Binance’s Bitcoin Reserves Hit 102% for 30 Months Straight – Proof of Funds Snapshot Drops

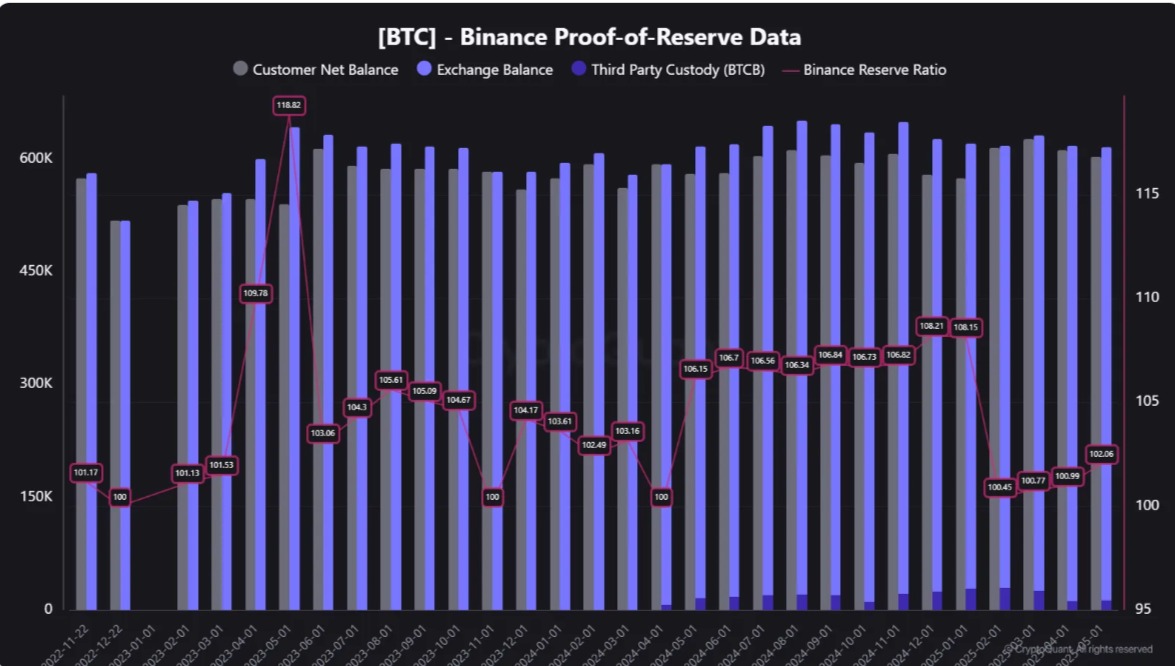

In an industry where ’trust me bro’ audits still pass for compliance, Binance just flexed cold hard crypto receipts. Their latest proof-of-reserves snapshot shows BTC holdings covering 102% of customer balances—for two and a half years running.

No bank would dare pull this off. Then again, no bank lets you trade leverage while wearing pajamas either. The exchange’s overcollateralization beats even Switzerland’s gold-backed franc—assuming you ignore that time they ’accidentally’ commingled funds.

While rivals play fractional reserve games, CZ’s ghost still haunts the platform with these numbers. Makes you wonder: is this transparency... or a distraction from the SEC’s ongoing ’How to Lose a Regulator in 10 Days’ saga?

Source: CryptoQuant

Significant asset holdings are crucial because they fully back all customer funds and provide assurance.

After investors lost their money in the FTX and Mt. Gox incidents, there has been an increasing demand for crypto exchanges to disclose their holdings, with on-chain trackers continually validating this data.

Binance has taken the lead in making this information publicly available, which helps to build confidence among customers and users.

The rising reserves indicate strong asset backing and a commitment to transparency. As a result, customers, investors, and holders on Binance can feel secure against potential market uncertainties in the future.

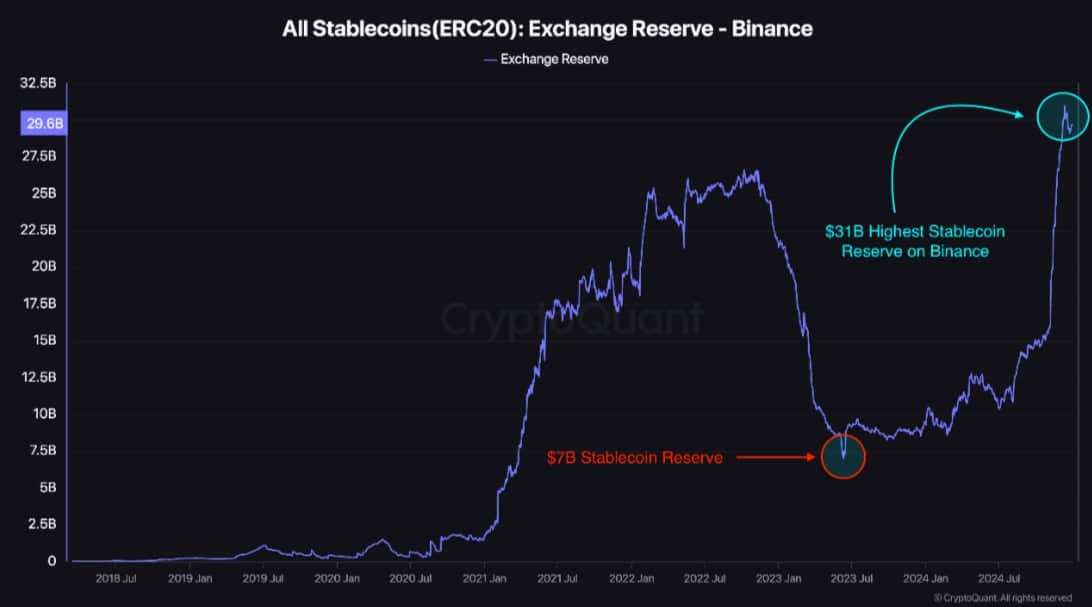

Source: CryptoQuant

In fact, over the past year, Binance’s reserves have experienced exponential growth as the company continues to secure customers’ investments through BTC and stablecoin reserves.

As of March 2025, Binance has recorded 29 consecutive months running holding above 100%.

Moreover, Binance’s stablecoin reserves have continued rising. As of January 2025, reserves climbed to $31 billion, strengthening the platform’s liquidity position.

This dual reserve growth in both BTC and stablecoins helps secure investor capital and cushions the exchange against extreme market volatility.

Why this matters for crypto as a whole

Undoubtedly, a positive and rising BTC reserve for Binance, the largest crypto platform on trading volume, plays a vital role in building more trust and confidence.

Thus, investors will have more confidence in the crypto exchange and the whole crypto market.

Significantly, signals the growth in the whole market where investors cannot lose their funds over fraudulent exchanges.

More importantly, this puts pressure on other exchanges to adopt similar practices, shifting the market toward more accountability.

Subscribe to our must read daily newsletter