Will Ripple’s Rally Sustain Momentum? – XRP Targets $2.4 Following 20% Weekly Surge

XRP has demonstrated significant bullish momentum with a 20% price increase over the past week, sparking speculation about whether the rally can continue toward the $2.4 resistance level. Market analysts are closely monitoring key technical indicators, including trading volume and RSI, to assess the sustainability of this upward trend. The recent surge aligns with broader positive sentiment in the altcoin market, though regulatory developments surrounding Ripple remain a critical factor. Traders are advised to watch for potential profit-taking near previous highs, which could introduce short-term volatility. Institutional interest and adoption metrics will also play a decisive role in determining if XRP can break through its next major price barrier.

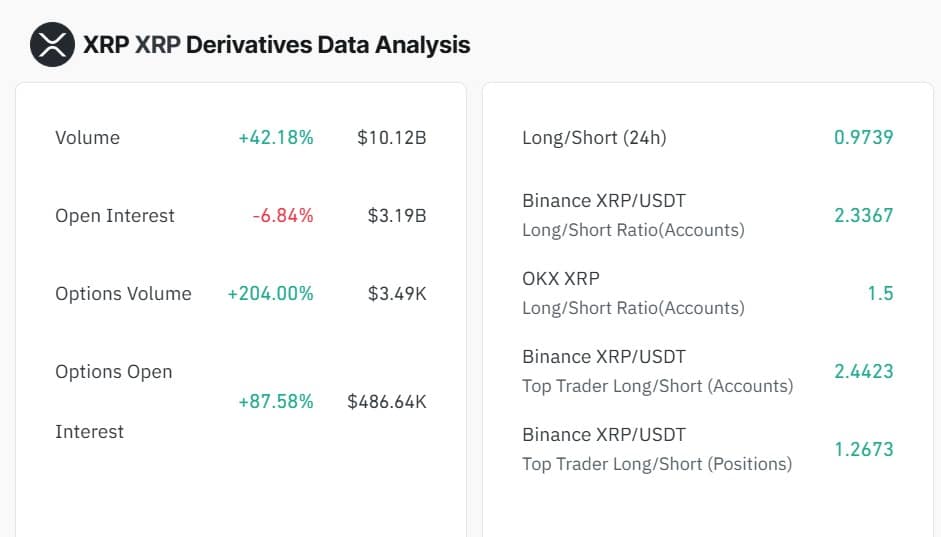

Source: Coinglass

The recent price pump has left analysts eyeing a strong upward movement. Inasmuch, popular crypto analyst Ali Martinez has predicted a rally to $2.4.

