repossessed by now.

So do you ape in? Your call. But remember: in crypto, the early buyers get the profits, the late buyers get the ’educational experience.’

Sources: Coinglass

Significantly, this demand can be observed across the market in both Futures and Spot.

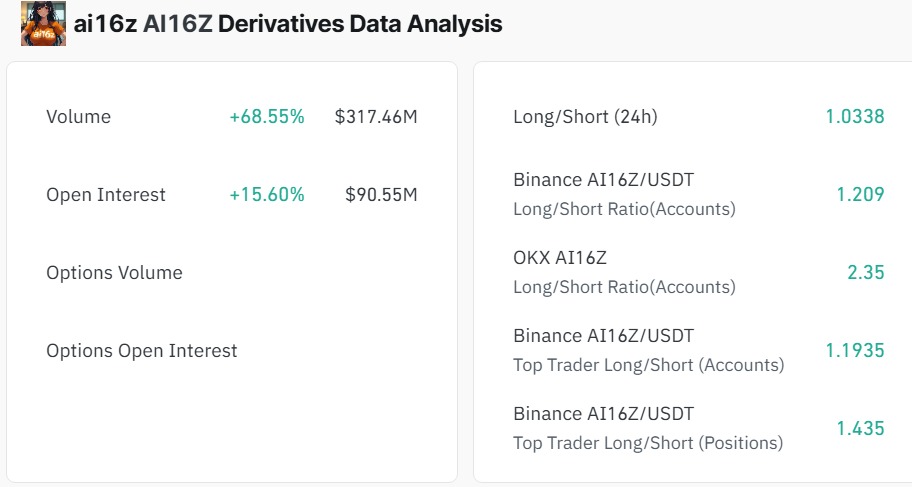

For starters, in the Futures market, investors have been very active, with the altcoin’s Open Interest surging by 15.7% and hitting $90.57 million. A hike in this metric means that a good number of investors are entering the market to take strategic positions. While these new investors have been entering the market, existing ones have held on to their positions too.

Source: Coinalyze

Among these investors, most of them are now taking long positions.

This can be evidenced by the fact that Ai16z’s funding rate held on strong within positive territory. A positive funding rate means that investors are mostly bullish and expect the price to rise further from its press time level.

Source: Coinglass

Besides the Futures contracts, exchange activities also indicated a high demand for the memecoin.

Consider this – Ai16z’s exchange netflows have been negative for three consecutive days. This implied that while Ai16Z surged, it was driven largely by exchange demand. Simply put, exchanges have been recording more withdrawals than deposits – A sign of a high accumulation rate.

What next for Ai16Z?

According to AMBCrypto’s analysis, Ai16Z is now seeing a shift in market sentiment after its latest dip. Thus, after dropping to a low of $0.19, the memecoin successfully defended its $0.2 support and bounced. This alluded to strengthening upward momentum as demand started to recover across the board.

The uptick in momentum can be validated by the recent bullish crossover on the memecoin’s Stoch. Over the last 24 hours, Ai16Z’s Stoch surged to make a crossover – Signaling strong upward momentum.

If these conditions hold, we will see Ai16Z rally to $0.287. For this outlook to hold, the memecoin needs a daily close above $0.257.

Source: Coinalyze

However, the only handle that Ai16Z bulls have to overcome is sellers in the Spot market.

In the last 24 hours, Ai16Z recorded a negative delta of 29.9k, with sellers offloading 250.9k. This selling pressure resulted in the aforementioned pullback on the daily charts. If activities here don’t shift towards buying, we could see a full-blown retracement with Ai16Z dropping to $0.22.

Subscribe to our must read daily newsletter