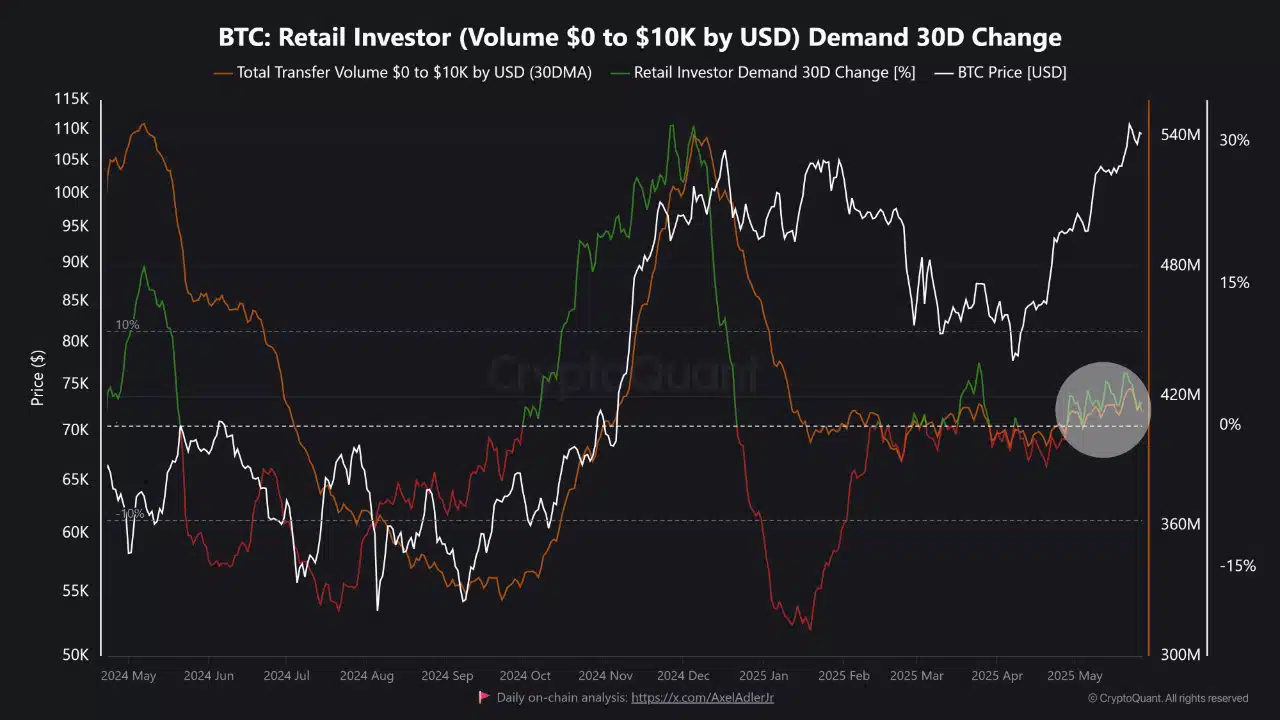

Bitcoin’s Retail Demand Flatlines – Will the Bull Run Stumble?

Retail investors aren’t biting—BTC’s grassroots momentum stalls as the big players keep the party going. Here’s why it matters.

No mom-and-pop FOMO? No problem—for now. Institutional whales keep pumping, but history whispers: retail rallies fuel the craziest peaks. Remember 2021? Exactly.

Cue the cynical take: Wall Street’s playing with your decentralized revolution again. Surprise.

Source: CryptoQuant

Valuation metrics hint at overextension

Spot exchange flows on 28 May reflected strong outflows of $721.44 million against inflows of $616.51 million.

Additionally, exchange reserves dropped by 0.96%, with the same sitting at $266.49 billion at press time. This suggested that investors have been withdrawing BTC from exchanges, often a precursor to long-term holding or institutional custody.

Such a pattern has historically preceded strong price trends, as reduced liquid supply can tighten order books.

Source: Coinglass

In fact, valuation indicators seemed to clearly show early signs of cooling, despite Bitcoin’s strong price trajectory. The NVT Golden Cross—used to assess price against on-chain transaction volume—dropped by 26.06% to 1.075.

Meanwhile, the Puell Multiple, which evaluates miner revenue against historical norms, fell by 11.22% to 1.297.

These findings implied that the price growth may be outpacing both network value and miner-based valuation anchors.

Retail presence fades as network activity drops, whales take control

Despite the hike in price, Bitcoin’s network growth has stalled somewhat. Over the past 7 days, new addresses declined by 5.93%, active addresses fell by 6.46%, and zero balance addresses dropped by 9.79%.

These metrics reflected falling onboarding and transactional activity. In a robust bull run, these numbers typically surge, indicating heightened demand and speculative interest.

Such a disconnect could be a sign that the ongoing rally has not been organically supported by a broader user base.

Source: IntoTheBlock

Bitcoin’s transaction profile revealed significant imbalances too. Transactions below $100 fell sharply, with the $0–$1 bracket down 66.38% and the $10–$100 bracket down 6.90%.

Conversely, transactions above $10 million soared by 59.26%, while those between $1 million and $10 million climbed by 13.26%.

This hinted at a rally led by high-net-worth investors or institutional participants – All while retail remained largely on the sidelines.

Although large players can MOVE prices quickly, sustained rallies typically require volume and support across all transaction sizes.

Source: IntoTheBlock

Will BTC’s breakout be sustainable without retail participation?

Bitcoin’s recent price surge has been clearly driven by institutional flows and long-term holding sentiment, as evidenced by the shrinking exchange reserves and strong outflows.

However, cooling valuation indicators, declining address activity, and shrinking retail transaction volumes suggested the rally lacks a broad foundation. Without renewed retail interest, the momentum may weaken or become increasingly fragile.

For Bitcoin to break decisively into a sustainable bull cycle, retail participants must return with confidence, liquidity, and volume.

Subscribe to our must read daily newsletter