Jupiter’s $19M Buyback Flops—JUP Price Keeps Sinking. Now What?

Solana’s favorite DEX throws money at the problem—traders yawn.

Jupiter’s ’shock and awe’ buyback strategy fizzles as JUP slides another 12% post-announcement. Market makers pocket the liquidity while retail bags get heavier.

When tokenomics meets reality: Another crypto project learns that burning cash doesn’t magically create demand. The algo traders feast while the faithful pray for a reversal.

Source: Pine Analytics

However, the token has fallen by 15% from Jupiter’s $0.50 average price for the buyback program, according to a recent report by research firm Pine Analytics.

What capped JUP’s upside?

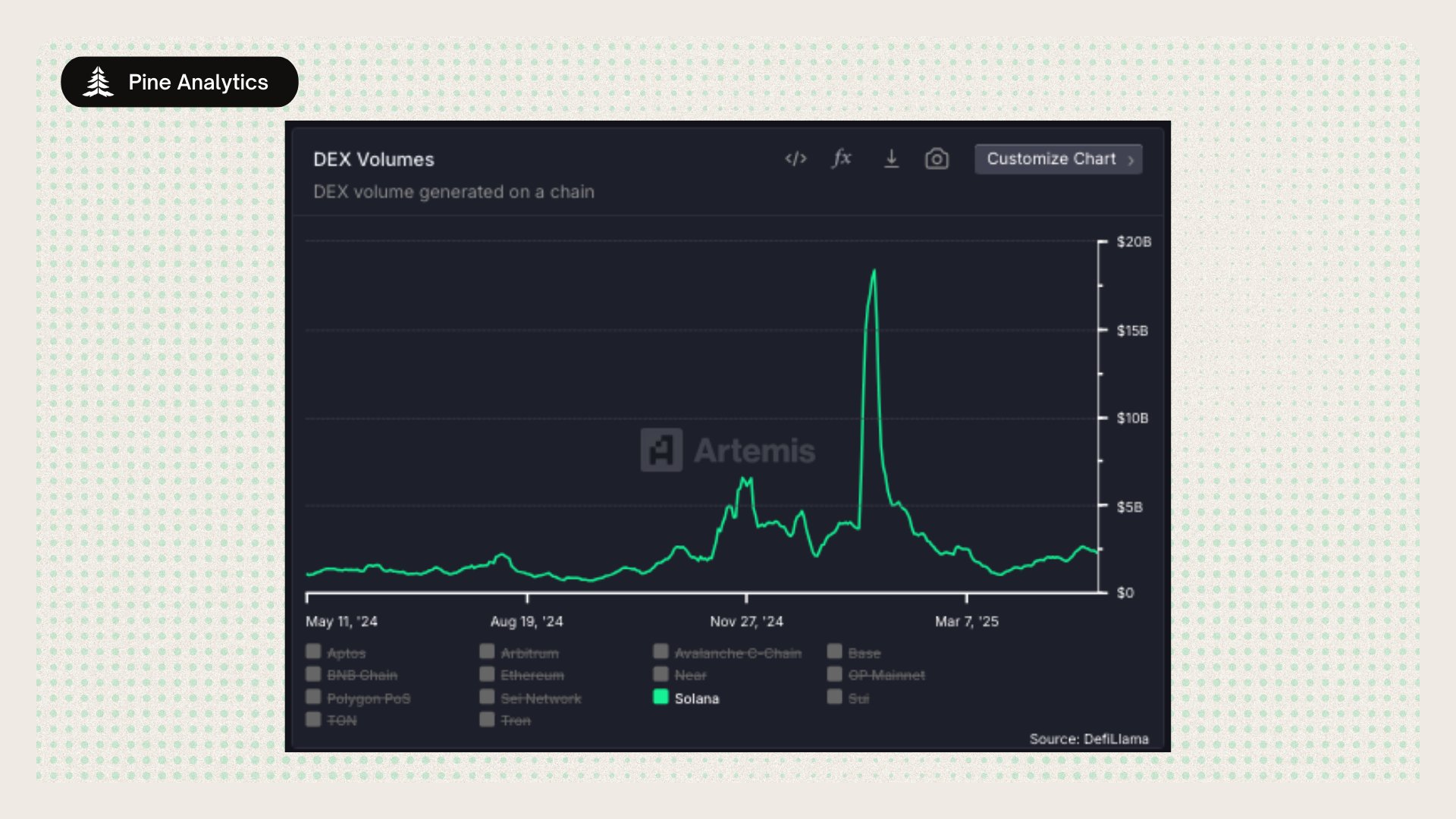

Pine Analytics noted that JUP’s price may have been capped due to the overall contraction in Q1, citing a sharp drop in on-chain activity in Solana’s DEX (decentralized exchange).

Source: Artemis

Besides, token dilution may also be blamed for the sluggish price action. In January 2025, 700 million JUP were unlocked (7% of the supply) for the Jupuary airdrop.

Interestingly, about 27% of the overall token supply has been unlocked as of 2025. Over 5 billion JUP are still locked and could dent the price when this supply hits the market.

That being said, the weekly market snapshot revealed a slight accumulation in the first week of May. According to CoinGlass’s Exchange Netflows, over $4M JUP tokens were moved out of exchanges – A sign of modest accumulation.

Source: Coinglass

According to Hyblock, whales trimmed their positions, which coincided with the price decline from $0.5 to $0.41. The $0.41-zone could be a potential short-term support for a bullish reversal.

However, such a recovery might only be feasible if RSI improves and surges above 50 again to demonstrate renewed buying pressure.

Source: Hyblock

Take a Survey: Chance to Win $500 USDT