Bitcoin Braces for Impact: 500K BTC Liquidity Event Looms

Market holds its breath as Bitcoin faces a potential seismic liquidity test—half a million BTC hangs in the balance.

Volatility’s reckoning: The OG crypto’s price discovery mechanism gets another stress test, just as Wall Street ’experts’ rediscover their risk management playbooks.

Whether this becomes a fire sale or a fakeout depends on who’s really holding the bags—diamond hands or leveraged paper tigers.

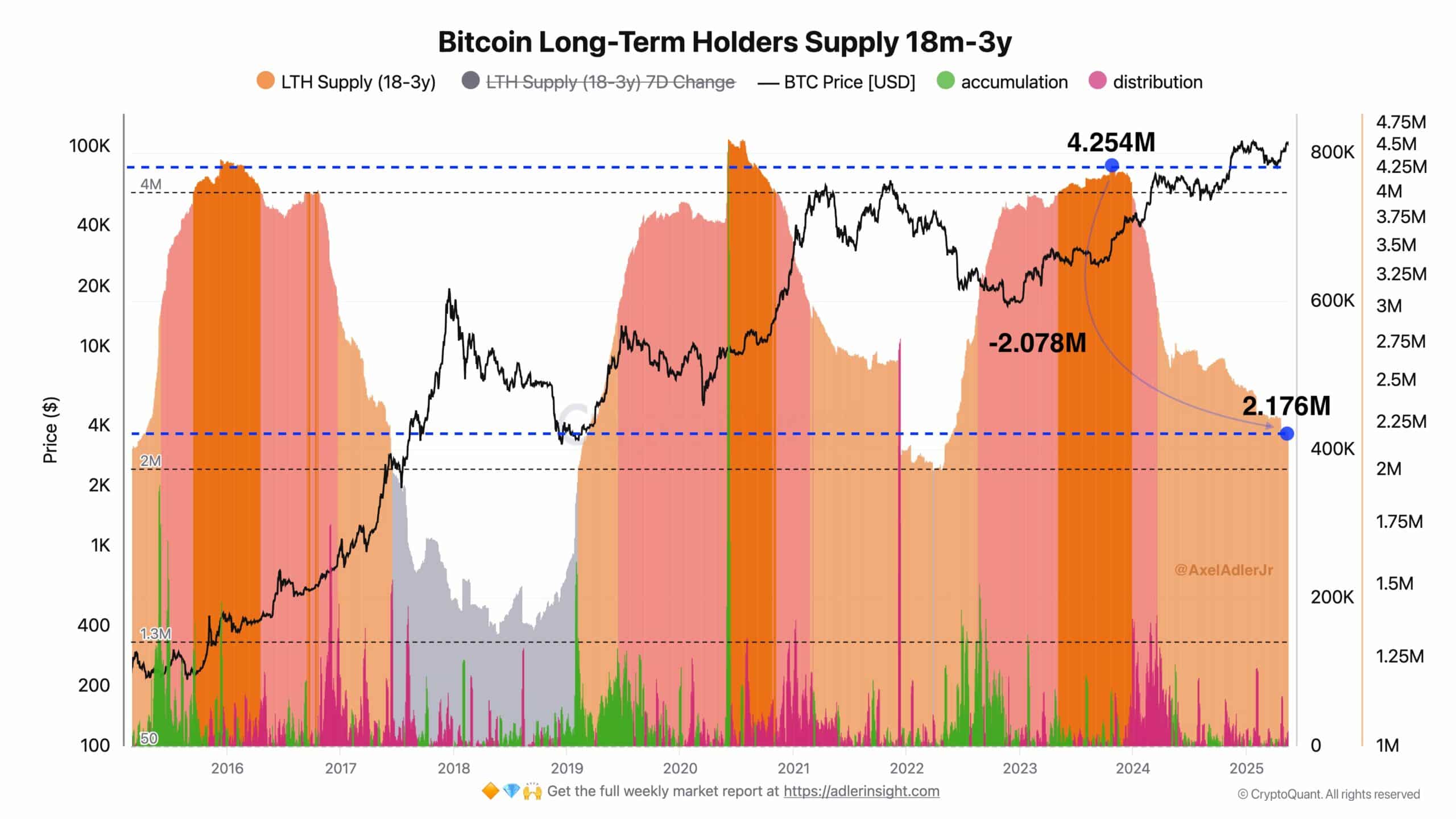

Long-term holder distribution and volatility signals

The attached chart revealed a significant trend.

Since November 2023, Long-Term Holders (LTHs) – those with BTC aged 18 months to 3 years – have offloaded over 2 million coins. They have netted roughly $138 billion in realized gains.

Source: CryptoQuant

This steady decline in LTH supply, from a peak of 4.254 million down to 2.176 million BTC, is a sign of a clear distribution phase. In fact, it looks a lot like what we’ve seen during past bear markets.

Most notably in 2022, when a similar pattern preceded a 63% annual drop from Bitcoin’s $46,017 opening.