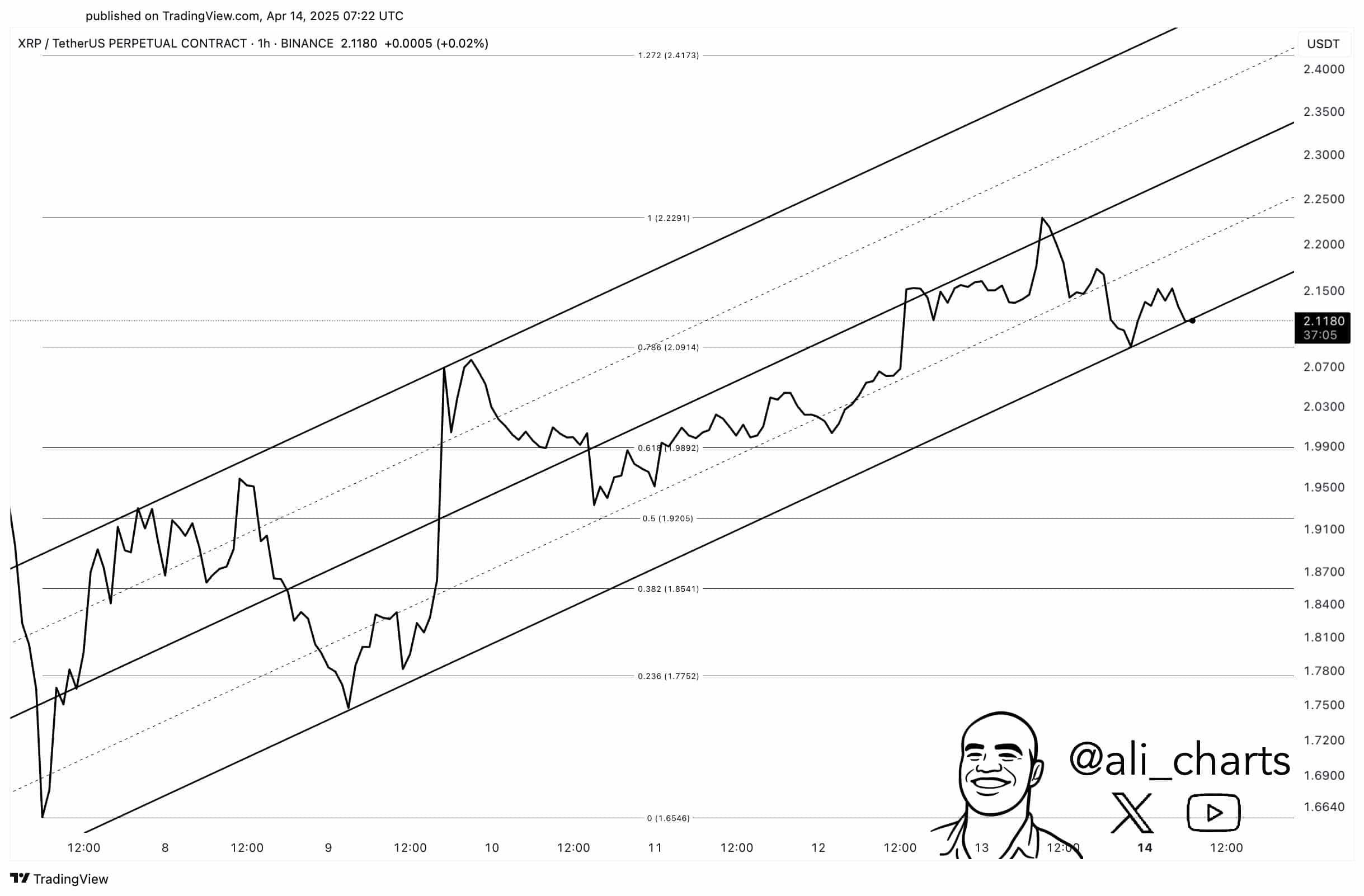

Source: X

According to Martinez’s analysis, XRP is currently trading within an ascending triangle. This pattern is typically a bullish continuation signal, indicating that buyers are gradually gaining strength.

Martinez suggests that XRP will face key resistance at around $2.22. A breakout above this level could trigger a significant upward move toward $2.40.

The pressing question remains: Can XRP maintain its momentum and achieve sustained gains?

Can XRP sustain gains?

AMBCrypto’s analysis indicated that XRP was experiencing strong upward momentum, driven by growing bullish sentiment.

Despite a slight drop over the past day, the altcoin’s DEX buy-sell ratio remains above 1, standing at 1.5 at press time. This means that for every sell order, there are 1.5 buy orders, indicating higher buying pressure.

As a result, more buy orders are being executed in the market compared to sell orders, further supporting the bullish momentum.

