Bitcoin Lurks in the Shadows—Is a Monster Rally Brewing During Market Mayhem?

While traditional markets reel from inflation whiplash and central bank flip-flopping, Bitcoin’s price action hints at coiled-spring energy. The crypto king hasn’t crashed alongside stocks—and that divergence has traders whispering about an explosive move.

Key signals to watch: Institutional inflows are creeping up despite the noise, and the hash rate just punched through another all-time high (because nothing says ’long-term bet’ like miners doubling down during chaos). Meanwhile, Wall Street’s ’risk management’ departments are too busy revising their 200-page recession PowerPoints to notice.

Could this be the calm before the storm? Either way, Bitcoin’s playing a different game—one where ’macroeconomic uncertainty’ is just breakfast fuel.

Bitcoin rises amid record-breaking economic turbulence

The U.S. economic policy uncertainty index has surged to an all-time high in 2025.

The chart showed that each spike in uncertainty has historically coincided with bullish momentum for Bitcoin — and the latest surge is the most extreme yet.

Source: Alphractal

The second Trump administration’s tariff hikes, a reinstated debt ceiling, stalled Fed policy, and a credibility crisis for the U.S. dollar have all fueled investor anxiety.

Add to it the geopolitical risks and regulatory whiplash, the result is a highly volatile environment for traditional markets.

Bitcoin, in contrast, appears structurally immune to such chaos.

With trust in fiat waning, BTC is increasingly viewed not as speculative, but as a strategic hedge — one that may quietly be entering its next accumulation phase ahead of a major breakout.

BTC: Easing selling pressure

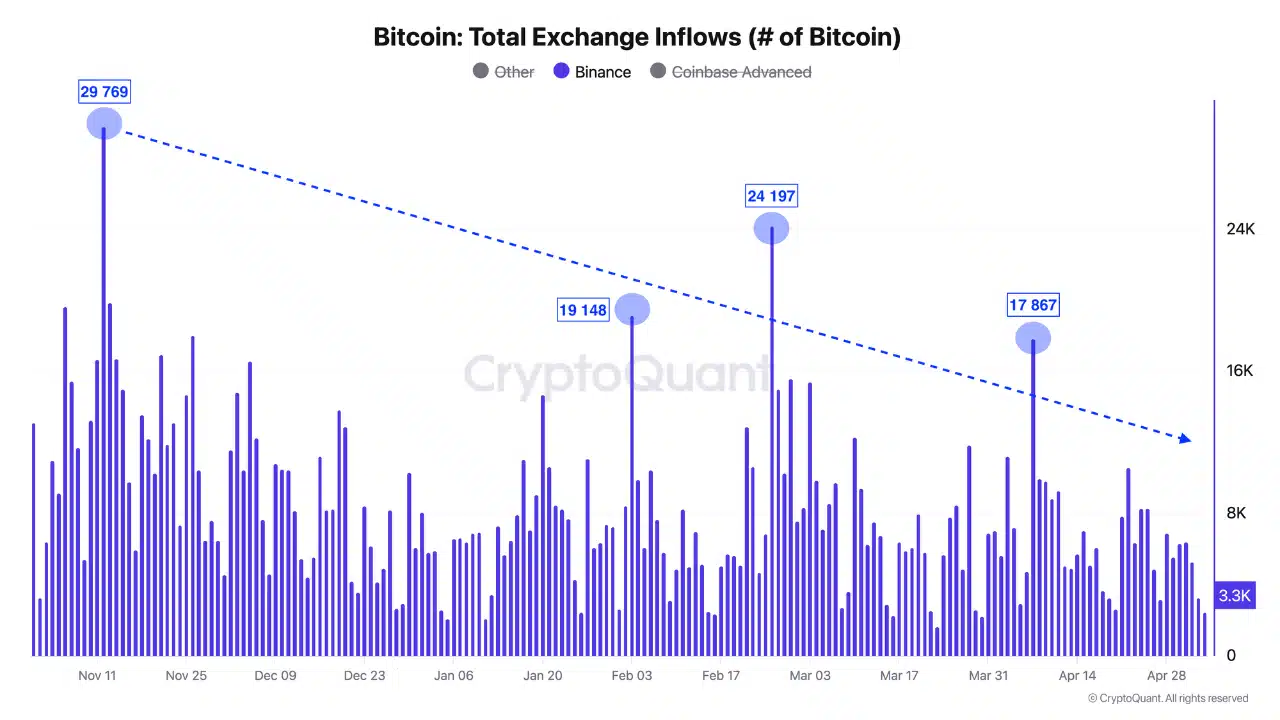

Bitcoin inflows to Binance have been in steady decline since late 2024, pointing to a reduction in immediate selling pressure.

While there were a few notable spikes above 17,000 BTC, the trend is clear: fewer coins are being moved to the exchange for liquidation.

Source: CryptoQuant

With macro risks rising and investor confidence in fiat systems faltering, this may reflect growing conviction in Bitcoin’s long-term role as a hedge.

Bitcoin’s price outlook

BTC traded NEAR $94,000 at press time, posting a minor pullback after testing the $96,000 mark. The RSI has slipped from overbought territory to around 58, indicating a cooling momentum without indicating overselling.

Source: TradingView

Meanwhile, the MACD was close to a bearish crossover; potential consolidation or short-term weakness. However, price structure remained intact above previous resistance levels, now acting as support.

If the dip finds footing above $91,000-$92,000, bulls could regain control swiftly.

Take a Survey: Chance to Win $500 USDT