Solana’s $180 Showdown: Will SOL Smash Through or Face Another Rejection?

Solana bulls are charging toward the $180 resistance level—a price point that’s crushed rallies twice before. This isn’t just technical analysis theater; it’s a make-or-break moment for SOL’s credibility as an ’Ethereum killer.’

Breaking $180 would open the path to retest its all-time high near $260. Fail? Traders will start muttering about ’ghost chains’ again—right before dumping bags to chase the next shiny AI token.

The blockchain’s raw speed gives it an edge, but crypto’s mercenary capital has zero loyalty. One false move, and those ’institutional inflows’ might just evaporate faster than a meme coin’s liquidity.

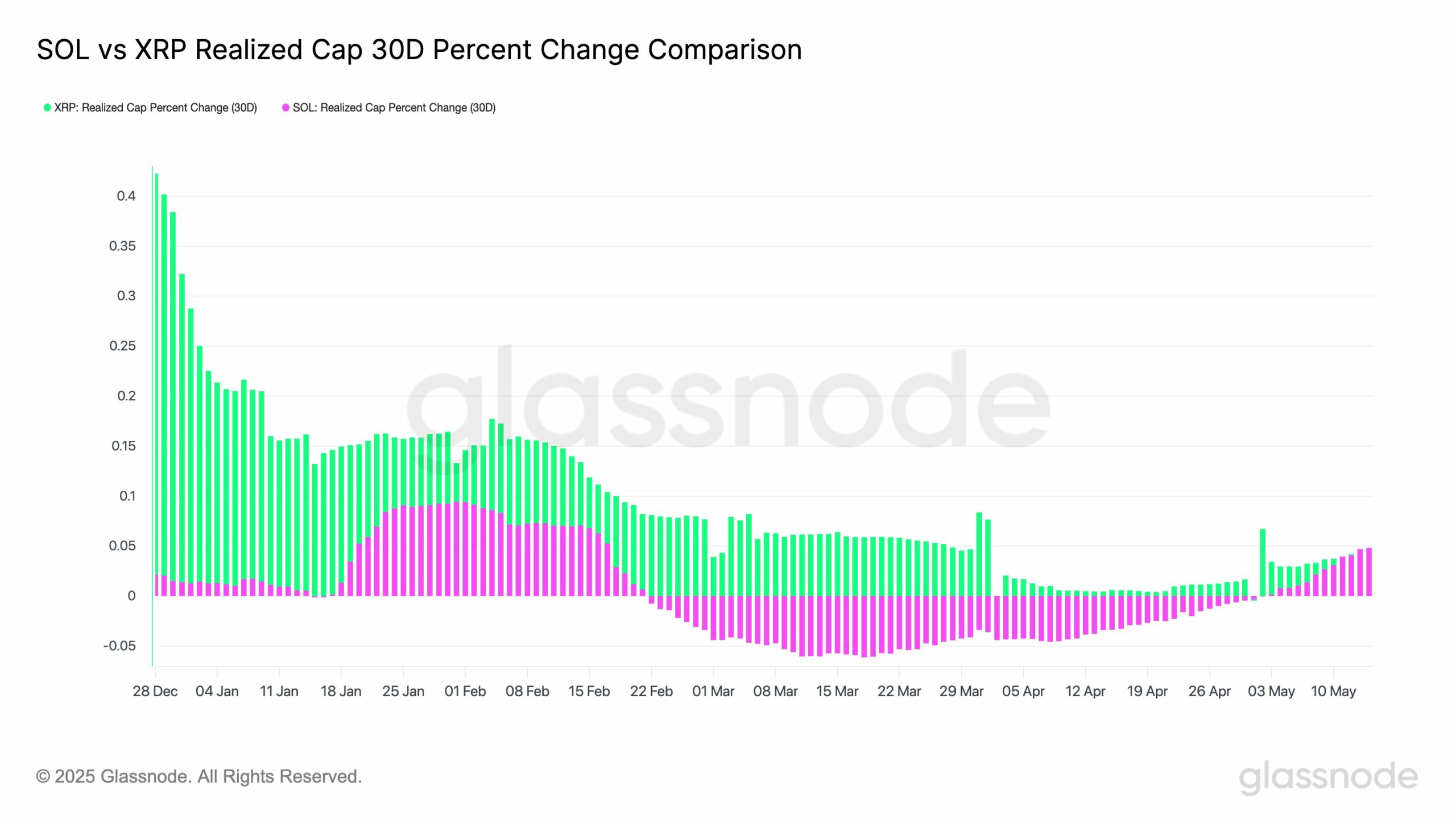

Source: Glassnode

Positive Futures data reinforces bullish outlook

Supporting positive capital inflows was the 90-day Cumulative Volume Delta (CVD) for Futures markets. It indicated a Taker Buy Dominant phase for SOL, according to a closer AMBCrypto analysis of CryptoQuant’s Futures data.

This metric reflects growing buyer conviction. When buy volume leads over time, it usually signals strong upside expectations from traders.

In SOL’s case, the CVD uptrend paired with recovering realized cap inflows gives SOL a solid base for potential continuation in its recent uptrend.

Source: CryptoQuant

SOL tests $180 supply zone after month-long rally

SOL tested a key supply zone around the $180 level on the daily chart at press time, following a month of steady gains.

This zone has historically capped further price advances and serves as a strong resistance level.

However, the recent shift in capital inflows and growing buyer dominance could invalidate this supply zone, potentially paving the way for a rally toward the $200 psychological level.

Source: TradingView

Rally to $200 hinges on demand strength

If bulls sustain the buying pressure, SOL can negate the $180 supply zone and explode for another surge towards the $200 psychological price level.

But for now, all eyes are on the scale of capital inflows and whether buyers can carry on.

If these bullish sentiments hold, SOL can see a breakout rally in the NEAR term — setting the stage for its next major price action.

Subscribe to our must read daily newsletter