Binance’s USDT Reserves Hit Record High – Bullish Signal or Just More Tether Magic?

Crypto whales are loading up. Tether’s reserves on Binance just spiked to levels not seen since the 2021 bull run – right as Bitcoin tests key resistance levels.

Market makers shifting strategy? The sudden USDT accumulation suggests big players are positioning for volatility. Either that, or Tether’s printers got another workout (hey, it’s not like traditional finance where audits actually mean something).

Technical indicators flash green. The last three times Binance’s USDT reserves surged like this, BTC rallied 20%+ within 30 days. Correlation isn’t causation... until it is.

Traders are watching two scenarios: Either this is the liquidity injection needed to break through $75K, or another case of stablecoin parking before a major shakeout. Place your bets – the casino never closes.

USDT reserves make a comeback

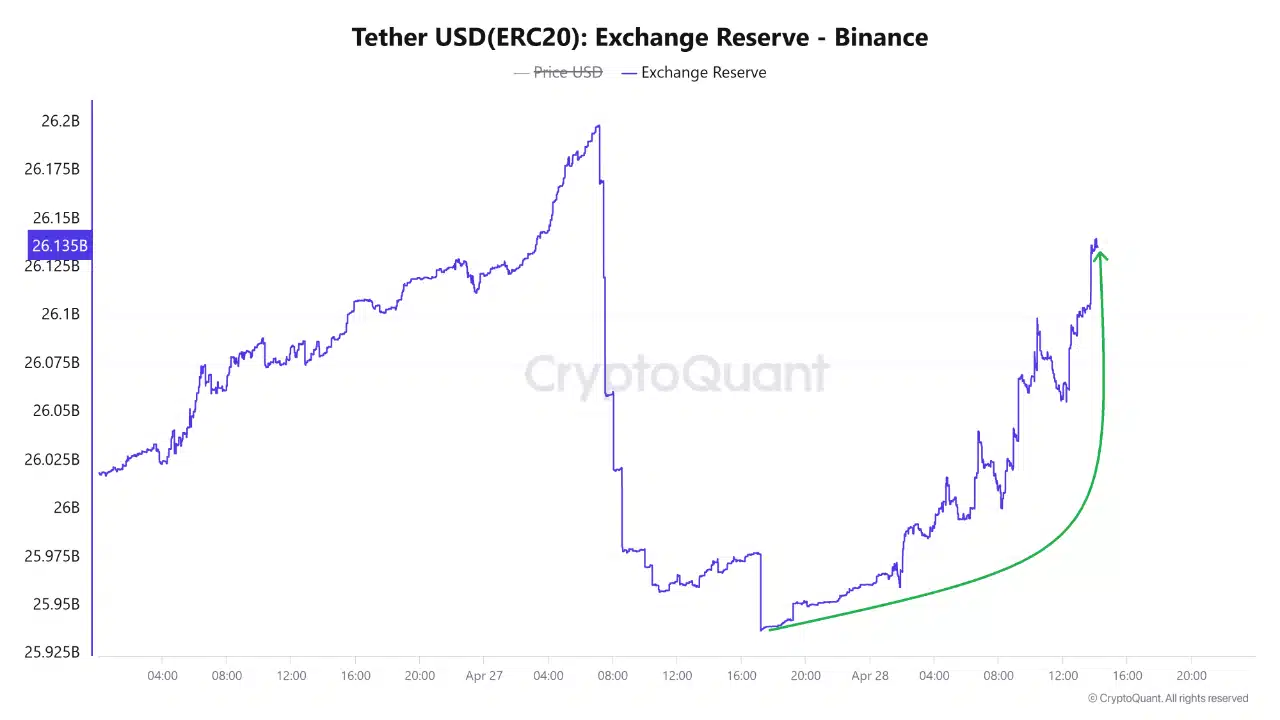

CryptoQuant’s data seemed to paint a compelling picture – After a sharp midweek dip, USDT reserves on Binance have rebounded with remarkable consistency. From a low NEAR 25.93B, the reserves have surged past 26.13B. This formed a steep upward arc, almost like a coiled spring.

Source: Cryptoquant

These type of inflows suggest traders are quietly reloading their ammo. Market participants appear to be readying for action. The return of liquidity – especially in the form of stablecoins – is rarely idle.

In fact, it’s often the first sign that capital is positioning ahead of a move.

When Tether leads, crypto follows

Historically, rising USDT inflows have been the prologue to price rallies. The logic is straightforward – Traders rarely move stablecoins into exchanges without an intent to deploy. In previous cycles, similar reserve builds preceded major surges in BTC and ETH, as sidelined capital returned to chase momentum.

When stablecoin reserves grow, it’s usually a signal of revived risk appetite. Even in times of muted price action, a climb in USDT reserves tends to whisper what the candles are yet to indicate – The bulls are circling.

Priming the powder for BTC, ETH and altcoins

So, what could this liquidity repositioning mean for the broader market? For Bitcoin, it may mark the first signs of a bid wall forming – A readiness to buy the dip or chase a breakout. For Ethereum, whose recent performance has lagged, fresh USDT on Binance could fuel rotation plays or DeFi inflows.

And for altcoins – the last to move but the fastest when they do – a stablecoin influx often sets the stage for sharp rallies across mid and low-caps.

The market may be quiet now, but bigger things are coming!

Take a Survey: Chance to Win $500 USDT