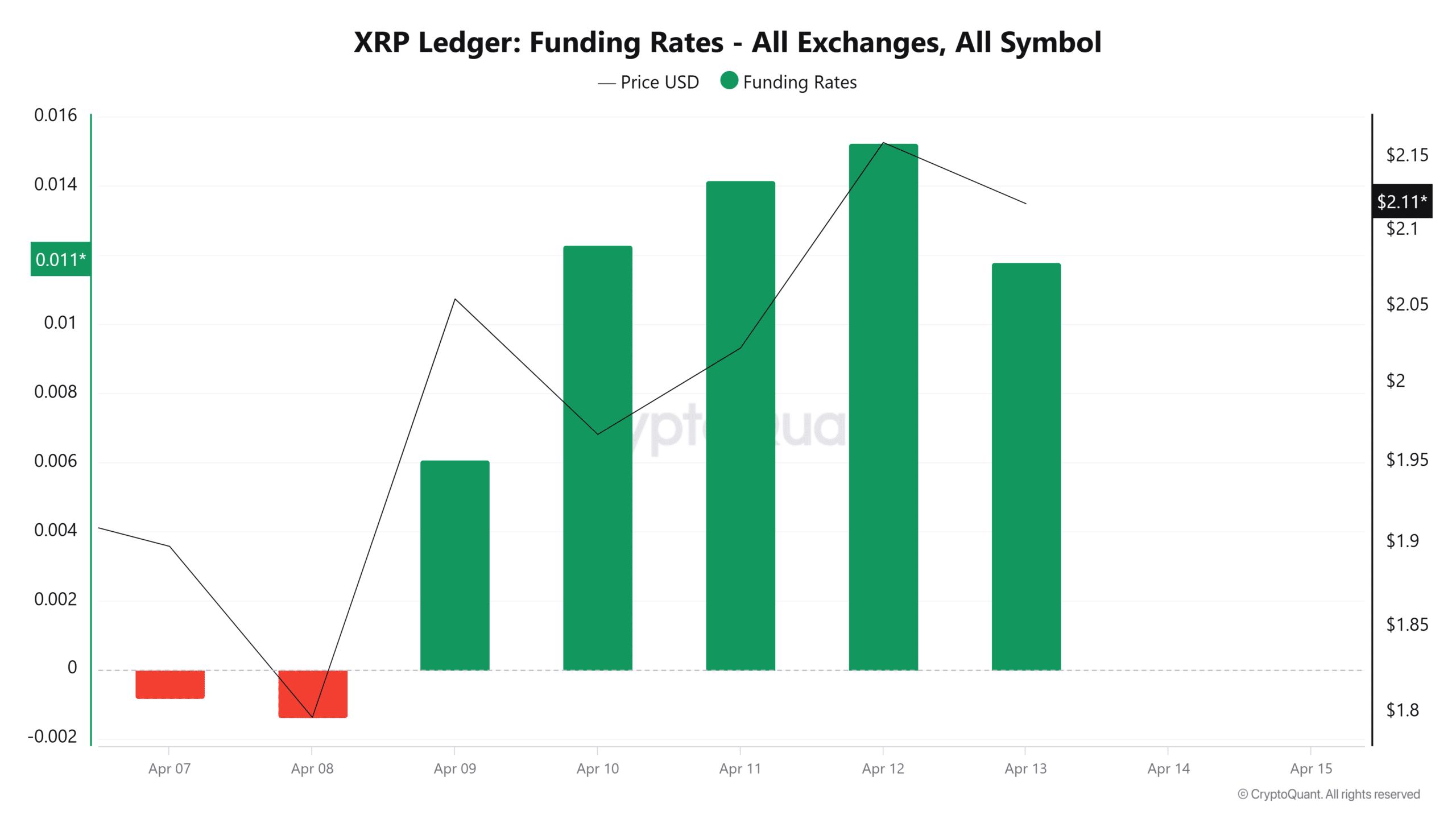

Source: CryptoQuant

Additionally, with XRP’s Funding Rate holding positive over the past five days, it suggests that investors are bullish and are going long.

As such, those buy orders and rising options volume mean market entrants are getting into the market and taking long positions, reflecting strong bullish sentiments.