What makes the current cycle different is the outcome. Despite comparable levels of long-term distribution and profit-taking, Bitcoin has continued to trend higher. It is up nearly 200% during the same phase.

That tells us something’s changed. Instead of causing a crash, all this selling and volatility might be shaking things up and setting the stage for stronger, smarter accumulation.

Bitcoin’s next big opportunity

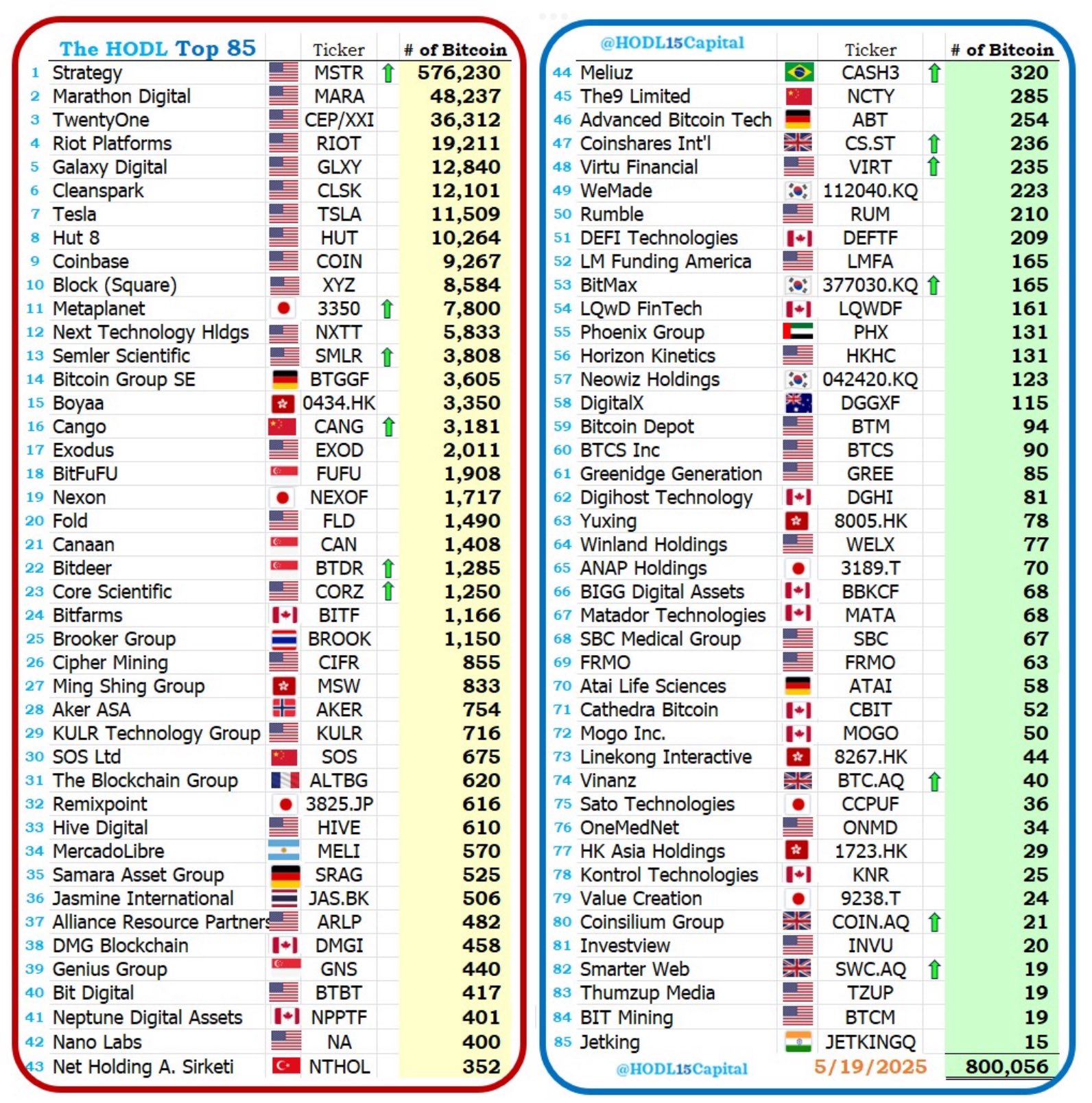

Monitoring this cohort closely is essential. Based on their current BTC treasury, data-driven analysis from a leading expert projects that up to 500k bitcoin could enter the market by year-end.

This could mean the buildup of a significant wave of exit liquidity beneath the surface.

According to AMBCrypto, such a release will inevitably put Bitcoin’s volatility under renewed pressure. Hence, testing the market’s capacity to absorb large-scale distribution without disrupting the broader uptrend.

However, with institutional and corporate interest in Bitcoin now surpassing levels seen in the 2023–24 cycle, this volatility might be less like a threat. Instead, it could be more like another opportunity.

Source: X

If history is any guide, Bitcoin could once again demonstrate its resilience, offering bulls a strategic entry and setting the stage for further price discovery.

Subscribe to our must read daily newsletter