Stablecoins: The Underestimated Factors Poised to Transform the Banking Sector

Stablecoins, often overshadowed by volatile cryptocurrencies, are emerging as a disruptive force in traditional banking. Their ability to maintain price stability through algorithmic mechanisms or asset backing presents unique advantages for financial systems. As regulatory frameworks evolve, these digital assets could address liquidity challenges, enhance cross-border transactions, and potentially reduce systemic risks. The integration of stablecoins into mainstream finance may necessitate fundamental changes in how banks manage reserves, process settlements, and extend credit. This shift could particularly impact emerging markets where access to stable currencies remains limited. Financial institutions must now grapple with both the opportunities and threats posed by this innovation, as stablecoins challenge conventional notions of monetary sovereignty and intermediation.

Understanding stablecoins beyond speculation

For context, stablecoins are designed to maintain a 1:1 peg with assets like the U.S. dollar. In contrast to risk assets, stablecoins exhibit a negative correlation with broader market dynamics.

Simply put, an uptick in stablecoin dominance signals a capital reallocation away from volatile assets, indicating a flight to liquidity. Within this framework, stablecoins function as a de-risking instrument.

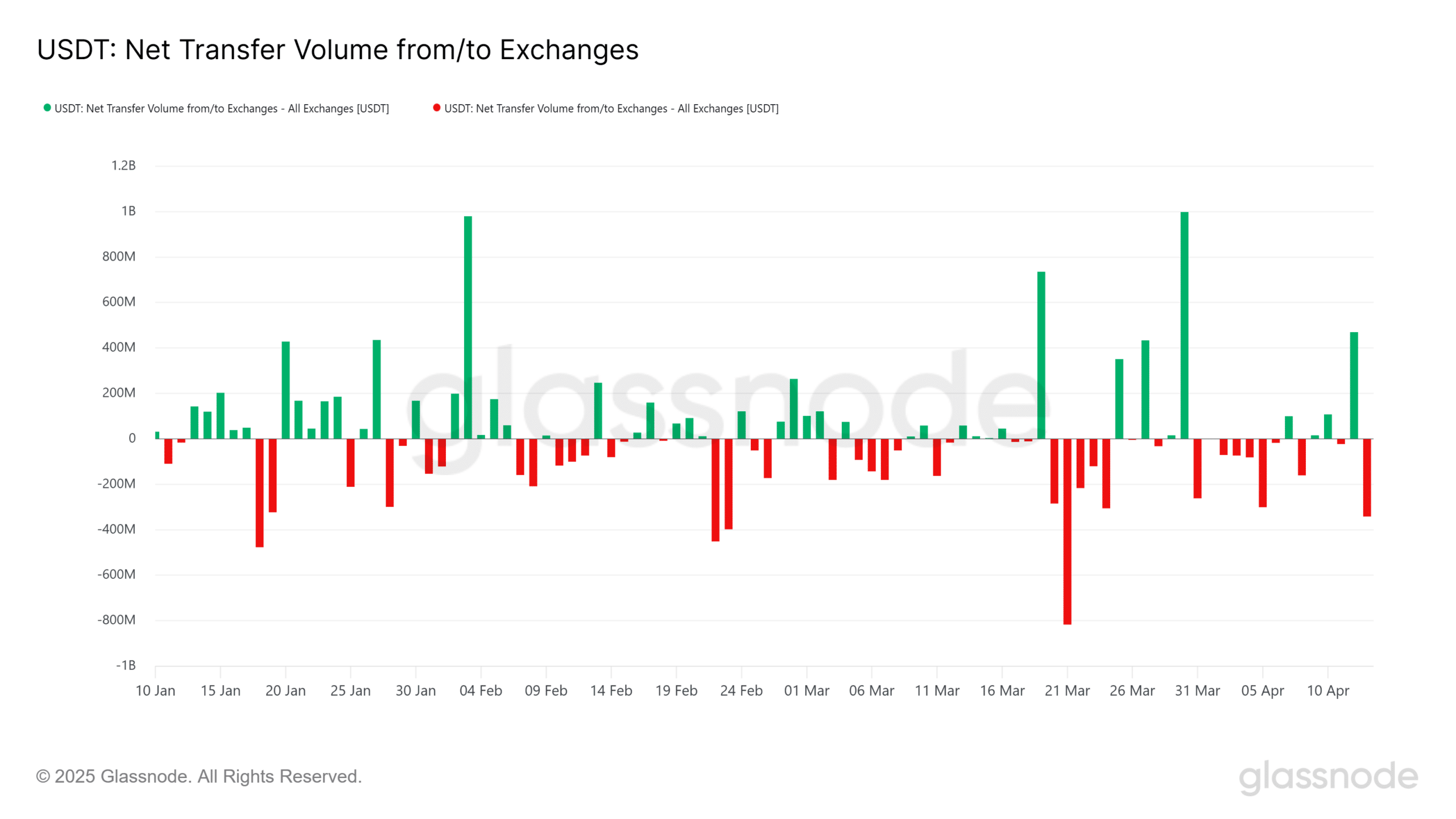

Illustratively, during the 20–24 March window, USDT netflow chart printed pronounced red-bodied candlesticks, reflecting elevated accumulation.

This coincided with Bitcoin’s[BTC] parabolic move toward a local top at $88k, followed by a sharp corrective move to $81k.

Source: Glassnode

Hence, their inherent stability renders them less speculative than other risk assets. However, many banks continue to misinterpret the strategic role of these stable tokens — often reducing them to simplistic fiat proxies.

As the financial landscape evolves and decentralization gains structural relevance, below are some key aspects of stablecoins that banks should know.

Critical realities banks must understand

Clear oversight is critical for any asset class, but stablecoins face a fragmented regulatory landscape.

For instance, in the U.S., unclear jurisdiction between the SEC and CFTC creates confusion. The EU, by contrast, is moving toward standardization with its MiCA framework.

Meanwhile, Asia presents a mixed picture. This global divergence complicates cross-border operations. In fact, as countries roll out their own Central Bank Digital Currency (CBDC) pilots, stablecoins may face tighter rules moving forward.

But it doesn’t stop there. Even in remittance services, which require cross-border payments, banks must address regulatory hurdles to fully capitalize on this use case.

In conclusion, stablecoins offer significant use cases in the banking sector, enhancing transparency and decentralization.

However, for their potential to be fully realized, banks must establish strict regulatory oversight, streamline cross-border payments, and shift their perspective – viewing stablecoins not as speculative competitors, but as the future of mainstream finance.

Take a Survey: Chance to Win $500 USDT