XRP Price Prediction 2025: Will Whale Activity and ETF Hype Push XRP Past $3.80?

- What Does XRP's Technical Analysis Reveal?

- How Are Whales and ETFs Impacting XRP's Price?

- What Risks Could Derail XRP's Rally?

- How Does XRP Compare to Other Altcoins?

- What's Next for XRP Price?

- XRP Price Prediction FAQs

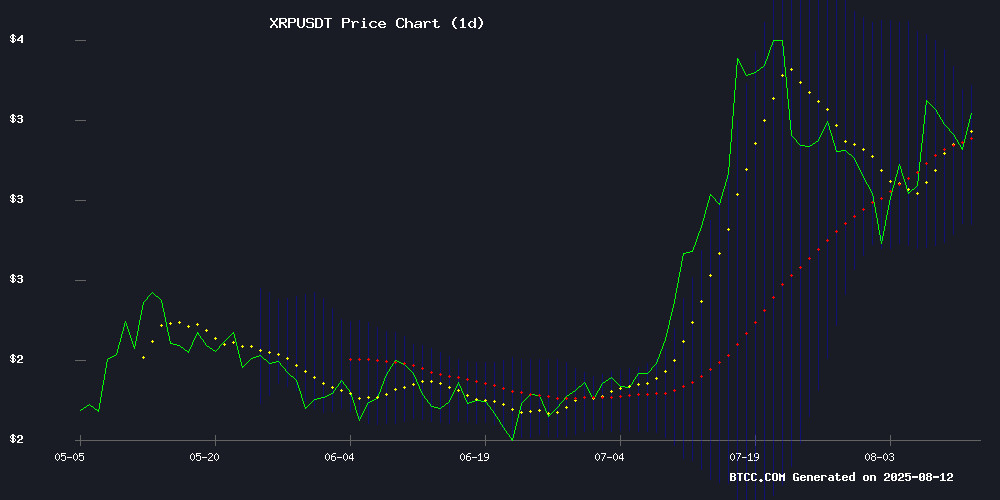

XRP is showing strong bullish signals in August 2025, trading above key moving averages with MACD indicators flashing green. Whale accumulation and growing ETF speculation are fueling optimism, but unscheduled token unlocks worth $3.2 billion could trigger profit-taking. Technical analysis suggests XRP could test $3.80 resistance if current momentum holds, with some analysts eyeing even higher targets. This article breaks down the key factors influencing XRP's price movement and what traders should watch in the coming weeks.

What Does XRP's Technical Analysis Reveal?

As of August 12, 2025, XRP is trading at 3.1393 USDT, comfortably above its 20-day moving average of 3.1027 - a classic bullish signal. The MACD shows a positive crossover with values at 0.1061 (MACD line) versus 0.0958 (signal line), while the 0.0104 histogram reinforces upward momentum. Bollinger Bands suggest potential volatility ahead, with the price hovering NEAR the middle band (3.1027). The upper band at 3.3583 and lower at 2.8471 mark key resistance and support levels respectively.

Source: BTCC TradingView data

How Are Whales and ETFs Impacting XRP's Price?

Recent on-chain data reveals significant whale activity, with $108 million worth of XRP moved to exchanges like BTCC and Coinbase in the past week. While exchange reserves are climbing (traditionally a precursor to selling), the ETF buzz is creating counterbalancing demand. The SEC is currently reviewing multiple XRP ETF applications, with Bloomberg analysts assigning an 85% approval probability by mid-October. "The combination of technical strength and positive news Flow could propel XRP toward the $3.80 resistance level," notes a BTCC market analyst.

What Risks Could Derail XRP's Rally?

The August 9 surprise unlock of 1 billion XRP (worth $3.28 billion) from Ripple's escrow wallets caught many investors off guard. Such deviations from the typical monthly schedule often trigger volatility as markets interpret strategic shifts. Additionally, HODL Waves metrics show short-term holders (1-6 months) are reducing positions, suggesting profit-taking may be underway. Exchange reserves have climbed 15% since July, another potential warning sign for short-term traders.

How Does XRP Compare to Other Altcoins?

In the race for 5x returns in 2025, XRP competes with projects like sui Blockchain and Unilabs Finance. While SUI attracts institutional interest through partnerships, and Unilabs leverages AI-powered DeFi solutions, XRP's advantage lies in its regulatory clarity and established market position. After its 10% weekly gain following the SEC resolution, some analysts like GalaxyBTC predict a potential rise to $10 based on historical breakout patterns.

What's Next for XRP Price?

The immediate technical picture suggests XRP could test $3.80 if it maintains above $3.00 support. A decisive MOVE above $3.30 could pave the way for a challenge of the all-time high at $3.60. However, traders should watch for:

| Factor | Impact |

|---|---|

| ETF approval timeline | Potential 20-30% upside on approval |

| Whale movements | Large sells could trigger 10-15% pullbacks |

| Exchange reserves | Growing reserves may indicate selling pressure |

This article does not constitute investment advice. Always conduct your own research before trading.

XRP Price Prediction FAQs

Can XRP reach $5 in 2025?

While some technical models suggest XRP could reach $5 by year-end, particularly if ETF approvals materialize, the $3.80 level remains the key resistance to watch first. The cryptocurrency would need to break through several technical barriers and maintain strong volume to achieve this target.

Is now a good time to buy XRP?

The current technical setup suggests XRP could have upside potential, especially if it holds above $3.00 support. However, the unexpected token unlocks and growing exchange reserves indicate potential volatility ahead. Dollar-cost averaging might be a prudent strategy rather than going all-in at current levels.

How does XRP's ETF potential compare to Bitcoin and Ethereum?

While Bitcoin and ethereum ETFs have already been approved, an XRP ETF would be significant as the first for a "non-security" altcoin. Approval could open floodgates for similar products, though the process may face more scrutiny given XRP's regulatory history.