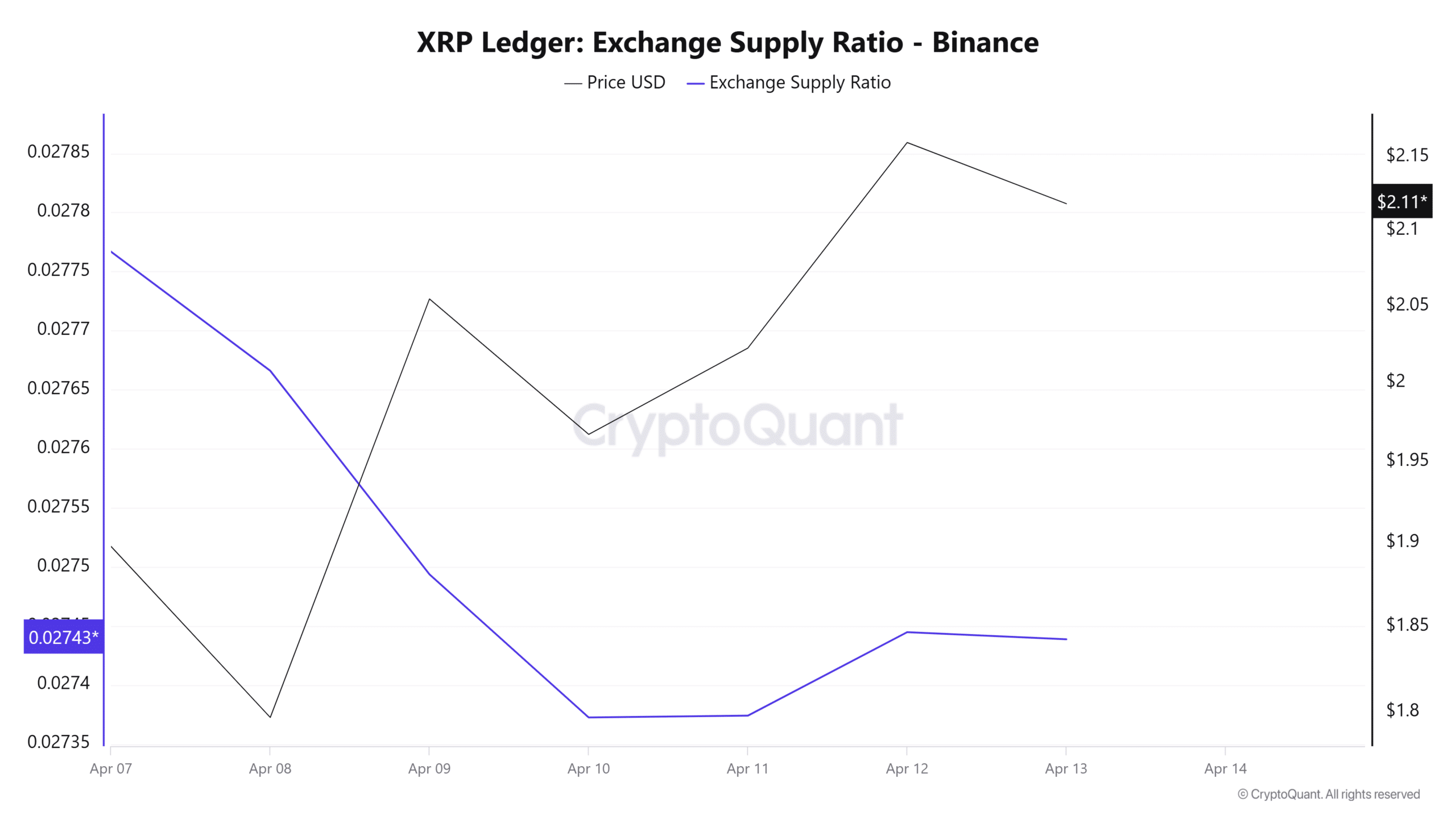

Source: CryptoQuant

Finally, XRP’s Exchange Supply Ratio has declined over the past week to 0.02743. With supply into exchange declining, it implies that investors and holding are sending fewer XRP tokens to exchanges to sell.

Usually, such market behavior reduces selling pressure, which in turn plays a key role in price stability.

Source: Cryptoquant

In summary, XRP is benefiting from favorable market conditions, positioning the altcoin for further price gains.

If the current sentiment remains strong, XRP could reclaim the $2.2 resistance level. A breakout above this level may lead to an attempt at $2.5.

However, if a pullback occurs at $2.2, XRP could retrace to $1.9.

Take a Survey: Chance to Win $500 USDT