Solana Faces $13 Million Liquidation Challenge – Potential Catalysts for SOL’s Recovery

Solana (SOL) has encountered significant market pressure with $13 million in liquidations, raising questions about its near-term trajectory. This development comes amid broader volatility in the crypto markets, where leveraged positions are being rapidly unwound. Analysts are now assessing whether key technical indicators or ecosystem developments could reverse SOL’s current trend. The asset’s performance against its peers and its ability to maintain critical support levels will be crucial in determining if this liquidation event marks a bottom or precedes further downside. Market participants are closely monitoring network activity, DeFi TVL metrics, and institutional flows for signs of accumulation at these levels.

SOL stalls with $13 mln in liquidations

In the last 24 hours, liquidations in the derivatives market saw an equal split between long and short positions, per Coinglass.

Both sides lost $6.5 million each, signaling trader exhaustion and indecision. Of course, this tug-of-war often results in muted price action, and that’s precisely what played out.

SOL’s daily gain stood at just 0.7% over the same period.

When liquidations are evenly matched, the market tends to teeter, unsure of its next move. However, AMBCrypto’s analysis suggested that bulls still held a slight edge.

In fact, the price could yet break in their favor—if momentum follows through.

Key activities favor the bulls

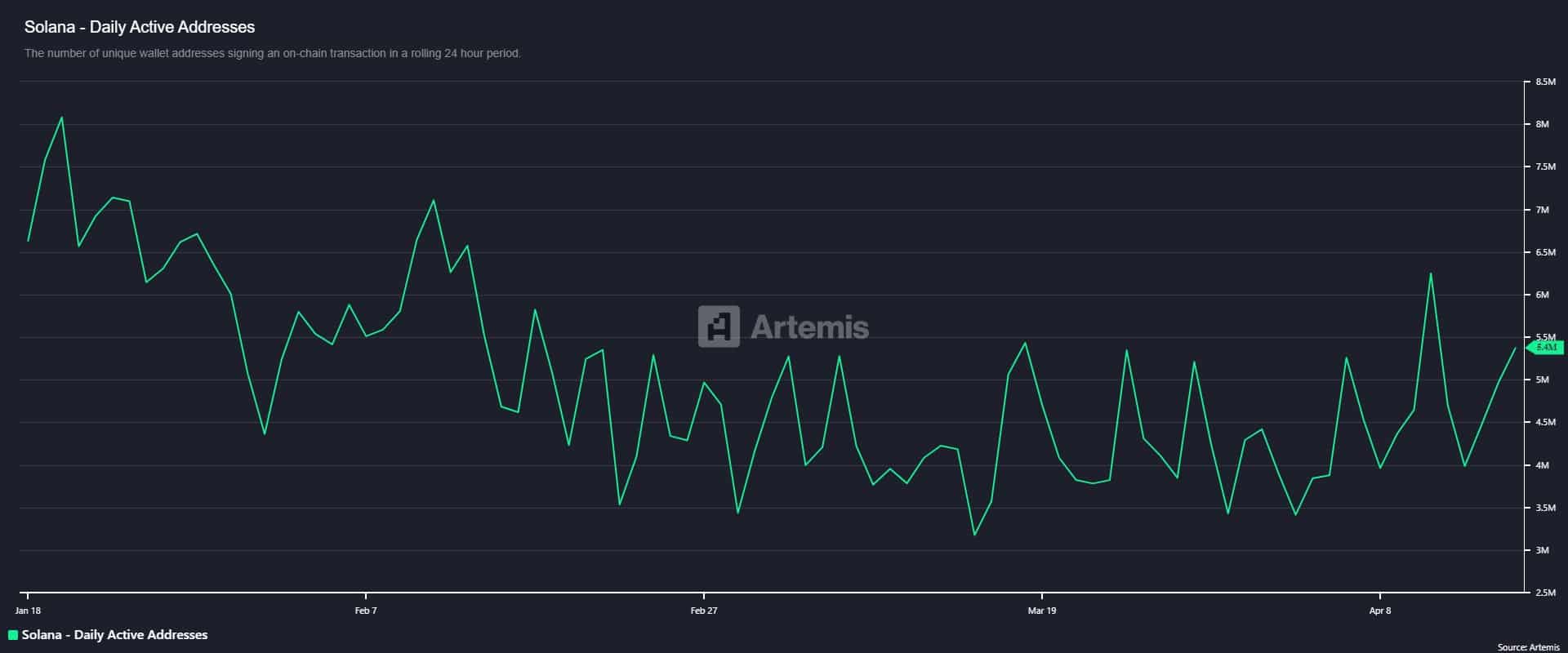

Moreover, on‑chain activity strengthened that view. Unique Active Addresses surged 31% within 24 hours, reaching 5.4 million, according to Artemis.

That spike implied fresh buying or receiving of SOL, intensifying bullish expectations.

Source: Artemis

This corresponds with the growing trading volume on decentralized exchanges (DEXes), which saw a 15.35% increase in the past week, reaching $16.2 billion—making Solana the chain with the highest DEX trading volume.

The bullish narrative is also present in the Futures market.

The amount of unsettled contracts continued to grow, along with the buying volume in the derivatives market.

Open Interest, which records the amount of unsettled derivative contracts, has nonetheless continued to rise. These contracts include both long and short positions.

The Long-to-Short Ratio, which effectively compares buying and selling volume in the derivatives market, gives readings above 1 to support a bullish move and below 1 to suggest seller dominance.

At press time, the Long-to-Short Ratio read 1.0087, indicating more buying volume. This likely implied that the growing Open Interest was dominated by long traders, increasing the likelihood of a price rally.

Source: DeFiLlama

In the last 24 hours, investor confidence has continued to grow as liquidity flowing into Solana ROSE by approximately $72 million, bringing its total value locked (TVL) to $7.144 billion.

When TVL climbs, it implies that more investors are locking their SOL—suggesting long-term commitment—into protocols to enable various activities, including liquidity provision.

If the market continues to reflect multiple bullish signals, it will likely skew in favor of the bulls, with SOL rallying.

Take a Survey: Chance to Win $500 USDT