Bitcoin Price Prediction 2025: $145K Target in Sight as Institutional Demand Meets Macro Tailwinds

- Technical Analysis: Why $145K Bitcoin Looks Achievable

- Institutional Demand vs. Seasonal Volatility

- The $127 Trillion Liquidity Wave

- Quantum Computing FUD: How Real Is the Threat?

- Market Movers: From Trump Media to Palantir

- Is Bitcoin a Good Investment in August 2025?

- Bitcoin Price Prediction 2025: Your Questions Answered

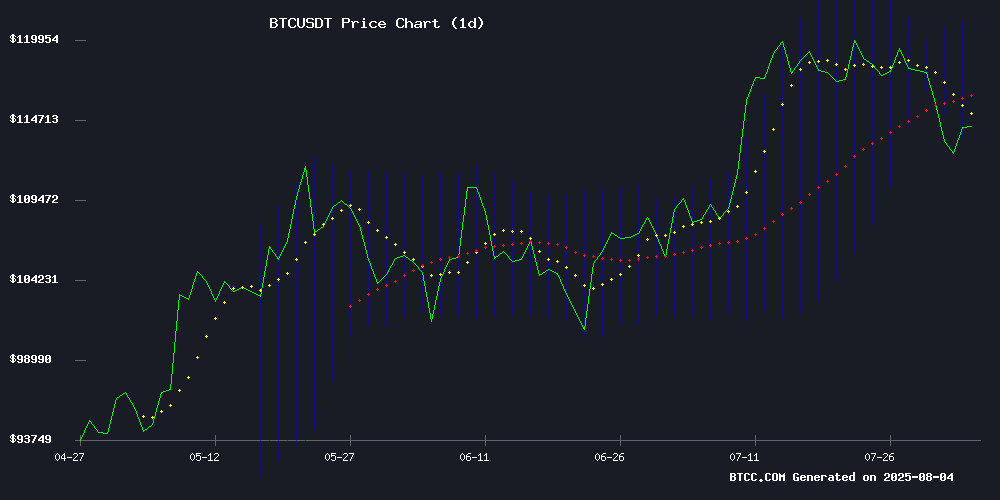

Bitcoin is showing strong bullish signals as technical indicators and fundamental factors align. With BTC currently trading around $115K, analysts point to a completed inverted head & shoulders pattern and growing institutional accumulation despite August's historical volatility. The $127 trillion global liquidity surge adds fuel to Bitcoin's potential breakout toward $145K, though short-term pullbacks remain possible. Here's why crypto investors are watching this pivotal moment.

Technical Analysis: Why $145K Bitcoin Looks Achievable

BTC currently trades at $115,223.36, slightly below its 20-day moving average of $117,255.67 - what traders call a "healthy discount" before potential upside. The MACD indicator shows bullish momentum with a positive histogram (1,604.36), while Bollinger Bands suggest moderate volatility. The BTCC analyst team notes: "The inverted Head & Shoulders pattern completion and MACD crossover could fuel a rally toward $145K if BTC holds above $113,323 support." This technical pattern, formed between February-July 2025, is one of the most reliable bullish reversal formations in crypto markets.

The BTCC analyst team notes: "The inverted Head & Shoulders pattern completion and MACD crossover could fuel a rally toward $145K if BTC holds above $113,323 support." This technical pattern, formed between February-July 2025, is one of the most reliable bullish reversal formations in crypto markets.

Institutional Demand vs. Seasonal Volatility

August has historically been Bitcoin's most volatile month, with average declines of 12% in 2022-2023. However, 2025 tells a different story. On-chain data shows strong accumulation trends, with approximately 160,000 BTC accumulated over 30 days despite price fluctuations. The U.S. leads global bitcoin ownership, followed by an unnamed European nation, reflecting deepening institutional adoption. "We're seeing pension funds and corporate treasuries treat BTC like digital gold," notes a BTCC market strategist. This demand clashes with Robert Kiyosaki's recent $90K warning, creating what traders call a "battle of narratives."

The $127 Trillion Liquidity Wave

Global liquidity has surged to $127.3 trillion according to MacroScope analysts - a tidal wave of capital that could lift Bitcoin's boat. Unlike previous cycles dominated by Fed policy, this liquidity expansion spans Asian, European, and Middle Eastern central banks.

"When this much money sloshes through the system, hard assets like Bitcoin become natural beneficiaries," explains financial analyst Merlijn The Trader. "The technical setup suggests we could see BTC capture 0.1% of that liquidity - which would mean $127 billion inflows."

Quantum Computing FUD: How Real Is the Threat?

Elon Musk recently reignited debates about quantum computing's potential to break Bitcoin's SHA-256 security. His AI chatbot Grok estimates less than 10% probability by 2035, but the discussion highlights crypto's evolving risk landscape. IBM's 2,000-qubit Blue Jay system (targeted for 2033) and competing projects from Google/Microsoft keep this conversation alive. "It's a legitimate long-term concern," admits a BTCC security researcher, "but not something that should impact 2025 investment decisions."

Market Movers: From Trump Media to Palantir

While Bitcoin consolidates, traditional markets show mixed signals:

- Trump Media stock fell 4% despite $3.1B Bitcoin holdings

- Palantir surges 100% YTD ahead of earnings

- Berkshire Hathaway takes $5B Kraft Heinz write-down

Is Bitcoin a Good Investment in August 2025?

The case looks compelling based on three factors:

| Metric | Value | Implication |

|---|---|---|

| Price/20MA | -1.7% | Mean reversion potential |

| MACD | 1,604.36 | Bullish momentum |

| Bollinger %B | 0.48 | Neutral territory |

Bitcoin Price Prediction 2025: Your Questions Answered

What's driving Bitcoin's potential move to $145K?

The combination of a completed inverted head & shoulders pattern, institutional accumulation, and unprecedented global liquidity creates perfect conditions for a breakout. Technical analysts note the $110K neckline breakout in mid-July set the stage.

How reliable is the inverted head & shoulders pattern?

In crypto markets, it has about 65% success rate according to TradingView data. The current pattern developed over six months (Feb-July 2025), making it more significant than shorter-term formations.

Should I worry about August's historical volatility?

Seasonal patterns aren't destiny. While August has seen declines averaging 12% in recent years, 2025's institutional demand appears to be rewriting the script. Always use proper risk management.

What's the quantum computing risk to Bitcoin?

Current estimates suggest minimal near-term risk. Grok's

Where can I trade BTC securely?

Reputable exchanges like BTCC offer secure trading environments. Always research platforms thoroughly and never invest more than you can afford to lose.