As Japan’s Bond Market Implodes, Bitcoin Emerges as a Contrarian Lifeline

Tokyo’s debt dominoes are teetering—yields spiking, the BOJ scrambling. Meanwhile, Bitcoin hodlers just shrug.

When traditional finance cracks, digital gold starts gleaming. No bailouts, no yield curve control—just a finite supply and global liquidity.

Wall Street suits still call it speculative. Tell that to Japanese pension funds quietly allocating to cold storage.

Funny how ’risk assets’ become safe havens when central banks lose the plot. *cough* negative rates *cough*

Source: Financelot/X

Japan’s economic crisis deepens

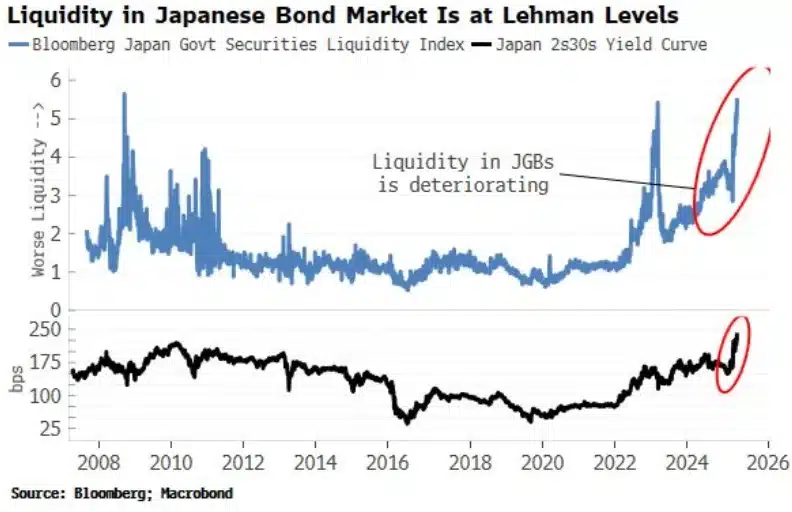

The upheaval in Japan’s bond market largely originates from the Bank of Japan’s abrupt change in monetary policy. After years of aggressive bond purchases, the BOJ scaled back its intervention, releasing a flood of supply that sent yields sharply higher.

Despite reducing its buying, the central bank still holds $4.1 trillion in government debt, over half of all outstanding bonds, leaving a lasting distortion on market dynamics and investor sentiment.

Additionally, Japan’s national debt has climbed to $7.8 trillion, driving its debt-to-GDP ratio to a record 260% – Over twice that of the United States.

The economic fallout has been swift and severe, with Q1 2025’s real GDP contracting by 0.7%, far worse than forecasts, while inflation climbed to 3.6% in April.

At the same time, real wages dropped by 2.1% year-over-year, fueling growing fears of an entrenched stagflationary cycle.

Community reactions

Owing to the same, the Kobeissi Letter took to X and noted,

Source: The Kobeissi Letter/X

As expected, on the back of such financial turmoil, talk of Bitcoin hasn’t been too far behind either. One analyst added,

Source: James Van Straten/X

Japan’s crypto journey

Despite mounting stress in Japan’s bond market, the nation’s crypto industry is expanding steadily, with the Japan VIRTUAL and Crypto Assets Exchange Association reporting 32 registered crypto-asset exchange operators on 30 April

Trading activity remains strong, with February figures showing spot volumes nearing JPY1.9 trillion (USD13.1 billion) and margin trading volumes close behind at JPY1.5 trillion.

At the same time, Japan has been pressing forward with regulatory clarity. Especially since the ruling Liberal Democratic Party’s Web3 Project Team has been advocating for formally recognizing crypto-assets as a separate asset class under the Financial Instruments and Exchange Act.

Against this backdrop, bitcoin [BTC] is increasingly viewed as a hedge against traditional financial instability, especially as the once-reliable yen carry trade comes under mounting pressure.

Therefore, with Japan’s debt turmoil intensifying, crypto-linked assets are fast becoming a preferred SAFE haven for investors.

How is Metaplanet acting as an example?

This also coincided with Metaplanet’s stock surging by 15.55% on 27 May, hitting its upper limit once again as confidence in its Bitcoin-centric strategy strengthens amid rising bond yields and economic instability.

Simultaneously, Cardano [ADA] has been capturing the attention of Japanese retail investors, with growing demand for the ADA/JPY pair.

Such a shift in sentiment suggests that as traditional financial structures falter, Japan’s crypto landscape may emerge as a critical refuge for capital seeking resilience and clarity.

Subscribe to our must read daily newsletter