Bitcoin Whales Swallow 110K BTC—Are They Gearing Up for a Price Tsunami?

Crypto’s big players just yanked 110,000 Bitcoin off exchanges—roughly $6 billion at current prices. That’s the largest single-day withdrawal since the 2021 bull run. Are the whales betting on a supply squeeze?

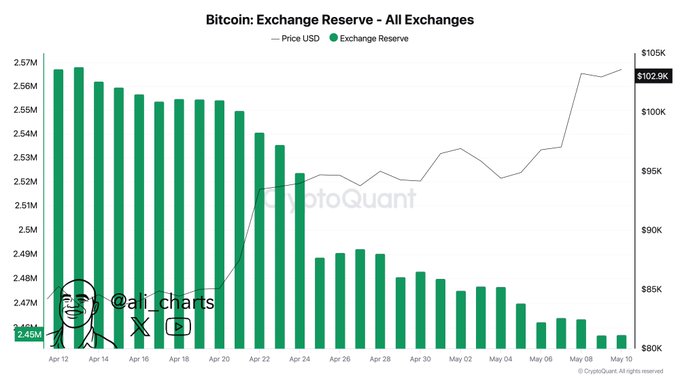

Exchange reserves now sit at multi-year lows. Meanwhile, the Bitcoin halving’s supply cut is already priced in—or so the Wall Street analysts claim between sips of their $18 artisanal lattes.

History suggests this could be the prelude to a parabolic move. The last time whales hoarded this hard, BTC ripped to $69K. But with Tether’s printers warming up again, even the cynics are whispering ’new ATH.’

Whales withdrew 110,000 BTC, time to buy?

Since the day Bitcoin began bleeding, whales and industry giants have seized the opportunity to buy the dip.

Recently, a prominent crypto expert shared data on bitcoin exchange reserves over the past 30 days, revealing that whales have withdrawn over 110,000 BTC during this period.

This substantial withdrawal of BTC indicates potential accumulation and could create buying pressure, leading to a further upside rally, which explains Bitcoin’s recent surge.

Meanwhile, whales haven’t stopped yet, they have been continuously accumulating BTC.

In just 48 hours, whales added another 20,000 BTC to their wallets.

This continuous accumulation of BTC reflects the whales’ interest and confidence in the asset for the long term.

Source: X

Retailers least participation

On the other hand, retail investors were largely absent during this period and were seen offloading their holdings due to panic.

According to on-chain analysts, retail typically returns NEAR market tops, not during recoveries or corrections.

Despite BTC trading just 5% below its previous peak, retail participation stayed muted, possibly limiting frothy speculation—for now.

$500 million worth of bullish bets

Besides all this, traders appear to be aligning with the current market sentiment, as revealed by the on-chain analytics tool Coinglass.

Data shows that traders are currently overleveraged at the $102,819 level on the lower side (support) and $104,871 on the upper side (resistance).

At these levels, traders have built $496.55 million worth of long positions and $319.26 million worth of short positions.

This metric indicates that bulls are currently dominating the market, hoping that the BTC price won’t fall below the $102,819 support level anytime soon.

At press time, BTC traded around $104,300—up 0.75% in 24 hours. However, trading volume dipped 7%, hinting at lower engagement.

Bitcoin price action & technical analysis

According to AMBCrypto’s technical analysis, BTC appears bullish and is poised for a new high. The daily chart reveals that the asset is heading toward the key resistance level of $106,800.

Source: TradingView

If this upward momentum continues and the price breaks through this resistance, there is a strong possibility that BTC could experience a notable surge and potentially reach a new all-time high.

BTC’s Relative Strength Index (RSI) stood at 74, indicating that the asset is in overbought territory.

There is a strong possibility that it could experience a price correction until the RSI moves out of the overbought zone.

Take a Survey: Chance to Win $500 USDT