Arizona Joins Bitcoin Revolution: Governor Signs Groundbreaking Reserve Bill Into Law

Move over, New Hampshire—Arizona just stole the spotlight. The state’s governor quietly inked a bill adding Bitcoin to its reserve assets, making it the latest to hedge against fiat’s slow-motion collapse.

Why it matters: While Wall Street still debates ETFs, states are sprinting toward hard-money sovereignty. Arizona’s playbook? Treat BTC like digital gold—no apologies, no reversals.

The cynical twist: Meanwhile, legacy finance keeps charging you 2% fees to hold their inflating paper. How’s that ’safe’ investment working out?

Unpacking the Arizona Bitcoin reserve bill

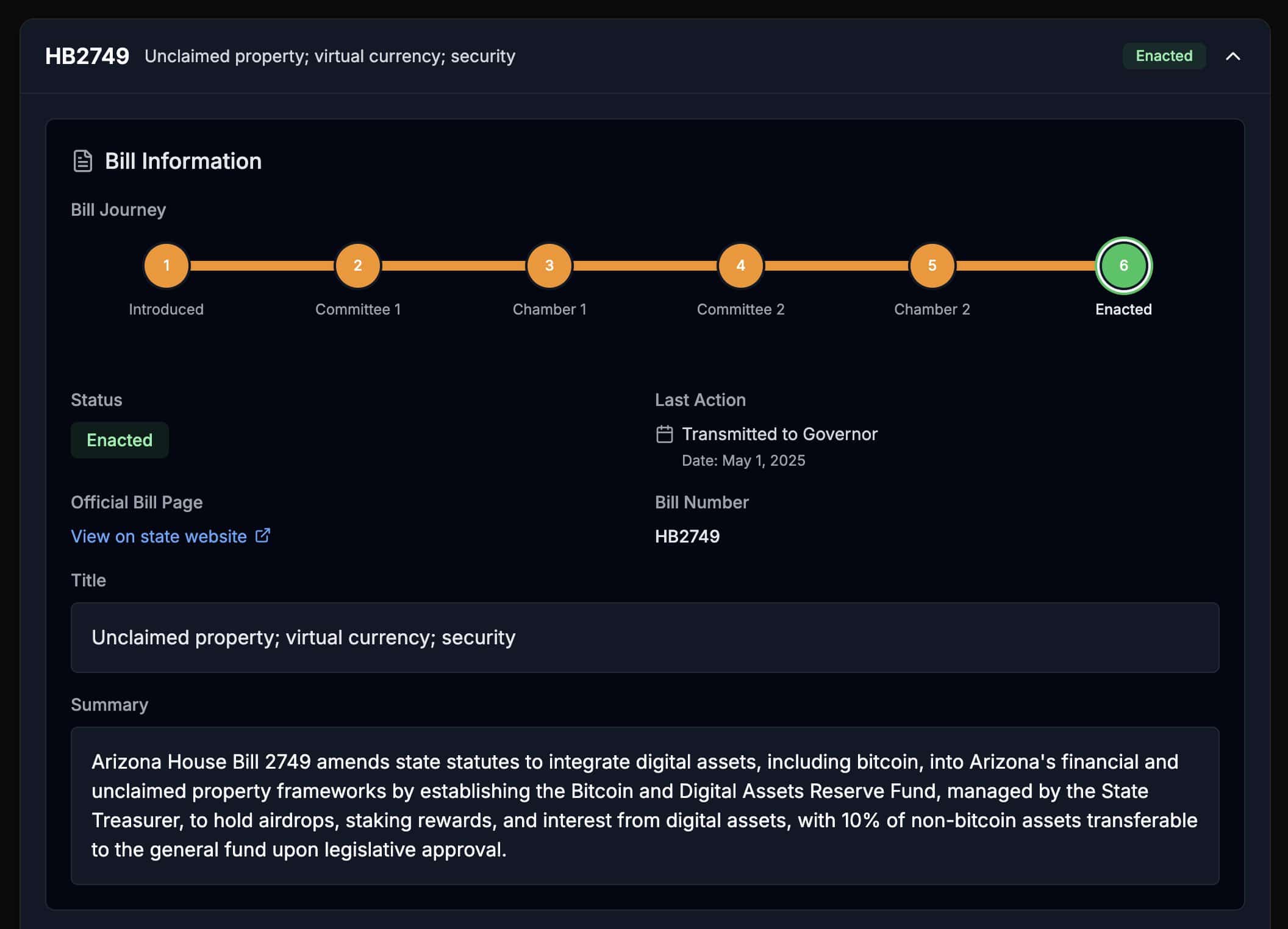

But the approved bill (HB 2749) doesn’t rely on retirement funds. To fund the new reserve, the state WOULD use ‘unclaimed assets’ and staking rewards. Per Bitcoin Laws,

“HB 2749 has been signed into law, technically creating AZ’s first crypto reserve. It doesn’t allow investment, but moves unclaimed assets, airdrops, and staking rewards into a reserve.”

Source: Bitcoin Laws

One of the remaining bills, which aims to build a reserve from forfeited assets (HB 2324), failed to pass in the final reading.

However, the final bill (SB 1373), which seeks direct investment into BTC using the state’s resources, still awaits Governor Hobbs’ decision.

That said, Matthew Sigel, VanEck’s head of digital assets research, hailed Arizona’s greenlight as a ‘great achievement.’

According to Binance founder Changpeng Zhao (CZ), the Arizona update was a warning shot to late BTC buyers. He said,

“You can buy while governments are buying or after they have bought. The “before” option is disappearing.”

For Oregon, the passed bill (SB 167) doesn’t directly deal with Bitcoin but provides the groundwork for adoption, noted Bitcoin Laws.

Overall, Arizona was the second state to enact a strategic BTC reserve into law, and Texas could soon join the league pending House vote and the governor’s action.

Source: Bitcoin Laws (Excerpt on state BTC reserve race)

As of May 2025, nation-states accounted for 2.5% of the total BTC supply and held 529,705 coins (worth $52.8B), per Bitbo data.

Exchange-traded funds (ETFs) and public companies ranked first and second for BTC adoption.

Take a Survey: Chance to Win $500 USDT